Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

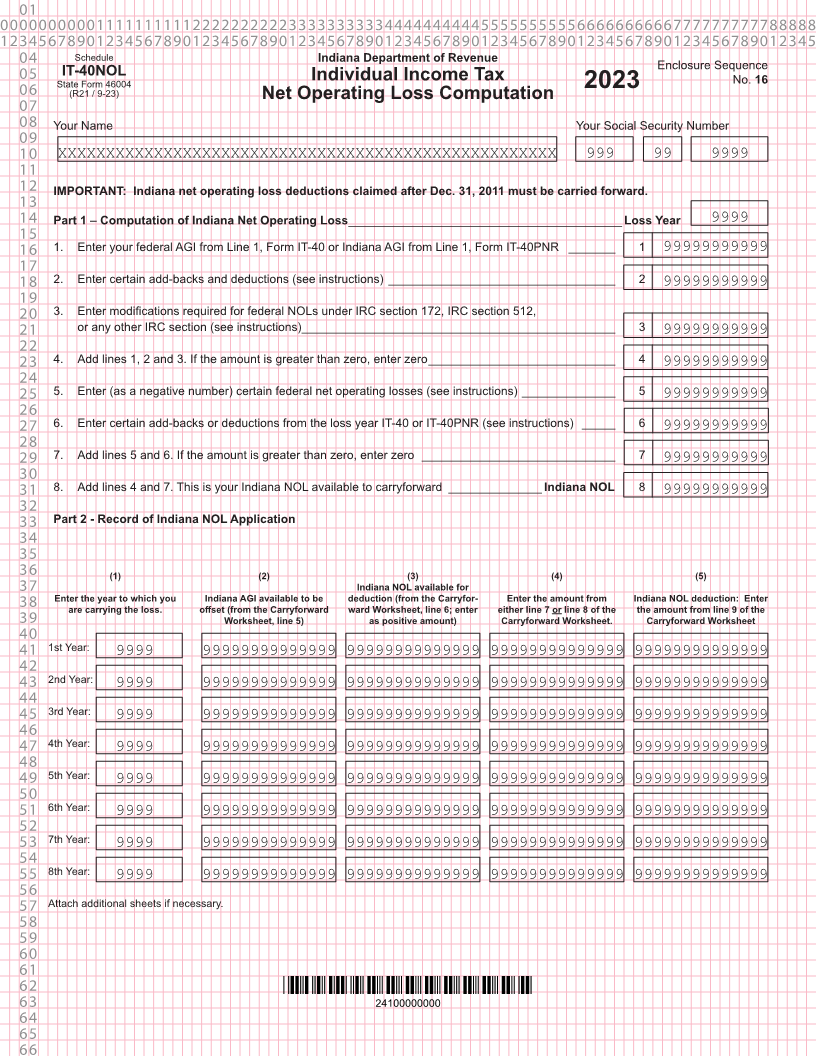

04 Schedule Indiana Department of Revenue

Enclosure Sequence

IT-40NOL

05 State Form 46004 Individual Income Tax No. 16

06 (R21 / 9-23) 2023

Net Operating Loss Computation

07

08 Your Name Your Social Security Number

09

10 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

11

12 IMPORTANT: Indiana net operating loss deductions claimed after Dec. 31, 2011 must be carried forward.

13

14 Part 1 – Computation of Indiana Net Operating Loss _________________________________________ Loss Year 9999

15

16 1. Enter your federal AGI from Line 1, Form IT-40 or Indiana AGI from Line 1, Form IT-40PNR _______ 1 99999999999

17

18 2. Enter certain add-backs and deductions (see instructions) __________________________________ 2

99999999999

19

20 3. Enter modifications required for federal NOLs under IRC section 172, IRC section 512,

21 or any other IRC section (see instructions) _______________________________________________ 3

99999999999

22

23 4. Add lines 1, 2 and 3. If the amount is greater than zero, enter zero ____________________________ 4

99999999999

24

25 5. Enter (as a negative number) certain federal net operating losses (see instructions) ______________ 5

99999999999

26

27 6. Enter certain add-backs or deductions from the loss year IT-40 or IT-40PNR (see instructions) _____ 6

99999999999

28

29 7. Add lines 5 and 6. If the amount is greater than zero, enter zero _____________________________ 7

99999999999

30

31 8. Add lines 4 and 7. This is your Indiana NOL available to carryforward ______________ Indiana NOL 8

99999999999

32

33 Part 2 - Record of Indiana NOL Application

34

35

36 (1) (2) (3) (4) (5)

37 Indiana NOL available for

38 Enter the year to which you Indiana AGI available to be deduction (from the Carryfor- Enter the amount from Indiana NOL deduction: Enter

are carrying the loss. offset (from the Carryforward ward Worksheet, line 6; enter either line 7 or line 8 of the the amount from line 9 of the

39 Worksheet, line 5) as positive amount) Carryforward Worksheet. Carryforward Worksheet

40

41 1st Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

42

43 2nd Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

44

45 3rd Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

46

47 4th Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

48

49 5th Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

50

51 6th Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

52

53 7th Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

54

55 8th Year:

9999 99999999999999 99999999999999 99999999999999 99999999999999

56

57 Attach additional sheets if necessary.

58

59

60

61

62 *24100000000*

63 24100000000

64

65

66