Enlarge image

Form

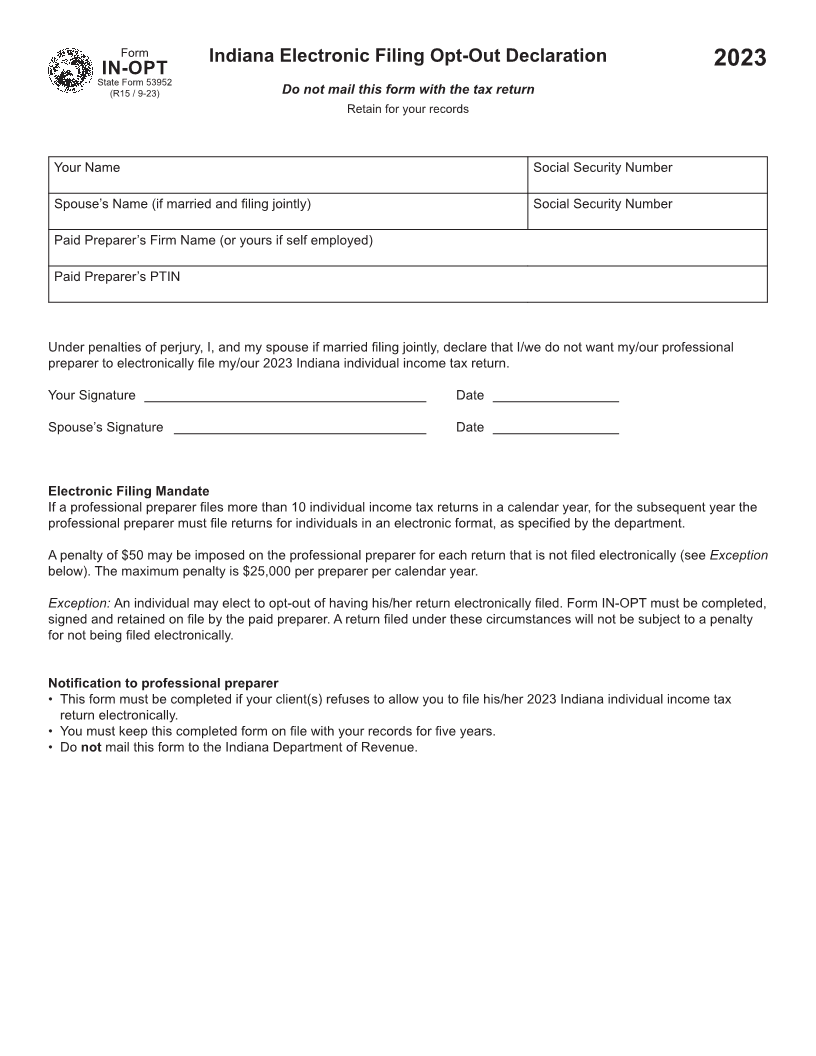

Indiana Electronic Filing Opt-Out Declaration 2023

IN-OPT

State Form 53952

(R15 / 9-23) Do not mail this form with the tax return

Retain for your records

Your Name Social Security Number

Spouse’s Name (if married and filing jointly) Social Security Number

Paid Preparer’s Firm Name (or yours if self employed)

Paid Preparer’s PTIN

Under penalties of perjury, I, and my spouse if married filing jointly, declare that I/we do not want my/our professional

preparer to electronically file my/our 2023 Indiana individual income tax return.

Your Signature ______________________________________ Date _________________

Spouse’s Signature __________________________________ Date _________________

Electronic Filing Mandate

If a professional preparer files more than 10 individual income tax returns in a calendar year, for the subsequent year the

professional preparer must file returns for individuals in an electronic format, as specified by the department.

A penalty of $50 may be imposed on the professional preparer for each return that is not filed electronically (see Exception

below). The maximum penalty is $25,000 per preparer per calendar year.

Exception: An individual may elect to opt-out of having his/her return electronically filed. Form IN-OPT must be completed,

signed and retained on file by the paid preparer. A return filed under these circumstances will not be subject to a penalty

for not being filed electronically.

Notification to professional preparer

• This form must be completed if your client(s) refuses to allow you to file his/her 2023 Indiana individual income tax

return electronically.

• You must keep this completed form on file with your records for five years.

• Do not mail this form to the Indiana Department of Revenue.