Enlarge image

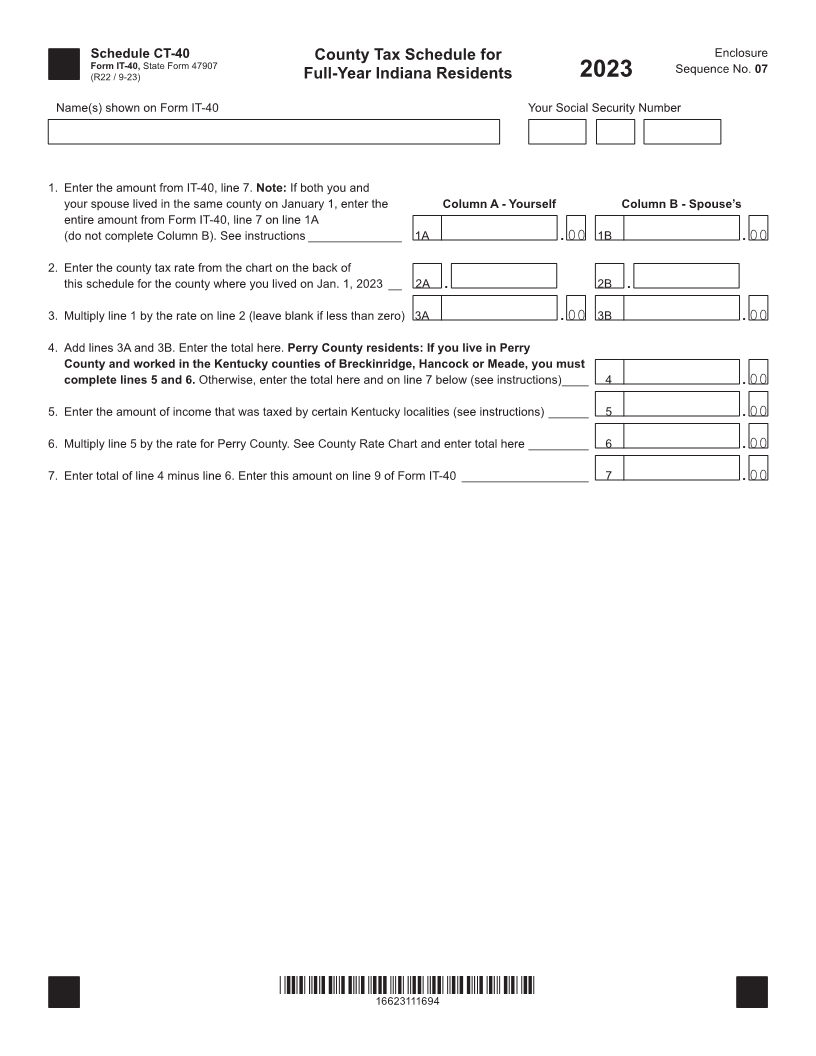

Schedule CT-40 County Tax Schedule for Enclosure

Form IT-40, State Form 47907

(R22 / 9-23) Full-Year Indiana Residents Sequence No. 07

2023

Name(s) shown on Form IT-40 Your Social Security Number

1. Enter the amount from IT-40, line 7. Note: If both you and

your spouse lived in the same county on January 1, enter the Column A - Yourself Column B - Spouse’s

entire amount from Form IT-40, line 7 on line 1A

(do not complete Column B). See instructions ______________ 1A .00 1B .00

2. Enter the county tax rate from the chart on the back of

this schedule for the county where you lived on Jan. 1, 2023 __ 2A . 2B .

3. Multiply line 1 by the rate on line 2 (leave blank if less than zero) 3A .00 3B .00

4. Add lines 3A and 3B. Enter the total here. Perry County residents: If you live in Perry

County and worked in the Kentucky counties of Breckinridge, Hancock or Meade, you must

complete lines 5 and 6. Otherwise, enter the total here and on line 7 below (see instructions) ____ 4 .00

5. Enter the amount of income that was taxed by certain Kentucky localities (see instructions) ______ 5 .00

6. Multiply line 5 by the rate for Perry County. See County Rate Chart and enter total here _________ 6 .00

7. Enter total of line 4 minus line 6. Enter this amount on line 9 of Form IT-40 ___________________ 7 .00

*16623111694*

16623111694