Enlarge image

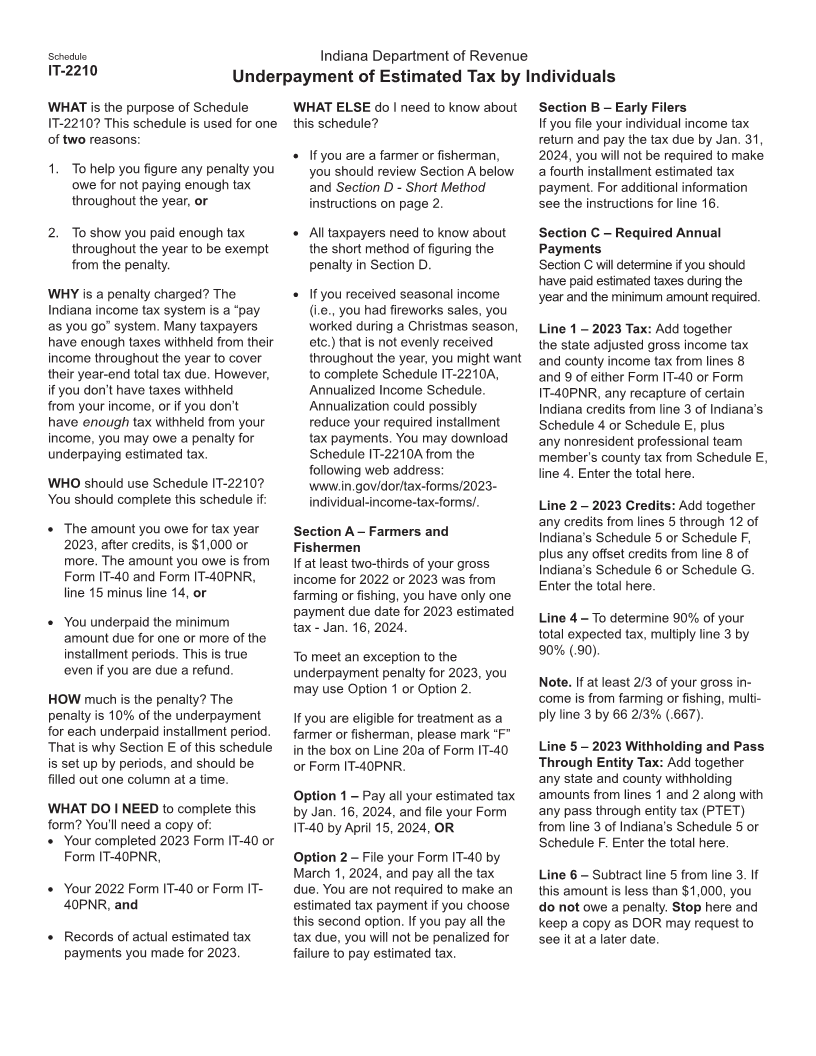

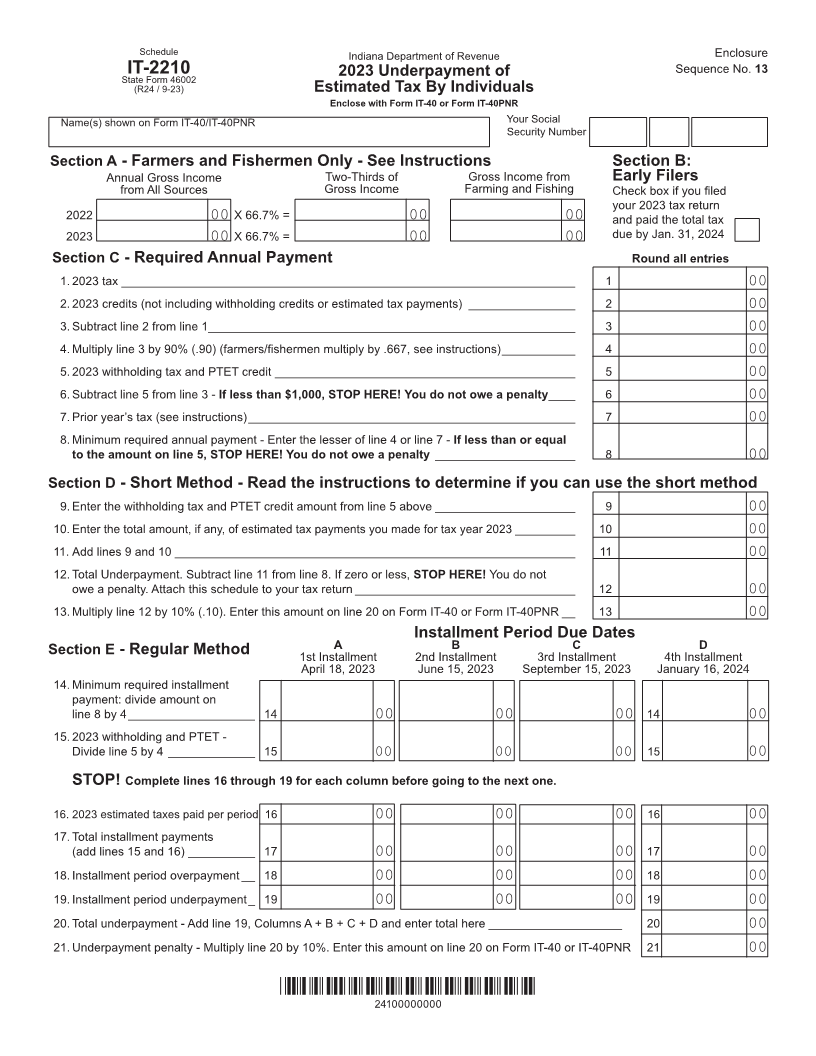

Schedule Indiana Department of Revenue Enclosure

Sequence No. 13

StateIT-2210Form 46002 2023 Underpayment of

(R24 / 9-23) Estimated Tax By Individuals

Enclose with Form IT-40 or Form IT-40PNR

Name(s) shown on Form IT-40/IT-40PNR Your Social

Security Number

Section A - Farmers and Fishermen Only - See Instructions Section B:

Annual Gross Income Two-Thirds of Gross Income from Early Filers

from All Sources Gross Income Farming and Fishing Check box if you filed

your 2023 tax return

2022 00 X 66.7% = 00 00 and paid the total tax

2023 00 X 66.7% = 00 00 due by Jan. 31, 2024

Section C - Required Annual Payment Round all entries

1. 2023 tax ____________________________________________________________________ 1 00

2. 2023 credits (not including withholding credits or estimated tax payments) ________________ 2 00

3. Subtract line 2 from line 1 _______________________________________________________ 3 00

4. Multiply line 3 by 90% (.90) (farmers/fishermen multiply by .667, see instructions) ___________ 4 00

5. 2023 withholding tax and PTET credit _____________________________________________ 5 00

6. Subtract line 5 from line 3 - If less than $1,000, STOP HERE! You do not owe a penalty ____ 6 00

7. Prior year’s tax (see instructions) _________________________________________________ 7 00

8. Minimum required annual payment - Enter the lesser of line 4 or line 7 - If less than or equal

to the amount on line 5, STOP HERE! You do not owe a penalty _____________________ 8 00

