- 2 -

Enlarge image

|

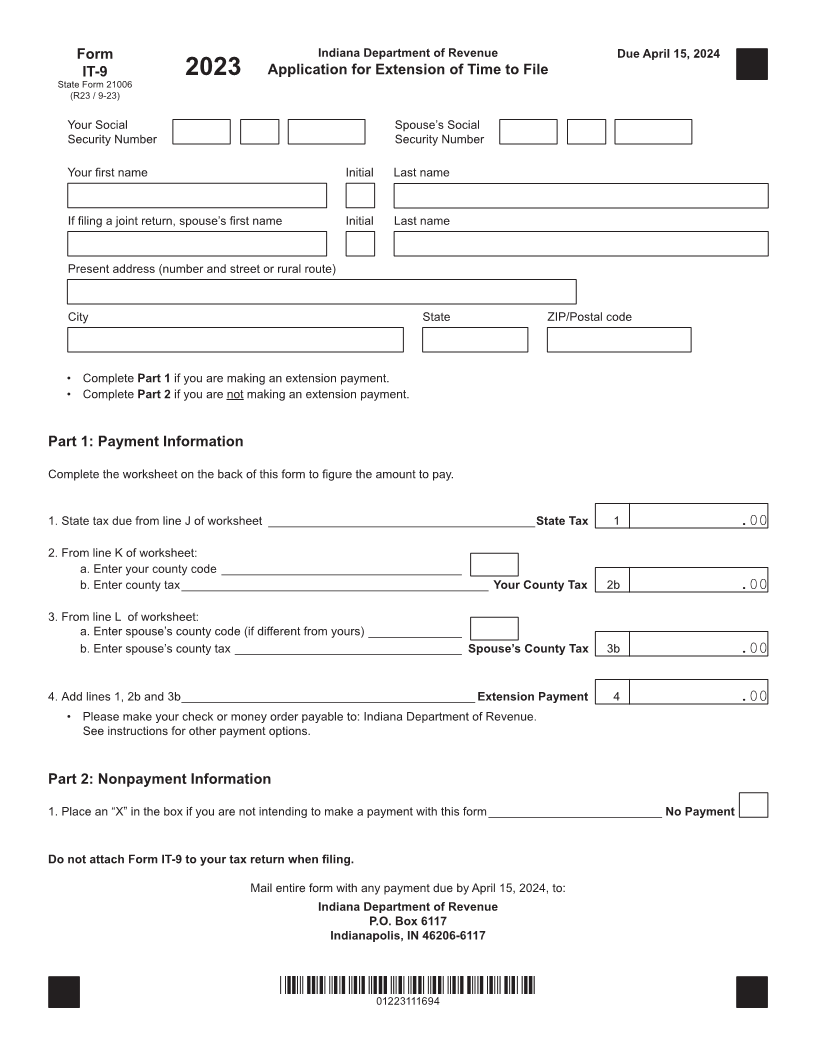

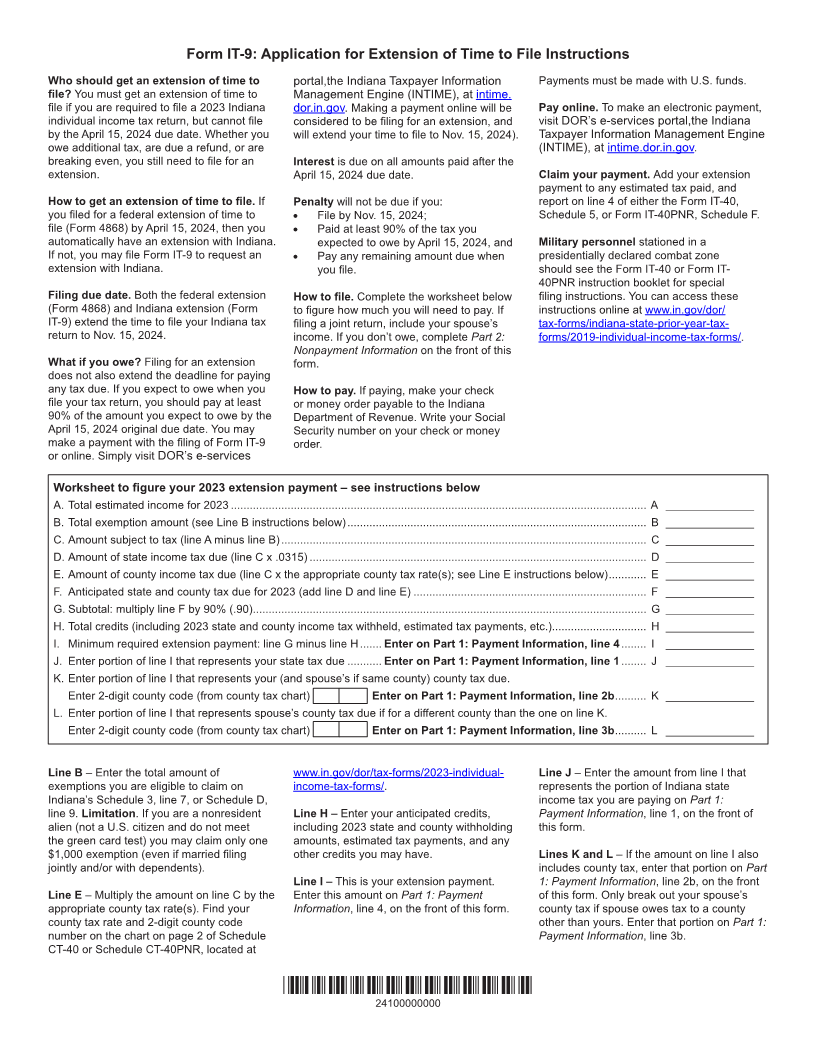

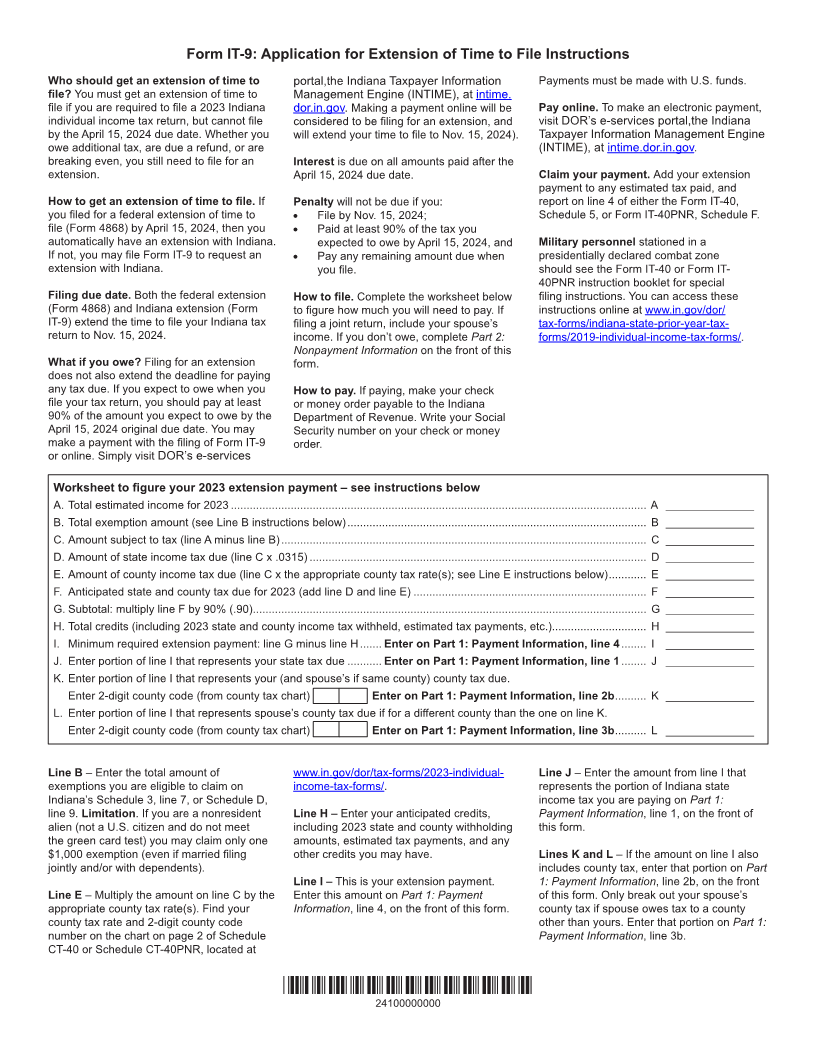

Form IT-9: Application for Extension of Time to File Instructions

Who should get an extension of time to portal,the Indiana Taxpayer Information Payments must be made with U.S. funds.

file? You must get an extension of time to Management Engine (INTIME), at intime.

file if you are required to file a 2023 Indiana dor.in.gov. Making a payment online will be Pay online. To make an electronic payment,

individual income tax return, but cannot file considered to be filing for an extension, and visit DOR’s e-services portal,the Indiana

by the April 15, 2024 due date. Whether you will extend your time to file to Nov. 15, 2024). Taxpayer Information Management Engine

owe additional tax, are due a refund, or are (INTIME), at intime.dor.in.gov.

