Enlarge image

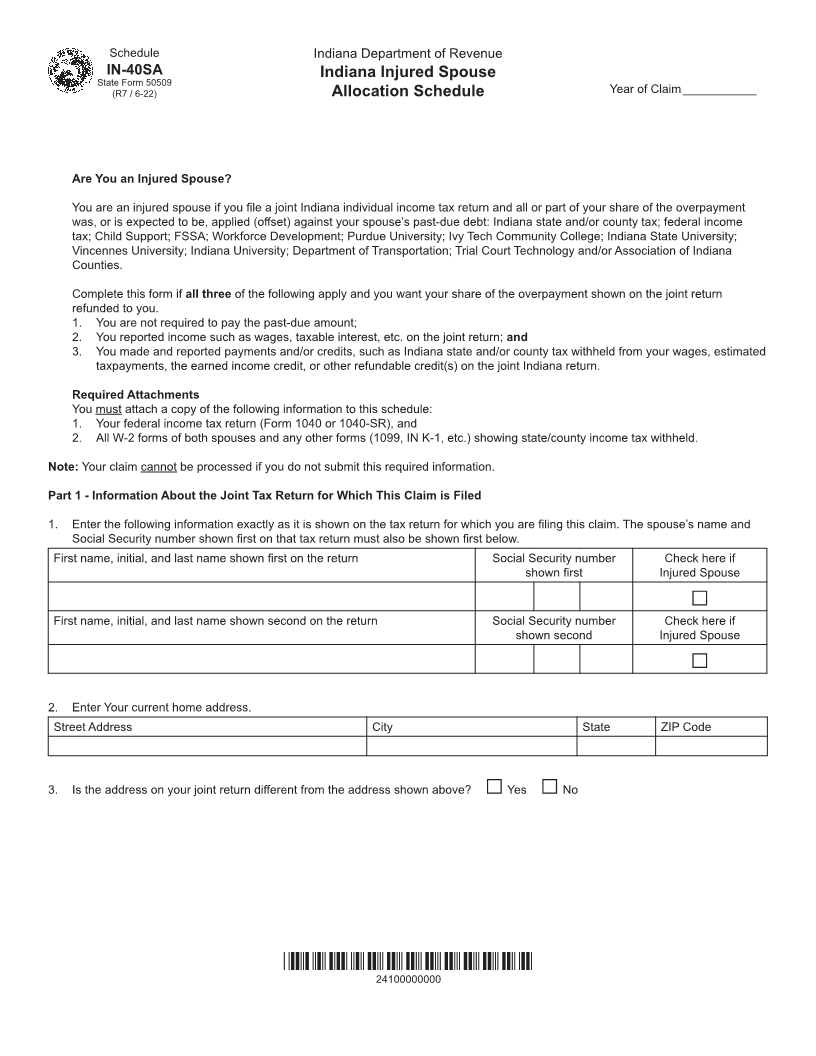

Schedule Indiana Department of Revenue

IN-40SA Indiana Injured Spouse

State Form 50509

(R7 / 6-22) Allocation Schedule Year of Claim ___________

Are You an Injured Spouse?

You are an injured spouse if you file a joint Indiana individual income tax return and all or part of your share of the overpayment

was, or is expected to be, applied (offset) against your spouse’s past-due debt: Indiana state and/or county tax; federal income

tax; Child Support; FSSA; Workforce Development; Purdue University; Ivy Tech Community College; Indiana State University;

Vincennes University; Indiana University; Department of Transportation; Trial Court Technology and/or Association of Indiana

Counties.

Complete this form if all three of the following apply and you want your share of the overpayment shown on the joint return

refunded to you.

1. You are not required to pay the past-due amount;

2. You reported income such as wages, taxable interest, etc. on the joint return; and

3. You made and reported payments and/or credits, such as Indiana state and/or county tax withheld from your wages, estimated

taxpayments, the earned income credit, or other refundable credit(s) on the joint Indiana return.

Required Attachments

You must attach a copy of the following information to this schedule:

1. Your federal income tax return (Form 1040 or 1040-SR), and

2. All W-2 forms of both spouses and any other forms (1099, IN K-1, etc.) showing state/county income tax withheld.

Note: Your claim cannot be processed if you do not submit this required information.

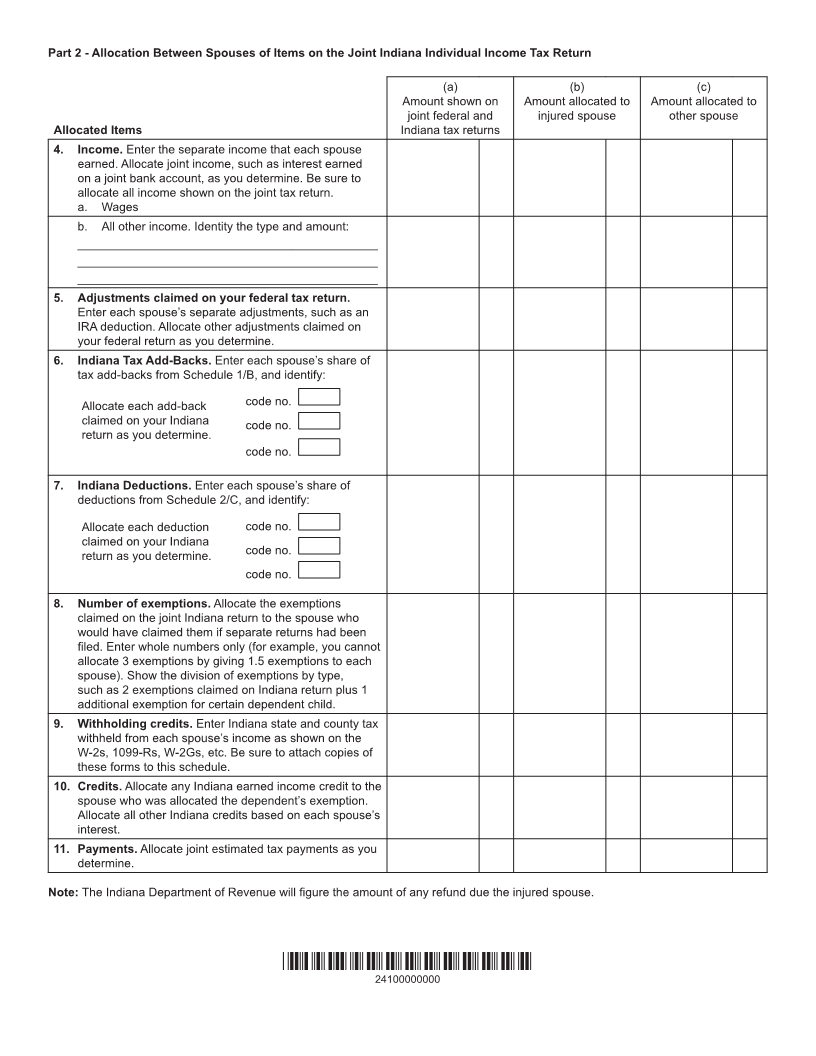

Part 1 - Information About the Joint Tax Return for Which This Claim is Filed

1. Enter the following information exactly as it is shown on the tax return for which you are filing this claim. The spouse’s name and

Social Security number shown first on that tax return must also be shown first below.

First name, initial, and last name shown first on the return Social Security number Check here if

shown first Injured Spouse

□

First name, initial, and last name shown second on the return Social Security number Check here if

shown second Injured Spouse

□

2. Enter Your current home address.

Street Address City State ZIP Code

3. Is the address on your joint return different from the address shown above? Yes No

□ □

*24100000000*

24100000000