Enlarge image

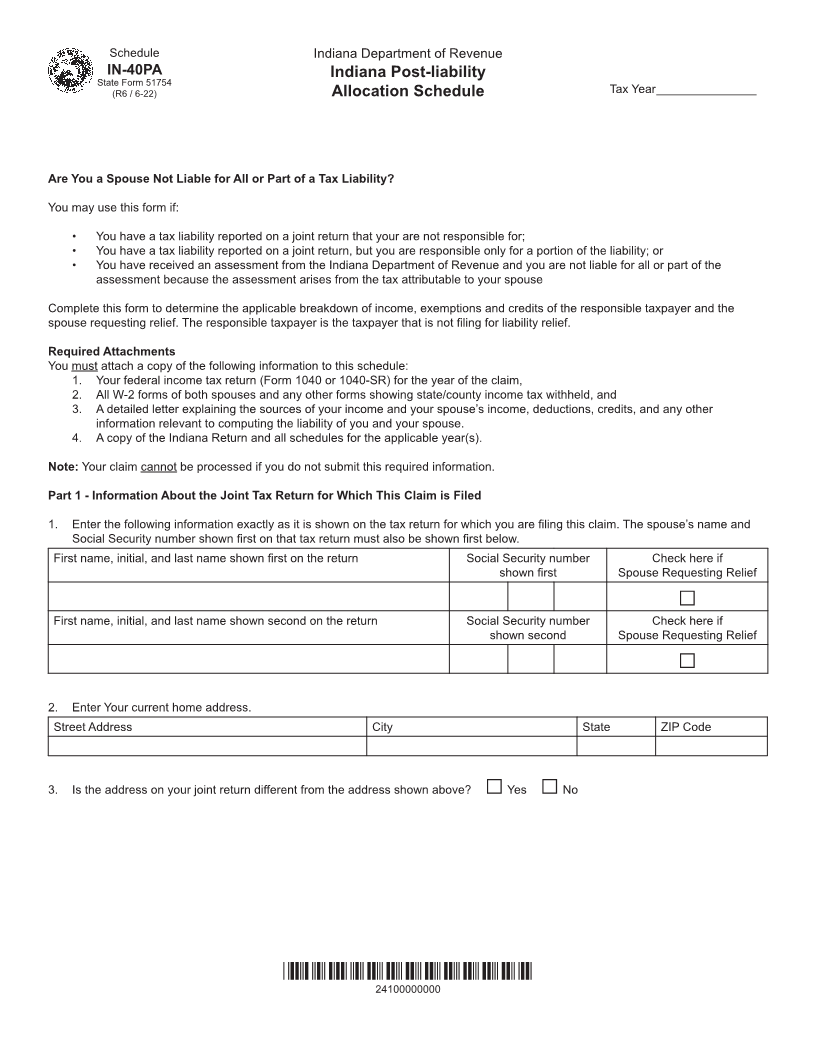

Schedule Indiana Department of Revenue

IN-40PA Indiana Post-liability

State Form 51754

(R6 / 6-22) Allocation Schedule Tax Year _______________

Are You a Spouse Not Liable for All or Part of a Tax Liability?

You may use this form if:

• You have a tax liability reported on a joint return that your are not responsible for;

• You have a tax liability reported on a joint return, but you are responsible only for a portion of the liability; or

• You have received an assessment from the Indiana Department of Revenue and you are not liable for all or part of the

assessment because the assessment arises from the tax attributable to your spouse

Complete this form to determine the applicable breakdown of income, exemptions and credits of the responsible taxpayer and the

spouse requesting relief. The responsible taxpayer is the taxpayer that is not filing for liability relief.

Required Attachments

You must attach a copy of the following information to this schedule:

1. Your federal income tax return (Form 1040 or 1040-SR) for the year of the claim,

2. All W-2 forms of both spouses and any other forms showing state/county income tax withheld, and

3. A detailed letter explaining the sources of your income and your spouse’s income, deductions, credits, and any other

information relevant to computing the liability of you and your spouse.

4. A copy of the Indiana Return and all schedules for the applicable year(s).

Note: Your claim cannot be processed if you do not submit this required information.

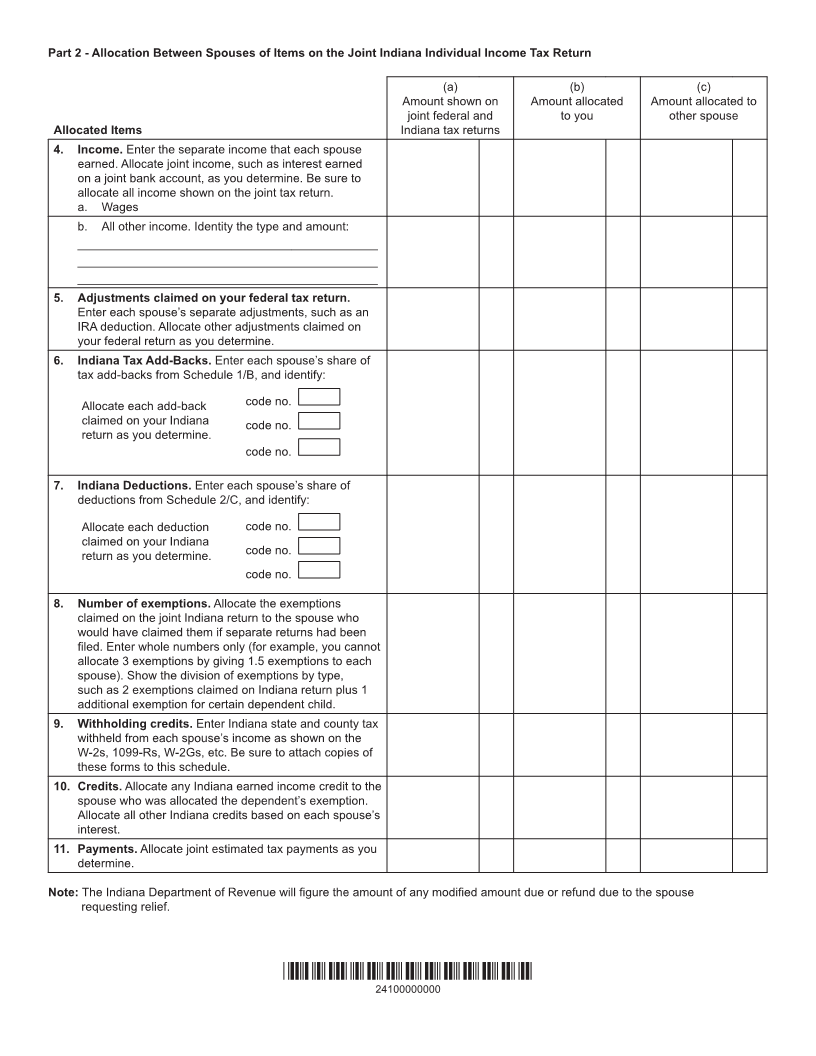

Part 1 - Information About the Joint Tax Return for Which This Claim is Filed

1. Enter the following information exactly as it is shown on the tax return for which you are filing this claim. The spouse’s name and

Social Security number shown first on that tax return must also be shown first below.

First name, initial, and last name shown first on the return Social Security number Check here if

shown first Spouse Requesting Relief

□

First name, initial, and last name shown second on the return Social Security number Check here if

shown second Spouse Requesting Relief

□

2. Enter Your current home address.

Street Address City State ZIP Code

3. Is the address on your joint return different from the address shown above? Yes No

□ □

*24100000000*

24100000000