Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

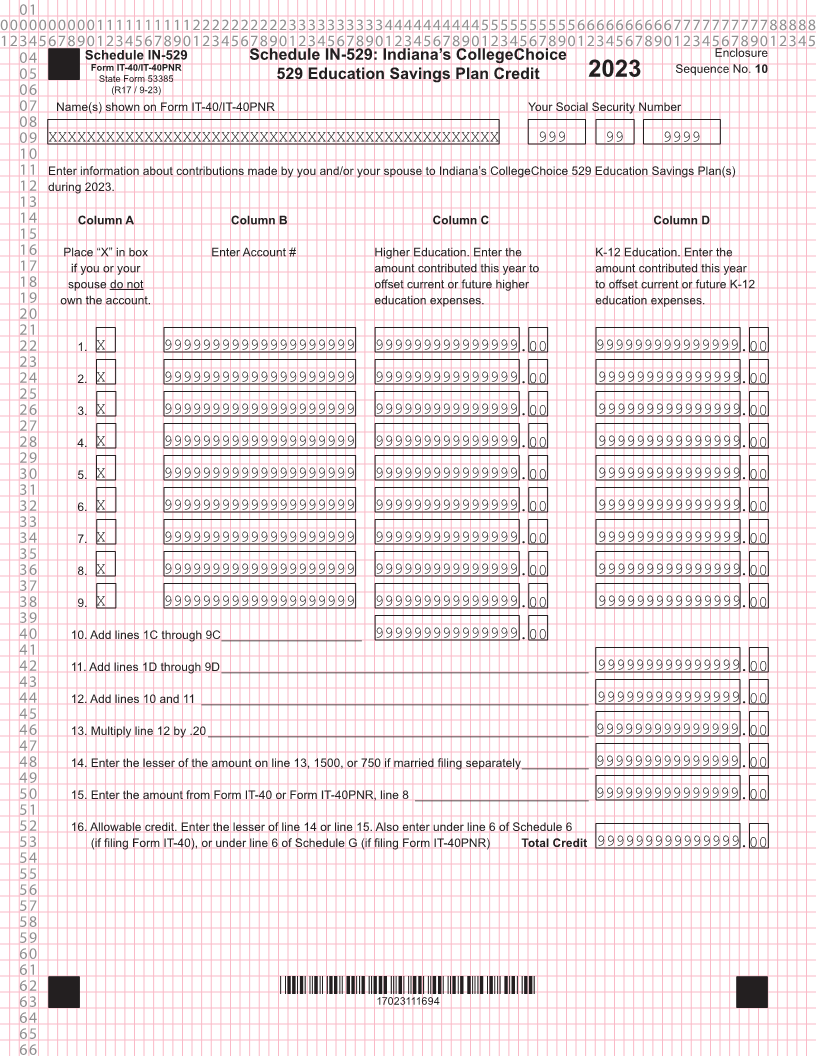

04 Schedule IN-529 Schedule IN-529: Indiana’s CollegeChoice Enclosure

Form IT-40/IT-40PNR Sequence No. 10

05 State Form 53385 529 Education Savings Plan Credit 2023

06 (R17 / 9-23)

07 Name(s) shown on Form IT-40/IT-40PNR Your Social Security Number

08

09 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

10

11 Enter information about contributions made by you and/or your spouse to Indiana’s CollegeChoice 529 Education Savings Plan(s)

12 during 2023.

13

14 Column A Column B Column C Column D

15

16 Place “X” in box Enter Account # Higher Education. Enter the K-12 Education. Enter the

17 if you or your amount contributed this year to amount contributed this year

18 spouse do not offset current or future higher to offset current or future K-12

19 own the account. education expenses. education expenses.

20

21

22 1. X 99999999999999999999 999999999999999 .00 999999999999999.00

23

24 2. X 99999999999999999999 999999999999999 .00 999999999999999.00

25

26 3. X 99999999999999999999 999999999999999 .00 999999999999999.00

27

28 4. X 99999999999999999999 999999999999999 .00 999999999999999.00

29

30 5. X 99999999999999999999 999999999999999 .00 999999999999999.00

31

32 6. X 99999999999999999999 999999999999999 .00 999999999999999.00

33

34 7. X 99999999999999999999 999999999999999 .00 999999999999999.00

35

36 8. X 99999999999999999999 999999999999999 .00 999999999999999.00

37

38 9. X 99999999999999999999 999999999999999 .00 999999999999999.00

39

40 10. Add lines 1C through 9C _____________________ 999999999999999 .00

41

42 11. Add lines 1D through 9D _______________________________________________________ 999999999999999.00

43

44 12. Add lines 10 and 11 __________________________________________________________ 999999999999999.00

45

46 13. Multiply line 12 by .20 _________________________________________________________ 999999999999999.00

47

48 14. Enter the lesser of the amount on line 13, 1500, or 750 if married filing separately __________ 999999999999999.00

49

50 15. Enter the amount from Form IT-40 or Form IT-40PNR, line 8 __________________________ 999999999999999.00

51

52 16. Allowable credit. Enter the lesser of line 14 or line 15. Also enter under line 6 of Schedule 6

53 (if filing Form IT-40), or under line 6 of Schedule G (if filing Form IT-40PNR) Total Credit 999999999999999.00

54

55

56

57

58

59

60

61

62 *17023111694*

63 17023111694

64

65

66