Enlarge image

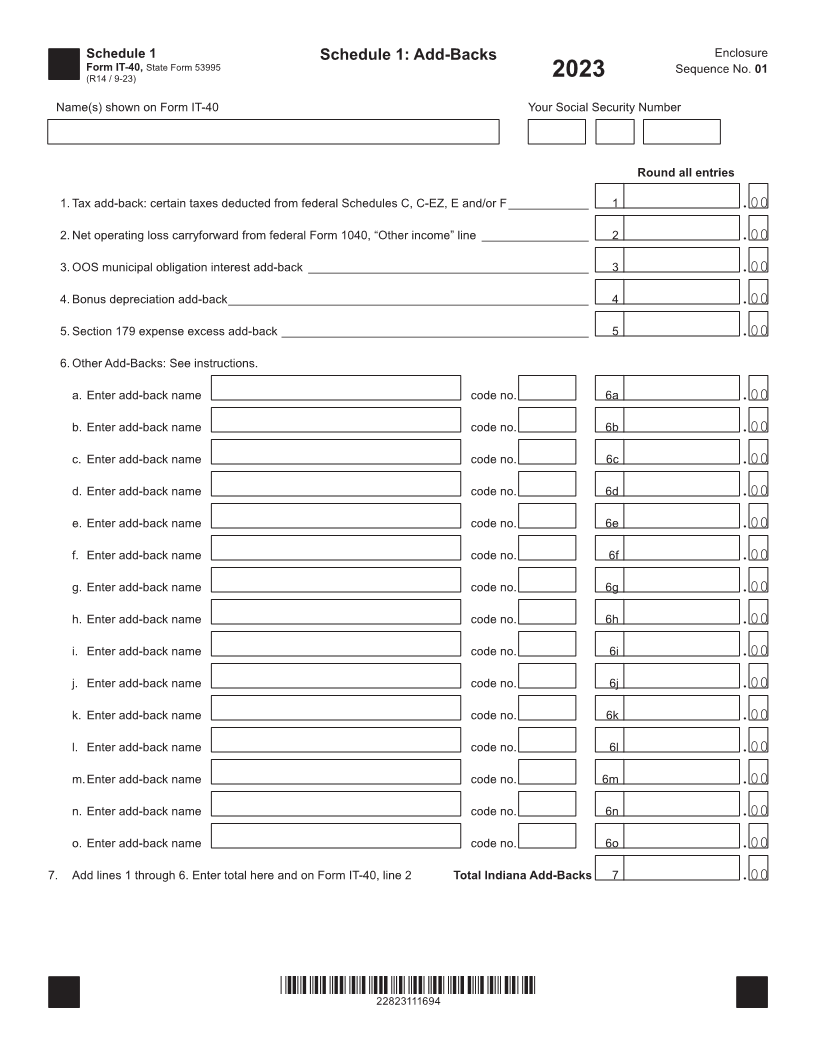

Schedule 1 Schedule 1: Add-Backs Enclosure

Form IT-40, State Form 53995 Sequence No. 01

(R14 / 9-23) 2023

Name(s) shown on Form IT-40 Your Social Security Number

Round all entries

1. Tax add-back: certain taxes deducted from federal Schedules C, C-EZ, E and/or F ____________ 1 .00

2. Net operating loss carryforward from federal Form 1040, “Other income” line ________________ 2 .00

3. OOS municipal obligation interest add-back __________________________________________ 3 .00

4. Bonus depreciation add-back ______________________________________________________ 4 .00

5. Section 179 expense excess add-back ______________________________________________ 5 .00

6. Other Add-Backs: See instructions.

a. Enter add-back name code no. 6a .00

b. Enter add-back name code no. 6b .00

c. Enter add-back name code no. 6c .00

d. Enter add-back name code no. 6d .00

e. Enter add-back name code no. 6e .00

f. Enter add-back name code no. 6f .00

g. Enter add-back name code no. 6g .00

h. Enter add-back name code no. 6h .00

i. Enter add-back name code no. 6i .00

j. Enter add-back name code no. 6j .00

k. Enter add-back name code no. 6k .00

l. Enter add-back name code no. 6l .00

m. Enter add-back name code no. 6m .00

n. Enter add-back name code no. 6n .00

o. Enter add-back name code no. 6o .00

7. Add lines 1 through 6. Enter total here and on Form IT-40, line 2 Total Indiana Add-Backs 7 .00

*22823111694*

22823111694