Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

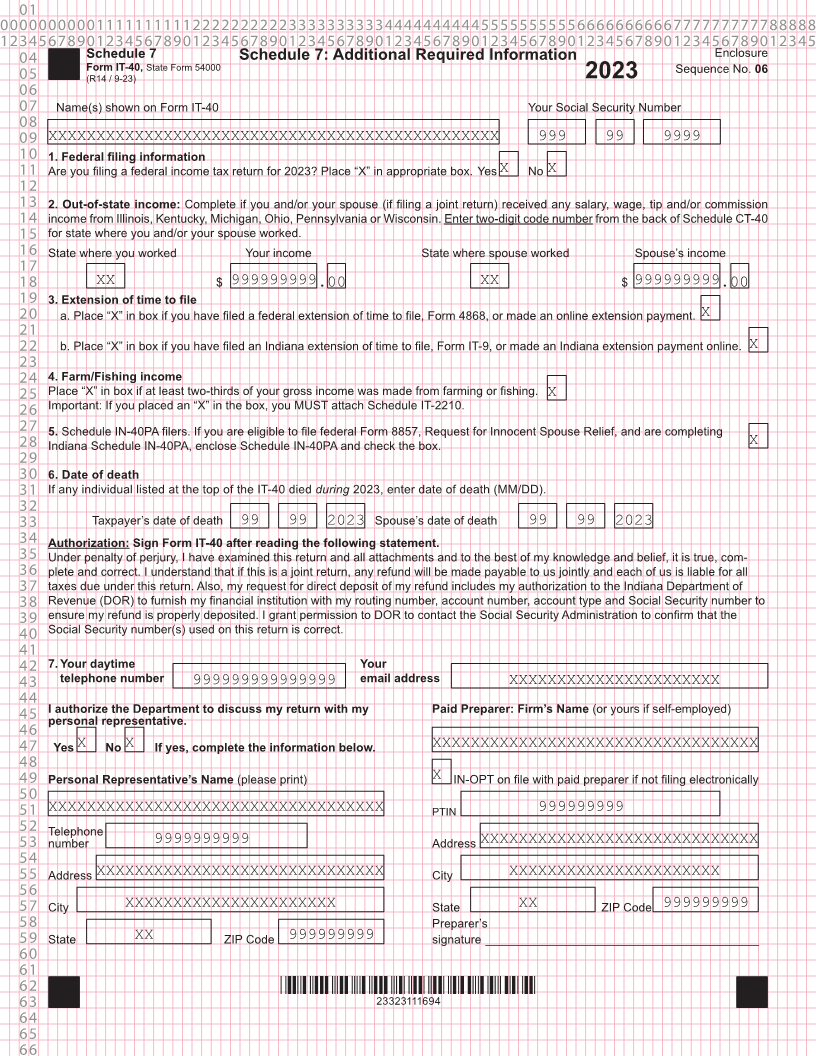

04 Schedule 7 Schedule 7: Additional Required Information Enclosure

05 Form IT-40, State Form 54000 Sequence No. 06

(R14 / 9-23) 2023

06

07 Name(s) shown on Form IT-40 Your Social Security Number

08

09 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

10 1. Federal filing information

11 Are you filing a federal income tax return for 2023? Place “X” in appropriate box. Yes X No X

12

13 2. Out-of-state income: Complete if you and/or your spouse (if filing a joint return) received any salary, wage, tip and/or commission

14 income from Illinois, Kentucky, Michigan, Ohio, Pennsylvania or Wisconsin. Enter two-digit code number from the back of Schedule CT-40

15 for state where you and/or your spouse worked.

16 State where you worked Your income State where spouse worked Spouse’s income

17

18 XX $ 999999999 .00 XX $ 999999999 .00

19 3. Extension of time to file

20 a. Place “X” in box if you have filed a federal extension of time to file, Form 4868, or made an online extension payment. X

21

22 b. Place “X” in box if you have filed an Indiana extension of time to file, Form IT-9, or made an Indiana extension payment online. X

23

24 4. Farm/Fishing income

25 Place “X” in box if at least two-thirds of your gross income was made from farming or fishing. X

26 Important: If you placed an “X” in the box, you MUST attach Schedule IT-2210.

27 5. Schedule IN-40PA filers. If you are eligible to file federal Form 8857, Request for Innocent Spouse Relief, and are completing

28 Indiana Schedule IN-40PA, enclose Schedule IN-40PA and check the box. X

29

30 6. Date of death

31 If any individual listed at the top of the IT-40 died during 2023, enter date of death (MM/DD).

32

33 Taxpayer’s date of death 99 99 2023 Spouse’s date of death 99 99 2023

34 Authorization: Sign Form IT-40 after reading the following statement.

35 Under penalty of perjury, I have examined this return and all attachments and to the best of my knowledge and belief, it is true, com-

36 plete and correct. I understand that if this is a joint return, any refund will be made payable to us jointly and each of us is liable for all

37 taxes due under this return. Also, my request for direct deposit of my refund includes my authorization to the Indiana Department of

38 Revenue (DOR) to furnish my financial institution with my routing number, account number, account type and Social Security number to

39 ensure my refund is properly deposited. I grant permission to DOR to contact the Social Security Administration to confirm that the

40 Social Security number(s) used on this return is correct.

41

42 7. Your daytime Your

43 telephone number email address

999999999999999 XXXXXXXXXXXXXXXXXXXXXX

44

45 I authorize the Department to discuss my return with my Paid Preparer: Firm’s Name (or yours if self-employed)

personal representative.

46

47 Yes X No X If yes, complete the information below. XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

48

49 Personal Representative’s Name (please print) X IN-OPT on file with paid preparer if not filing electronically

50

51 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX PTIN 999999999

52 Telephone

53 number 9999999999 Address XXXXXXXXXXXXXXXXXXXXXXXXXXXXX

54

55 Address XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX City XXXXXXXXXXXXXXXXXXXXXX

56

57 City XXXXXXXXXXXXXXXXXXXXXX State XX ZIP Code 999999999

58 Preparer’s

59 State XX ZIP Code 999999999 signature _________________________________________

60

61

62 *23323111694*

63 23323111694

64

65

66