breaking even, you still need to file for an Interest is due on all amounts paid after the

extension. April 15, 2024 due date. Claim your payment. Add your extension

payment to any estimated tax paid, and

How to get an extension of time to file. If Penalty will not be due if you: report on line 4 of either the Form IT-40,

you filed for a federal extension of time to • File by Nov. 15, 2024; Schedule 5, or Form IT-40PNR, Schedule F.

file (Form 4868) by April 15, 2024, then you • Paid at least 90% of the tax you

automatically have an extension with Indiana. expected to owe by April 15, 2024, and Military personnel stationed in a

If not, you may file Form IT-9 to request an • Pay any remaining amount due when presidentially declared combat zone

extension with Indiana. you file. should see the Form IT-40 or Form IT-

40PNR instruction booklet for special

Filing due date. Both the federal extension How to file. Complete the worksheet below filing instructions. You can access these

(Form 4868) and Indiana extension (Form to figure how much you will need to pay. If instructions online at www.in.gov/dor/

IT-9) extend the time to file your Indiana tax filing a joint return, include your spouse’s tax-forms/indiana-state-prior-year-tax-

return to Nov. 15, 2024. income. If you don’t owe, complete Part 2: forms/2019-individual-income-tax-forms/.

Nonpayment Information on the front of this

What if you owe? Filing for an extension form.

does not also extend the deadline for paying

any tax due. If you expect to owe when you How to pay. If paying, make your check

file your tax return, you should pay at least or money order payable to the Indiana

90% of the amount you expect to owe by the Department of Revenue. Write your Social

April 15, 2024 original due date. You may Security number on your check or money

make a payment with the filing of Form IT-9 order.

or online. Simply visit DOR’s e-services

Worksheet to figure your 2023 extension payment – see instructions below

A. Total estimated income for 2023 .................................................................................................................................... A ______________

B. Total exemption amount (see Line B instructions below) ............................................................................................... B ______________

C. Amount subject to tax (line A minus line B) .................................................................................................................... C ______________

D. Amount of state income tax due (line C x .0315) ........................................................................................................... D ______________

E. Amount of county income tax due (line C x the appropriate county tax rate(s); see Line E instructions below) ............ E ______________

F. Anticipated state and county tax due for 2023 (add line D and line E) .......................................................................... F ______________

G. Subtotal: multiply line F by 90% (.90) ............................................................................................................................. G ______________

H. Total credits (including 2023 state and county income tax withheld, estimated tax payments, etc.).............................. H ______________

I. Minimum required extension payment: line G minus line H ....... Enter on Part 1: Payment Information, line 4 ........ I ______________

J. Enter portion of line I that represents your state tax due ........... Enter on Part 1: Payment Information, line 1 ........ J ______________

K. Enter portion of line I that represents your (and spouse’s if same county) county tax due.

Enter 2-digit county code (from county tax chart) Enter on Part 1: Payment Information, line 2b .......... K ______________

L. Enter portion of line I that represents spouse’s county tax due if for a different county than the one on line K.

Enter 2-digit county code (from county tax chart) Enter on Part 1: Payment Information, line 3b .......... L ______________

Line B – Enter the total amount of www.in.gov/dor/tax-forms/2023-individual- Line J – Enter the amount from line I that

exemptions you are eligible to claim on income-tax-forms/. represents the portion of Indiana state

Indiana’s Schedule 3, line 7, or Schedule D, income tax you are paying on Part 1:

line 9. Limitation. If you are a nonresident Line H – Enter your anticipated credits, Payment Information, line 1, on the front of

alien (not a U.S. citizen and do not meet including 2023 state and county withholding this form.

the green card test) you may claim only one amounts, estimated tax payments, and any

$1,000 exemption (even if married filing other credits you may have. Lines K and L – If the amount on line I also

jointly and/or with dependents). includes county tax, enter that portion on Part

Line I – This is your extension payment. 1: Payment Information, line 2b, on the front

Line E – Multiply the amount on line C by the Enter this amount on Part 1: Payment of this form. Only break out your spouse’s

appropriate county tax rate(s). Find your Information, line 4, on the front of this form. county tax if spouse owes tax to a county

county tax rate and 2-digit county code other than yours. Enter that portion on Part 1:

number on the chart on page 2 of Schedule Payment Information, line 3b.

CT-40 or Schedule CT-40PNR, located at

*24100000000*

24100000000

|