Enlarge image

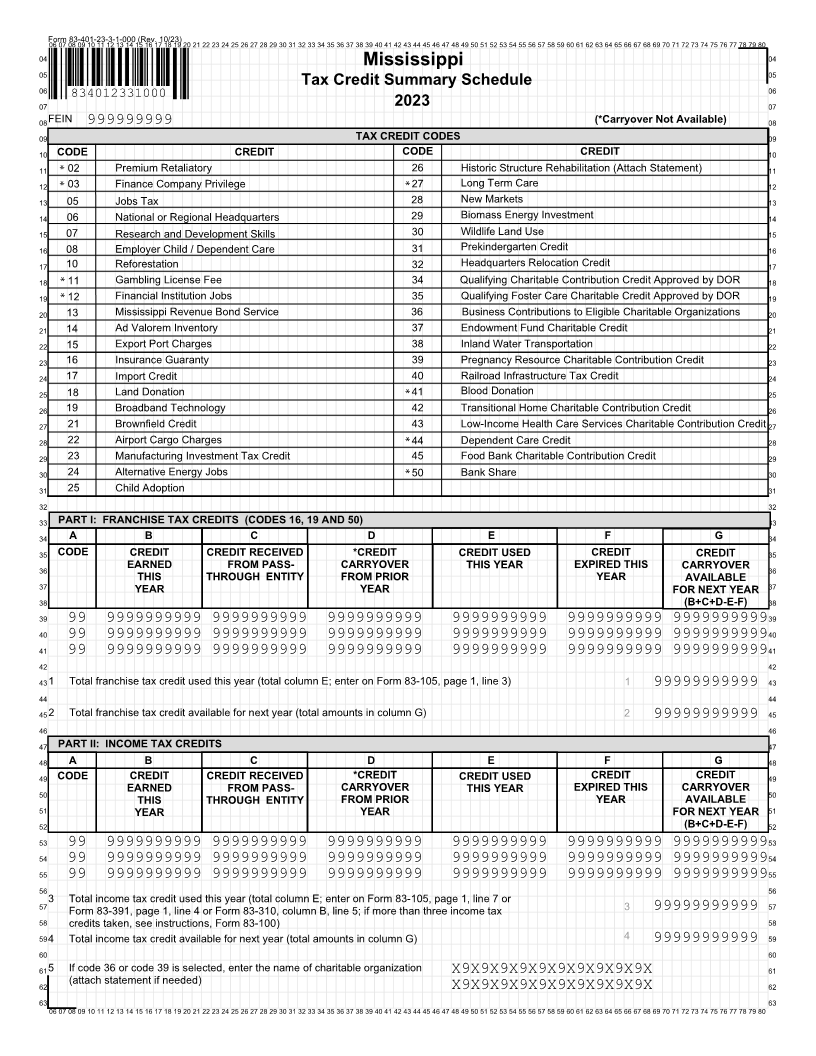

Form 83-401-23-3-1-000 (Rev. 10/23)06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04 Mississippi 04

05 05

Tax Credit Summary Schedule

06 834012331000 06

07 2023 07

08FEIN 999999999 (*Carryover Not Available) 08

09 TAX CREDIT CODES 09

10 CODE CREDIT CODE CREDIT 10

11 02 Premium Retaliatory 26 Historic Structure Rehabilitation (Attach Statement) 11

12 03 Finance Company Privilege 27 Long Term Care 12

13 05 Jobs Tax 28 New Markets 13

14 06 National or Regional Headquarters 29 Biomass Energy Investment 14

15 07 Research and Development Skills 30 Wildlife Land Use 15

16 08 Employer Child / Dependent Care 31 Prekindergarten Credit 16

17 10 Reforestation 32 Headquarters Relocation Credit 17

18 11 Gambling License Fee 34 Qualifying Charitable Contribution Credit Approved by DOR 18

19 12 Financial Institution Jobs 35 Qualifying Foster Care Charitable Credit Approved by DOR 19

20 13 Mississippi Revenue Bond Service 36 Business Contributions to Eligible Charitable Organizations 20

21 14 Ad Valorem Inventory 37 Endowment Fund Charitable Credit 21

22 15 Export Port Charges 38 Inland Water Transportation 22

23 16 Insurance Guaranty 39 Pregnancy Resource Charitable Contribution Credit 23

24 17 Import Credit 40 Railroad Infrastructure Tax Credit 24

25 18 Land Donation 41 Blood Donation 25

26 19 Broadband Technology 42 Transitional Home Charitable Contribution Credit 26

27 21 Brownfield Credit 43 Low-Income Health Care Services Charitable Contribution Credit 27

28 22 Airport Cargo Charges 44 Dependent Care Credit 28

29 23 Manufacturing Investment Tax Credit 45 Food Bank Charitable Contribution Credit 29

30 24 Alternative Energy Jobs 50 Bank Share 30

31 25 Child Adoption 31

32 32

33 PART I: FRANCHISE TAX CREDITS (CODES 16, 19 AND 50) 33

34 A B C D E F G 34

35 CODE CREDIT CREDIT RECEIVED *CREDIT CREDIT USED CREDIT CREDIT 35

36 EARNED FROM PASS- CARRYOVER THIS YEAR EXPIRED THIS CARRYOVER 36

THIS THROUGH ENTITY FROM PRIOR YEAR AVAILABLE

37 YEAR YEAR FOR NEXT YEAR 37

38 (B+C+D-E-F) 38

39 99 9999999999 9999999999 9999999999 9999999999 9999999999 9999999999 39

40 99 9999999999 9999999999 9999999999 9999999999 9999999999 9999999999 40

41 99 9999999999 9999999999 9999999999 9999999999 9999999999 9999999999 41

42 42

431 Total franchise tax credit used this year (total column E; enter on Form 83-105, page 1, line 3) 1 99999999999 43

44 44

452 Total franchise tax credit available for next year (total amounts in column G) 2 99999999999 45

46 46

47 PART II: INCOME TAX CREDITS 47

48 A B C D E F G 48

49 CODE CREDIT CREDIT RECEIVED *CREDIT CREDIT USED CREDIT CREDIT 49

50 EARNED FROM PASS- CARRYOVER THIS YEAR EXPIRED THIS CARRYOVER 50

THIS THROUGH ENTITY FROM PRIOR YEAR AVAILABLE

51 YEAR YEAR FOR NEXT YEAR 51

52 (B+C+D-E-F) 52

53 99 9999999999 9999999999 9999999999 9999999999 9999999999 9999999999 53

54 99 9999999999 9999999999 9999999999 9999999999 9999999999 9999999999 54

55 99 9999999999 9999999999 9999999999 9999999999 9999999999 9999999999 55

56 56

3 Total income tax credit used this year (total column E; enter on Form 83-105, page 1, line 7 or

57 Form 83-391, page 1, line 4 or Form 83-310, column B, line 5; if more than three income tax 3 99999999999 57

58 credits taken, see instructions, Form 83-100) 58

594 Total income tax credit available for next year (total amounts in column G) 4 99999999999 59

60 60

615 If code 36 or code 39 is selected, enter the name of charitable organization X9X9X9X9X9X9X9X9X9X9X 61

62 (attach statement if needed) 62

X9X9X9X9X9X9X9X9X9X9X

63 63

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80