Enlarge image

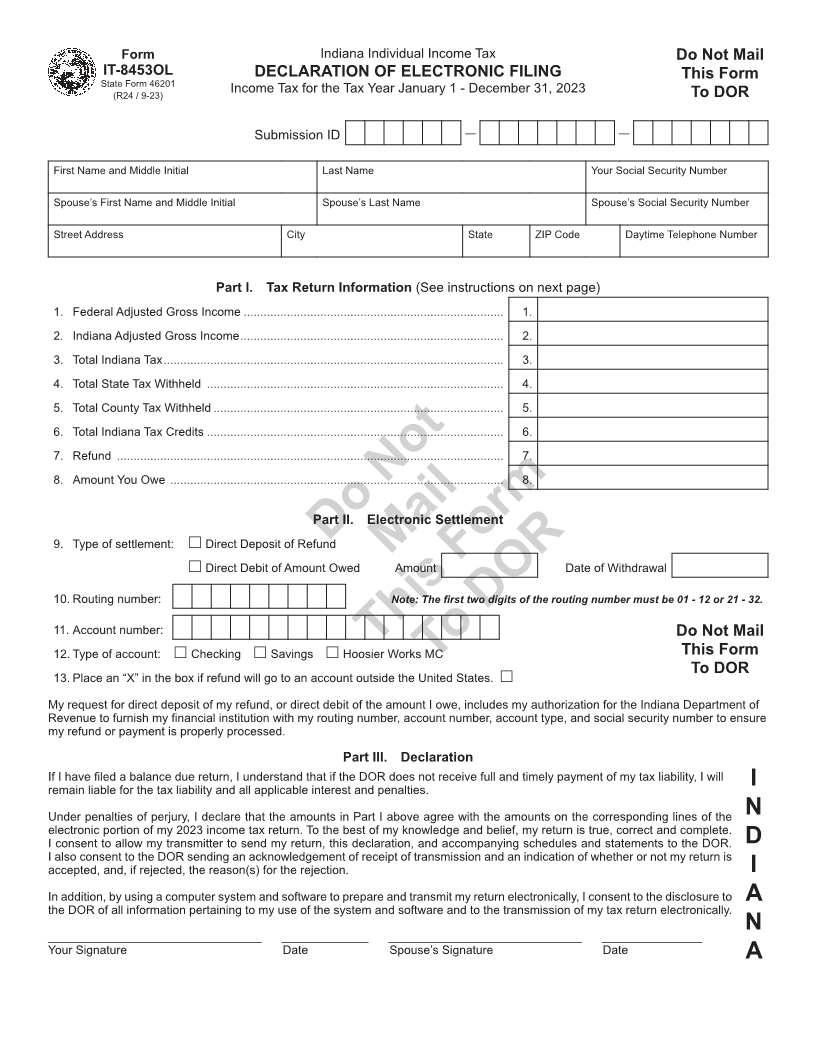

Form Indiana Individual Income Tax Do Not Mail

IT-8453OL DECLARATION OF ELECTRONIC FILING This Form

State Form 46201

(R24 / 9-23) Income Tax for the Tax Year January 1 - December 31, 2023 To DOR

Submission ID — —

First Name and Middle Initial Last Name Your Social Security Number

Spouse’s First Name and Middle Initial Spouse’s Last Name Spouse’s Social Security Number

Street Address City State ZIP Code Daytime Telephone Number

Part I. Tax Return Information (See instructions on next page)

1. Federal Adjusted Gross Income .............................................................................. 1.

2. Indiana Adjusted Gross Income ............................................................................... 2.

3. Total Indiana Tax ...................................................................................................... 3.

4. Total State Tax Withheld ......................................................................................... 4.

5. Total County Tax Withheld ....................................................................................... 5.

6. Total Indiana Tax Credits ......................................................................................... 6.

7. Refund .................................................................................................................... 7.

8. Amount You Owe .................................................................................................... 8.

Part II. Electronic Settlement

9. Type of settlement: Direct Deposit of Refund Do Not

Direct Debit of Amount Owed AmountMail Date of Withdrawal

10. Routing number: Note: The first two digits of the routing number must be 01 - 12 or 21 - 32.

11. Account number: Do Not Mail

12. Type of account: Checking Savings Hoosier Works MCThis Form This Form

To DOR To DOR

13. Place an “X” in the box if refund will go to an account outside the United States.

My request for direct deposit of my refund, or direct debit of the amount I owe, includes my authorization for the Indiana Department of

Revenue to furnish my financial institution with my routing number, account number, account type, and social security number to ensure

my refund or payment is properly processed.

Part III. Declaration

If I have filed a balance due return, I understand that if the DOR does not receive full and timely payment of my tax liability, I will

remain liable for the tax liability and all applicable interest and penalties. I

Under penalties of perjury, I declare that the amounts in Part I above agree with the amounts on the corresponding lines of the N

electronic portion of my 2023 income tax return. To the best of my knowledge and belief, my return is true, correct and complete.

I consent to allow my transmitter to send my return, this declaration, and accompanying schedules and statements to the DOR. D

I also consent to the DOR sending an acknowledgement of receipt of transmission and an indication of whether or not my return is

accepted, and, if rejected, the reason(s) for the rejection. I

In addition, by using a computer system and software to prepare and transmit my return electronically, I consent to the disclosure to A

the DOR of all information pertaining to my use of the system and software and to the transmission of my tax return electronically.

________________________________ _____________ _____________________________ _______________ N

Your Signature Date Spouse’s Signature Date

A