Enlarge image

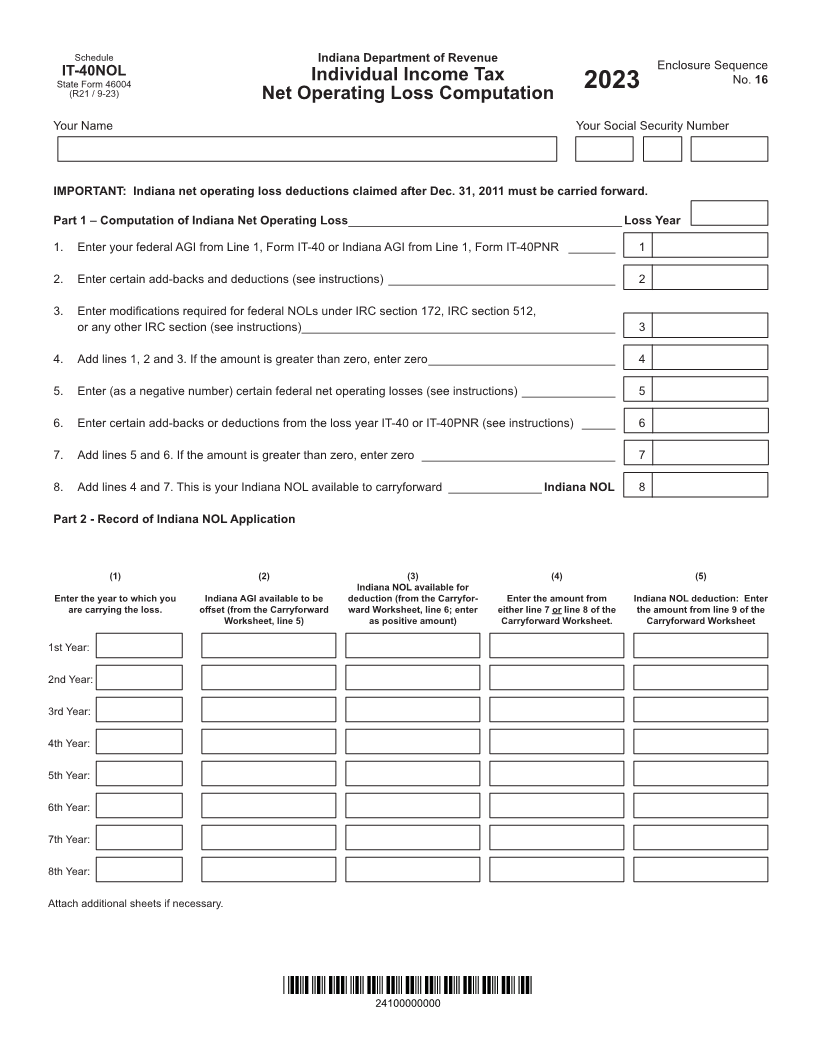

Schedule Indiana Department of Revenue

Enclosure Sequence

IT-40NOL

State Form 46004 Individual Income Tax No. 16

(R21 / 9-23) Net Operating Loss Computation 2023

Your Name Your Social Security Number

IMPORTANT: Indiana net operating loss deductions claimed after Dec. 31, 2011 must be carried forward.

Part 1 – Computation of Indiana Net Operating Loss _________________________________________ Loss Year

1. Enter your federal AGI from Line 1, Form IT-40 or Indiana AGI from Line 1, Form IT-40PNR _______ 1

2. Enter certain add-backs and deductions (see instructions) __________________________________ 2

3. Enter modifications required for federal NOLs under IRC section 172, IRC section 512,

or any other IRC section (see instructions) _______________________________________________ 3

4. Add lines 1, 2 and 3. If the amount is greater than zero, enter zero ____________________________ 4

5. Enter (as a negative number) certain federal net operating losses (see instructions) ______________ 5

6. Enter certain add-backs or deductions from the loss year IT-40 or IT-40PNR (see instructions) _____ 6

7. Add lines 5 and 6. If the amount is greater than zero, enter zero _____________________________ 7

8. Add lines 4 and 7. This is your Indiana NOL available to carryforward ______________ Indiana NOL 8

Part 2 - Record of Indiana NOL Application

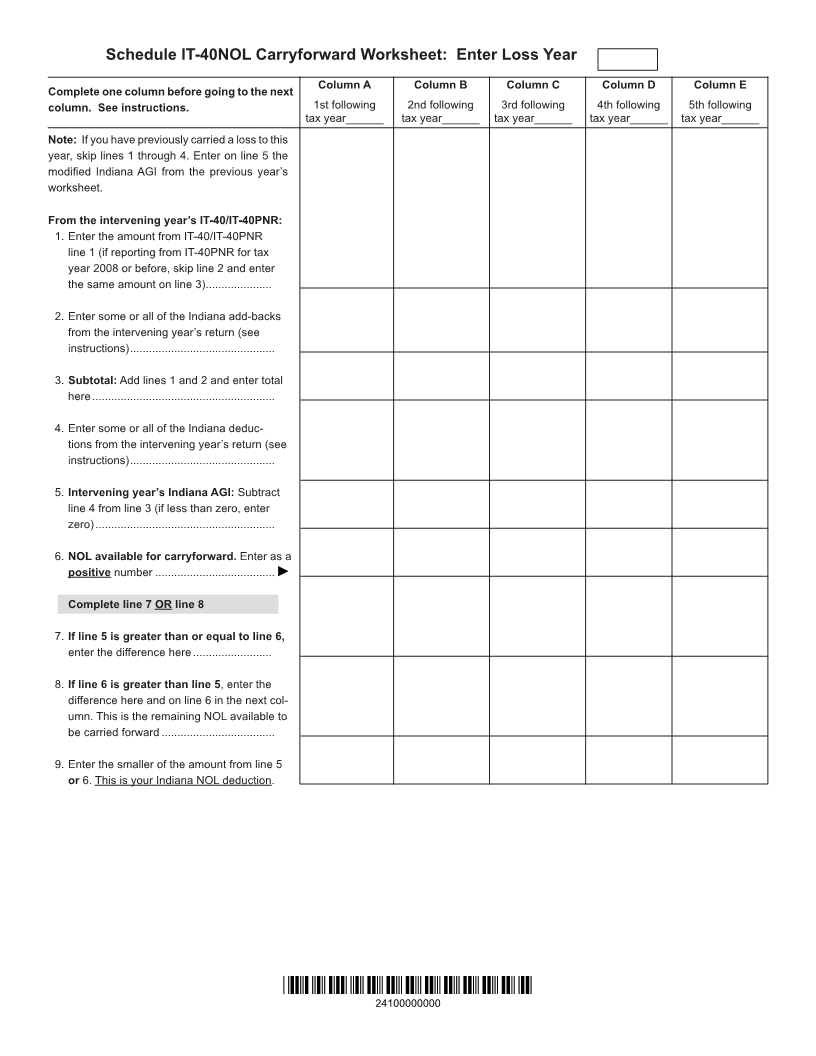

(1) (2) (3) (4) (5)

Indiana NOL available for

Enter the year to which you Indiana AGI available to be deduction (from the Carryfor- Enter the amount from Indiana NOL deduction: Enter

are carrying the loss. offset (from the Carryforward ward Worksheet, line 6; enter either line 7 or line 8 of the the amount from line 9 of the

Worksheet, line 5) as positive amount) Carryforward Worksheet. Carryforward Worksheet

1st Year:

2nd Year:

3rd Year:

4th Year:

5th Year:

6th Year:

7th Year:

8th Year:

Attach additional sheets if necessary.

*24100000000*

24100000000