Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

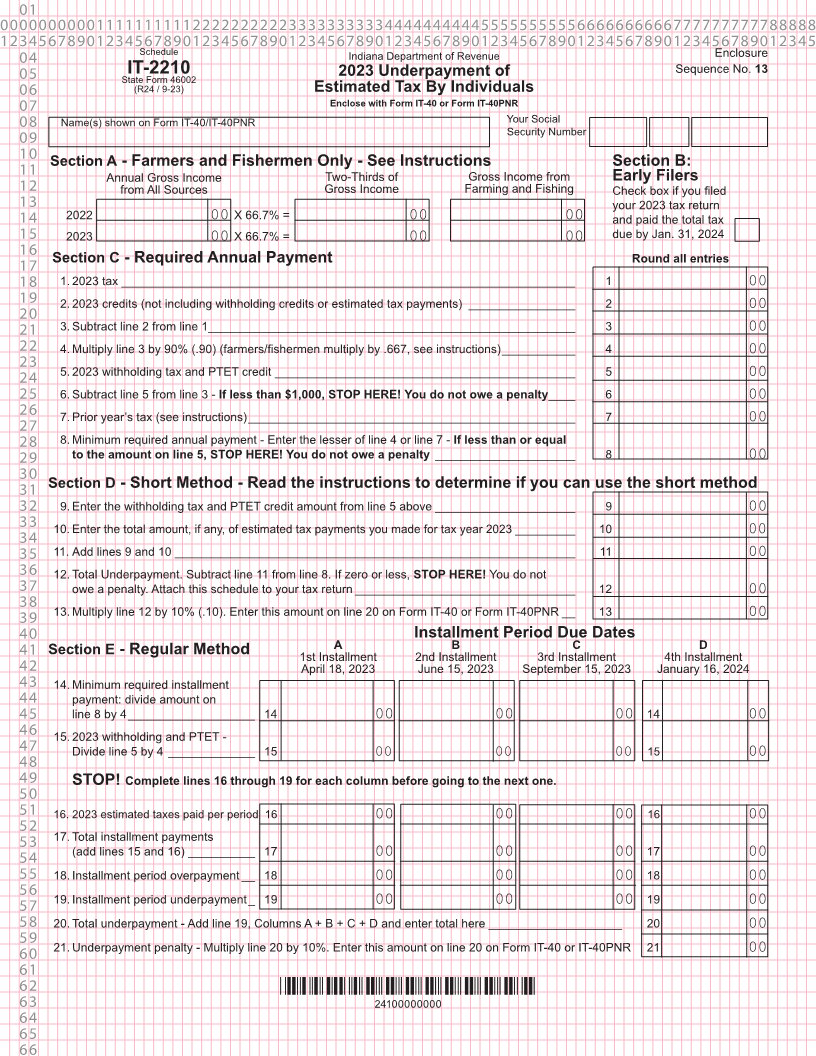

04 Schedule Indiana Department of Revenue Enclosure

Sequence No. 13

05 StateIT-2210Form 46002 2023 Underpayment of

06 (R24 / 9-23) Estimated Tax By Individuals

07 Enclose with Form IT-40 or Form IT-40PNR

08 Name(s) shown on Form IT-40/IT-40PNR Your Social

Security Number

09

10

Section A - Farmers and Fishermen Only - See Instructions Section B:

11 Two-Thirds of Gross Income from Early Filers

Annual Gross Income

12 from All Sources Gross Income Farming and Fishing Check box if you filed

13 your 2023 tax return

14 2022 00 X 66.7% = 00 00 and paid the total tax

15 2023 00 X 66.7% = 00 00 due by Jan. 31, 2024

16

17 - Required Annual Payment Round all entries

Section C

18 1. 2023 tax ____________________________________________________________________ 1 00

19 2. 2023 credits (not including withholding credits or estimated tax payments) ________________ 2 00

20

21 3. Subtract line 2 from line 1 _______________________________________________________ 3 00

22 4. Multiply line 3 by 90% (.90) (farmers/fishermen multiply by .667, see instructions) ___________ 4 00

23

5. 2023 withholding tax and PTET credit _____________________________________________ 5

24 00

25 6. Subtract line 5 from line 3 - If less than $1,000, STOP HERE! You do not owe a penalty ____ 6 00

26 7. Prior year’s tax (see instructions) _________________________________________________ 7 00

27

28 8. Minimum required annual payment - Enter the lesser of line 4 or line 7 - If less than or equal

29 to the amount on line 5, STOP HERE! You do not owe a penalty _____________________ 8 00

30

31 Section D - Short Method - Read the instructions to determine if you can use the short method

32 9. Enter the withholding tax and PTET credit amount from line 5 above _____________________ 9 00

33 10. Enter the total amount, if any, of estimated tax payments you made for tax year 2023 _________ 10 00

34

35 11. Add lines 9 and 10 ____________________________________________________________ 11 00

36 12. Total Underpayment. Subtract line 11 from line 8. If zero or less, STOP HERE! You do not

37 owe a penalty. Attach this schedule to your tax return _________________________________ 12 00

38

13. Multiply line 12 by 10% (.10). Enter this amount on line 20 on Form IT-40 or Form IT-40PNR __ 13

39 00

40 Installment Period Due Dates

A B C D

41 Section E - Regular Method 1st Installment 2nd Installment 3rd Installment 4th Installment

42 April 18, 2023 June 15, 2023 September 15, 2023 January 16, 2024

43 14. Minimum required installment

44 payment: divide amount on

45 line 8 by 4 ___________________ 14 00 00 00 14 00

46 15. 2023 withholding and PTET -

47 Divide line 5 by 4 _____________ 15 00 00 00 15 00

48

49 STOP! Complete lines 16 through 19 for each column before going to the next one.

50

51 16. 2023 estimated taxes paid per period 16 00 00 00 16 00

52

53 17. Total installment payments

(add lines 15 and 16) __________ 17

54 00 00 00 17 00

55 18. Installment period overpayment __ 18 00 00 00 18 00

56

19. Installment period underpayment _ 19

57 00 00 00 19 00

58 20. Total underpayment - Add line 19, Columns A + B + C + D and enter total here ____________________ 20 00

59

21. Underpayment penalty - Multiply line 20 by 10%. Enter this amount on line 20 on Form IT-40 or IT-40PNR 21

60 00

61

62 *24100000000*

63 24100000000

64

65

66