Section D - Short Method - Read the instructions to determine if you can use the short method

9. Enter the withholding tax and PTET credit amount from line 5 above _____________________ 9 00

10. Enter the total amount, if any, of estimated tax payments you made for tax year 2023 _________ 10 00

11. Add lines 9 and 10 ____________________________________________________________ 11 00

12. Total Underpayment. Subtract line 11 from line 8. If zero or less, STOP HERE! You do not

owe a penalty. Attach this schedule to your tax return _________________________________ 12 00

13. Multiply line 12 by 10% (.10). Enter this amount on line 20 on Form IT-40 or Form IT-40PNR __ 13 00

Installment Period Due Dates

A B C D

Section E - Regular Method 1st Installment 2nd Installment 3rd Installment 4th Installment

April 18, 2023 June 15, 2023 September 15, 2023 January 16, 2024

14. Minimum required installment

payment: divide amount on

line 8 by 4 ___________________ 14 00 00 00 14 00

15. 2023 withholding and PTET -

Divide line 5 by 4 _____________ 15 00 00 00 15 00

STOP! Complete lines 16 through 19 for each column before going to the next one.

16. 2023 estimated taxes paid per period 16 00 00 00 16 00

17. Total installment payments

(add lines 15 and 16) __________ 17 00 00 00 17 00

18. Installment period overpayment __ 18 00 00 00 18 00

19. Installment period underpayment _ 19 00 00 00 19 00

20. Total underpayment - Add line 19, Columns A + B + C + D and enter total here ____________________ 20 00

21. Underpayment penalty - Multiply line 20 by 10%. Enter this amount on line 20 on Form IT-40 or IT-40PNR 21 00

*24100000000*

24100000000