Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

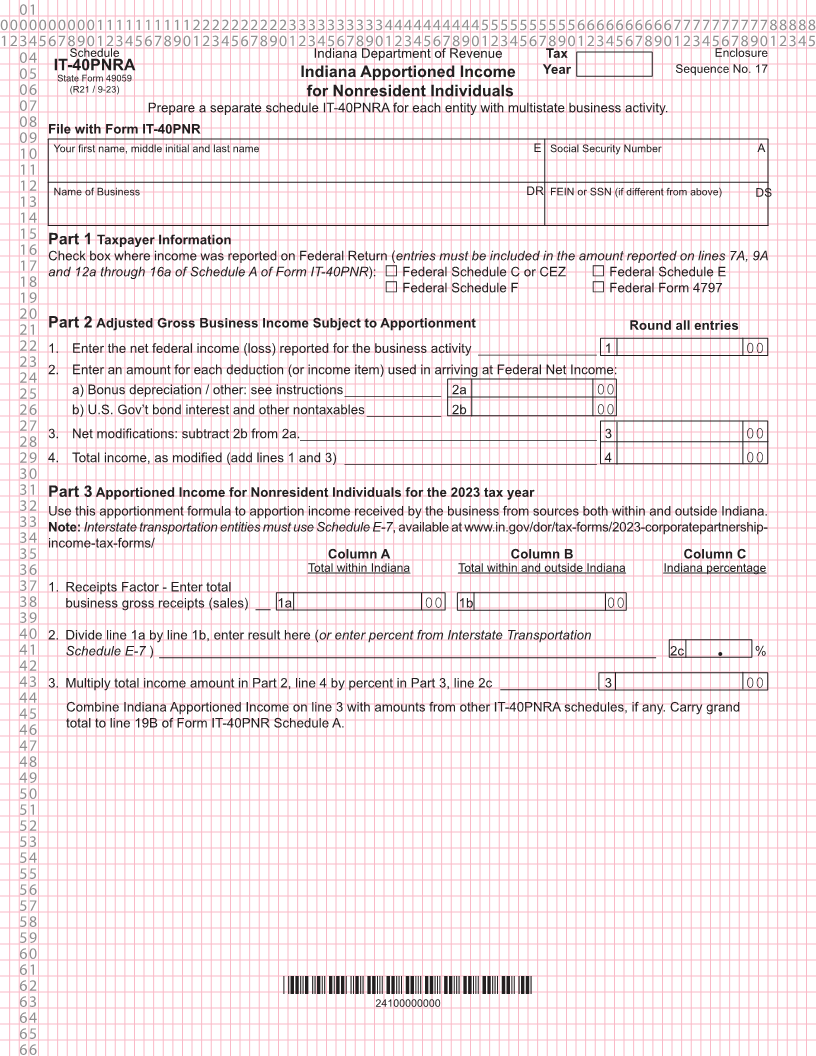

04 Schedule Indiana Department of Revenue Tax Enclosure

IT-40PNRA Sequence No. 17

05 State Form 49059 Indiana Apportioned Income Year

06 (R21 / 9-23) for Nonresident Individuals

07 Prepare a separate schedule IT-40PNRA for each entity with multistate business activity.

08

File with Form IT-40PNR

09

Your first name, middle initial and last name E Social Security Number A

10

11

12 Name of Business DR FEIN or SSN (if different from above) DS

13

14

15 Taxpayer Information

Part 1

16 Check box where income was reported on Federal Return (entries must be included in the amount reported on lines 7A, 9A

17 and 12a through 16a of Schedule A of Form IT-40PNR): □ Federal Schedule C or CEZ □ Federal Schedule E

18 □ Federal Schedule F □ Federal Form 4797

19

20

21 Part 2 Adjusted Gross Business Income Subject to Apportionment Round all entries

22 1. Enter the net federal income (loss) reported for the business activity ________________ 1 00

23

2. Enter an amount for each deduction (or income item) used in arriving at Federal Net Income:

24

25 a) Bonus depreciation / other: see instructions _____________ 2a 00

26 b) U.S. Gov’t bond interest and other nontaxables __________ 2b 00

27

3. Net modifications: subtract 2b from 2a.________________________________________ 3

28 00

29 4. Total income, as modified (add lines 1 and 3) __________________________________ 4 00

30

31 Part 3 Apportioned Income for Nonresident Individuals for the 2023 tax year

32 Use this apportionment formula to apportion income received by the business from sources both within and outside Indiana.

33 Note: Interstate transportation entities must use Schedule E-7, available at www.in.gov/dor/tax-forms/2023-corporatepartnership-

34 income-tax-forms/

35 Column A Column B Column C

36 Total within Indiana Total within and outside Indiana Indiana percentage

37 1. Receipts Factor - Enter total

38 business gross receipts (sales) __ 1a 00 1b 00

39

40 2. Divide line 1a by line 1b, enter result here (or enter percent from Interstate Transportation

41 Schedule E-7 ) ___________________________________________________________________ 2c . %

42

43 3. Multiply total income amount in Part 2, line 4 by percent in Part 3, line 2c _____________ 3 00

44

Combine Indiana Apportioned Income on line 3 with amounts from other IT-40PNRA schedules, if any. Carry grand

45

total to line 19B of Form IT-40PNR Schedule A.

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62 *24100000000*

63 24100000000

64

65

66