Enlarge image

01

0000000000111111111122222222223333333333444444444455555555556666666666777777777788888

1234567890123456789012345678901234567890123456789012345678901234567890123456789012345

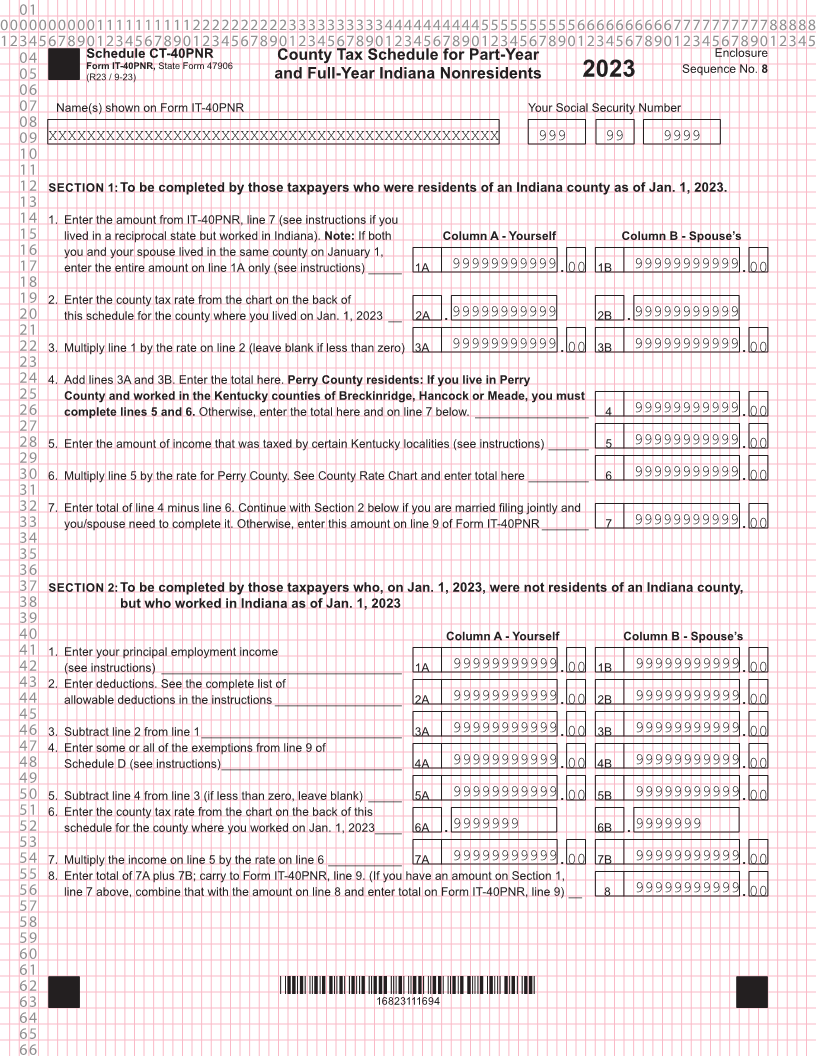

04 Schedule CT-40PNR County Tax Schedule for Part-Year Enclosure

Form IT-40PNR, State Form 47906

05 (R23 / 9-23) and Full-Year Indiana Nonresidents Sequence No. 8

2023

06

07 Name(s) shown on Form IT-40PNR Your Social Security Number

08

09 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999 99 9999

10

11

12 SECTION 1: To be completed by those taxpayers who were residents of an Indiana county as of Jan. 1, 2023.

13

14 1. Enter the amount from IT-40PNR, line 7 (see instructions if you

15 lived in a reciprocal state but worked in Indiana). Note: If both Column A - Yourself Column B - Spouse’s

16 you and your spouse lived in the same county on January 1,

17 enter the entire amount on line 1A only (see instructions) _____ 1A 99999999999 .00 1B 99999999999.00

18

19 2. Enter the county tax rate from the chart on the back of

20 this schedule for the county where you lived on Jan. 1, 2023 __ 2A .99999999999 2B .99999999999

21

22 3. Multiply line 1 by the rate on line 2 (leave blank if less than zero) 3A 99999999999 .00 3B 99999999999.00

23

24 4. Add lines 3A and 3B. Enter the total here. Perry County residents: If you live in Perry

25 County and worked in the Kentucky counties of Breckinridge, Hancock or Meade, you must

26 complete lines 5 and 6. Otherwise, enter the total here and on line 7 below. _________________ 4 99999999999.00

27

28 5. Enter the amount of income that was taxed by certain Kentucky localities (see instructions) ______ 5 99999999999.00

29

30 6. Multiply line 5 by the rate for Perry County. See County Rate Chart and enter total here _________ 6 99999999999.00

31

32 7. Enter total of line 4 minus line 6. Continue with Section 2 below if you are married filing jointly and

33 you/spouse need to complete it. Otherwise, enter this amount on line 9 of Form IT-40PNR _______ 7 99999999999.00

34

35

36

37 SECTION 2: To be completed by those taxpayers who, on Jan. 1, 2023, were not residents of an Indiana county,

38 but who worked in Indiana as of Jan. 1, 2023

39

40 Column A - Yourself Column B - Spouse’s

41 1. Enter your principal employment income

42 (see instructions) ____________________________________ 1A 99999999999.00 1B 99999999999.00

43 2. Enter deductions. See the complete list of

44 allowable deductions in the instructions ___________________ 2A 99999999999.00 2B 99999999999.00

45

46 3. Subtract line 2 from line 1 ______________________________ 3A 99999999999.00 3B 99999999999.00

47 4. Enter some or all of the exemptions from line 9 of

48 Schedule D (see instructions) ___________________________ 4A 99999999999.00 4B 99999999999.00

49

50 5. Subtract line 4 from line 3 (if less than zero, leave blank) _____ 5A 99999999999.00 5B 99999999999.00

51 6. Enter the county tax rate from the chart on the back of this

52 schedule for the county where you worked on Jan. 1, 2023 ____ 6A . 9999999 6B .9999999

53

54 7. Multiply the income on line 5 by the rate on line 6 ___________ 7A 99999999999.00 7B 99999999999.00

55 8. Enter total of 7A plus 7B; carry to Form IT-40PNR, line 9. (If you have an amount on Section 1,

56 line 7 above, combine that with the amount on line 8 and enter total on Form IT-40PNR, line 9) __ 8 99999999999.00

57

58

59

60

61

62 *16823111694*

63 16823111694

64

65

66