Enlarge image

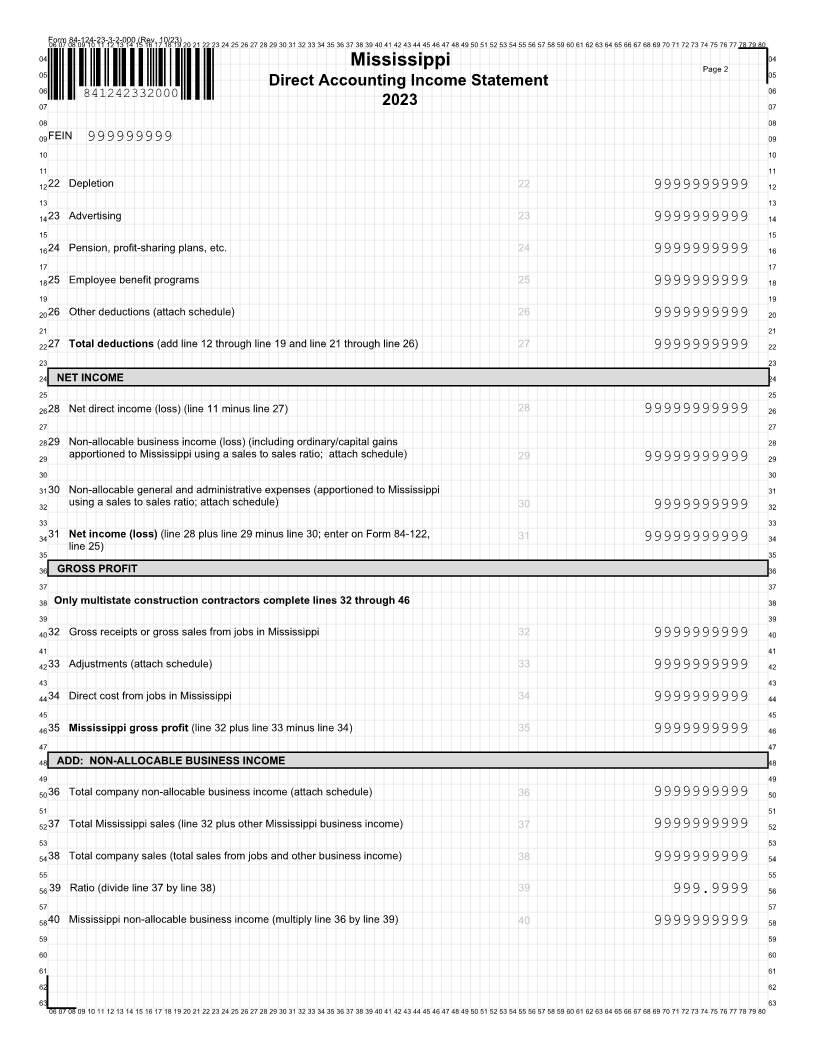

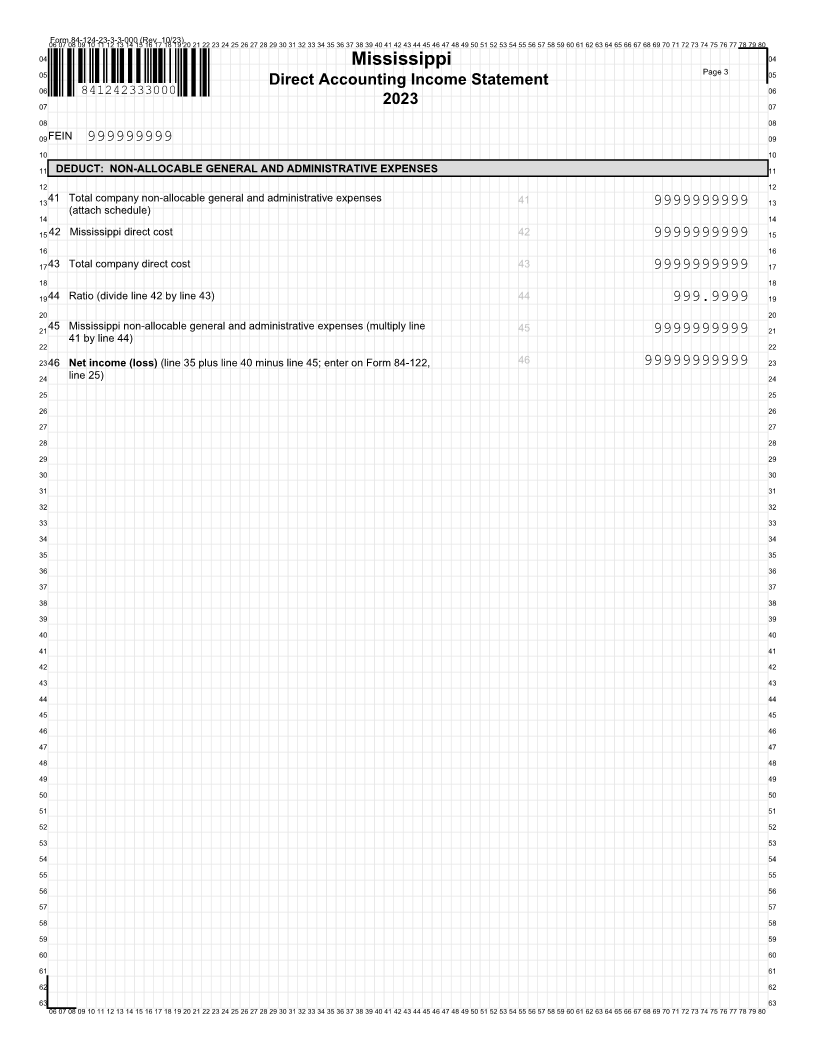

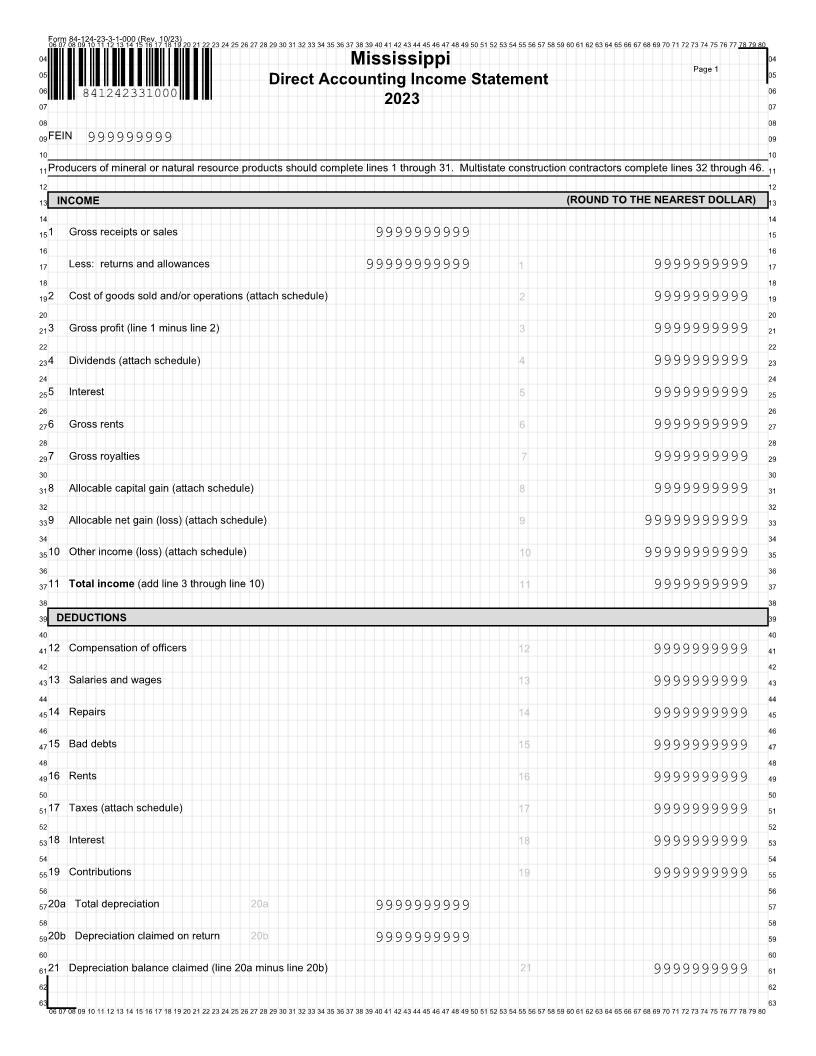

Form 84-124-23-3-1-000 (Rev. 10/23)06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 Mississippi Page 1 04

05 05

Direct Accounting Income Statement

06 841242331000 06

07 2023 07

08 08

09FEIN 999999999 09

10 10

11Producers of mineral or natural resource products should complete lines 1 through 31. Multistate construction contractors complete lines 32 through 46. 11

12 12

13 INCOME (ROUND TO THE NEAREST DOLLAR) 13

14 14

151 Gross receipts or sales 9999999999 15

16 16

17 Less: returns and allowances 99999999999 1 9999999999 17

18 18

192 Cost of goods sold and/or operations (attach schedule) 2 9999999999 19

20 20

213 Gross profit (line 1 minus line 2) 3 9999999999 21

22 22

234 Dividends (attach schedule) 4 9999999999 23

24 24

255 Interest 5 9999999999 25

26 26

276 Gross rents 6 9999999999 27

28 28

297 Gross royalties 7 9999999999 29

30 30

318 Allocable capital gain (attach schedule) 8 9999999999 31

32 32

339 Allocable net gain (loss) (attach schedule) 9 99999999999 33

34 34

3510 Other income (loss) (attach schedule) 10 99999999999 35

36 36

3711 Total income (add line 3 through line 10) 11 9999999999 37

38 38

39 DEDUCTIONS 39

40 40

4112 Compensation of officers 12 9999999999 41

42 42

4313 Salaries and wages 13 9999999999 43

44 44

4514 Repairs 14 9999999999 45

46 46

4715 Bad debts 15 9999999999 47

48 48

4916 Rents 16 9999999999 49

50 50

5117 Taxes (attach schedule) 17 9999999999 51

52 52

5318 Interest 18 9999999999 53

54 54

5519 Contributions 19 9999999999 55

56 56

5720a Total depreciation 20a 9999999999 57

58 58

5920b Depreciation claimed on return 20b 9999999999 59

60 60

6121 Depreciation balance claimed (line 20a minus line 20b) 21 9999999999 61

62 62

63 63

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80