Enlarge image

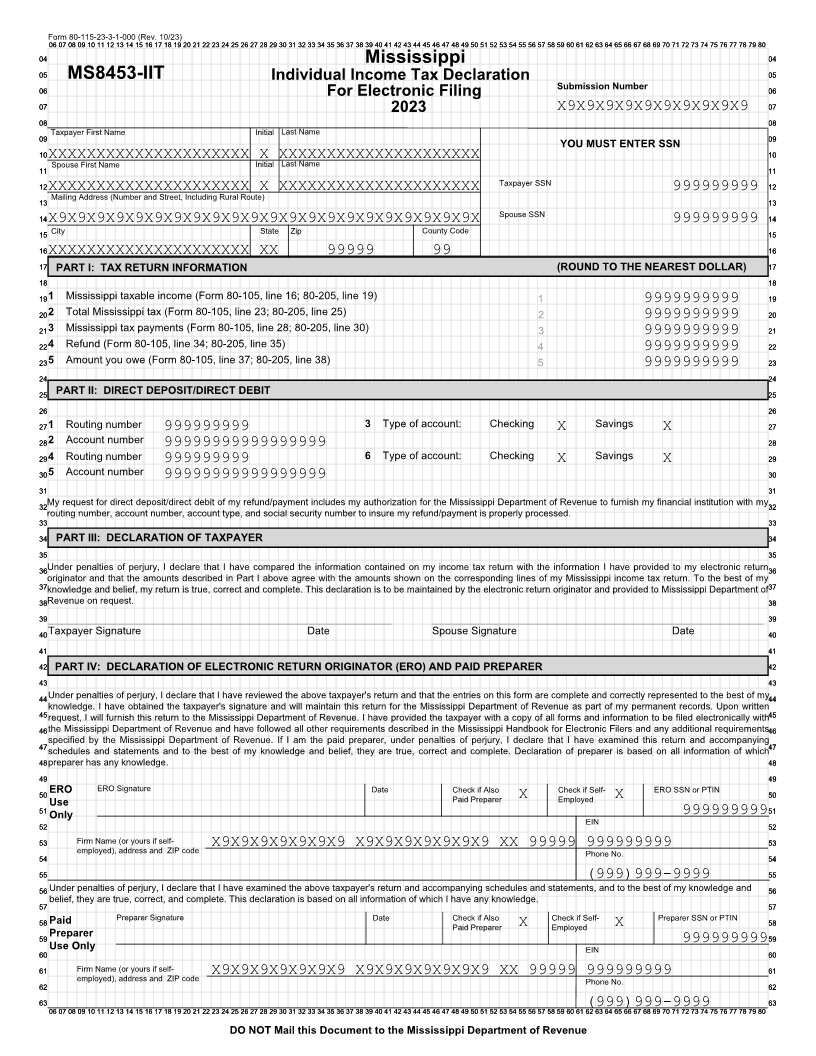

Form 80-115-23-3-1-000 (Rev. 10/23)

0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

0404 Mississippi 0404

0505 MS8453-IIT Individual Income Tax Declaration 0505

Submission Number

0606 For Electronic Filing 0606

0707 2023 X9X9X9X9X9X9X9X9X9X9 0707

0808 0808

Taxpayer First Name Initial Last Name

0909 YOU MUST ENTER SSN 0909

1010XXXXXXXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXX 1010

Last Name

1111 Spouse First Name Initial 1111

1212 Taxpayer SSN 1212

1313XXXXXXXXXXXXXXXXXXXXXMailing Address (Number and Street, Including Rural Route)X XXXXXXXXXXXXXXXXXXXXX 999999999 1313

1414 Spouse SSN 1414

X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X 999999999

1515 City State Zip County Code 1515

1616XXXXXXXXXXXXXXXXXXXXX XX 99999 99 1616

1717 PART I: TAX RETURN INFORMATION (ROUND TO THE NEAREST DOLLAR) 1717

1818 1818

19191 Mississippi taxable income (Form 80-105, line 16; 80-205, line 19) 1 9999999999 1919

20202 Total Mississippi tax (Form 80-105, line 23; 80-205, line 25) 2 9999999999 2020

21213 Mississippi tax payments (Form 80-105, line 28; 80-205, line 30) 3 9999999999 2121

22224 Refund (Form 80-105, line 34; 80-205, line 35) 4 9999999999 2222

23235 Amount you owe (Form 80-105, line 37; 80-205, line 38) 5 9999999999 2323

2424 2424

2525 PART II: DIRECT DEPOSIT/DIRECT DEBIT 2525

2626 2626

27271 Routing number 999999999 3 Type of account: Checking X Savings X 2727

28282 Account number 99999999999999999 2828

29294 Routing number 999999999 6 Type of account: Checking X Savings X 2929

30305 Account number 99999999999999999 3030

3131 3131

3232My request for direct deposit/direct debit of my refund/payment includes my authorization for the Mississippi Department of Revenue to furnish my financial institution with my3232

routing number, account number, account type, and social security number to insure my refund/payment is properly processed.

3333 3333

3434 PART III: DECLARATION OF TAXPAYER 3434

3535 3535

3636Under penalties of perjury, I declare that I have compared the information contained on my income tax return with the information I have provided to my electronic return3636

originator and that the amounts described in Part I above agree with the amounts shown on the corresponding lines of my Mississippi income tax return. To the best of my

3737knowledge and belief, my return is true, correct and complete. This declaration is to be maintained by the electronic return originator and provided to Mississippi Department of3737

3838Revenue on request. 3838

3939 3939

4040Taxpayer Signature Date Spouse Signature Date 4040

4141 4141

4242 PART IV: DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER 4242

4343 4343

4444Under penalties of perjury, I declare that I have reviewed the above taxpayer's return and that the entries on this form are complete and correctly represented to the best of my4444

knowledge. I have obtained the taxpayer's signature and will maintain this return for the Mississippi Department of Revenue as part of my permanent records. Upon written

4545request, I will furnish this return to the Mississippi Department of Revenue. I have provided the taxpayer with a copy of all forms and information to be filed electronically with4545

4646the Mississippi Department of Revenue and have followed all other requirements described in the Mississippi Handbook for Electronic Filers and any additional requirements4646

4747specified by the Mississippi Department of Revenue. If I am the paid preparer, under penalties of perjury, I declare that I have examined this return and accompanying4747

schedules and statements and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer is based on all information of which

4848preparer has any knowledge. 4848

4949 4949

5050 ERO ERO Signature Date Check if Also Check if Self- ERO SSN or PTIN 5050

Use Paid Preparer X Employed X

999999999

5151 Only EIN 5151

5252 5252

5353 Firm Name (or yours if self- X9X9X9X9X9X9X9 X9X9X9X9X9X9X9 XX 99999 999999999 5353

5454 employed), address and ZIP code Phone No. 5454

5555 (999)999-9999 5555

5656 Under penalties of perjury, I declare that I have examined the above taxpayer's return and accompanying schedules and statements, and to the best of my knowledge and 5656

belief, they are true, correct, and complete. This declaration is based on all information of which I have any knowledge.

5757 5757

5858 Paid Preparer Signature Date Check if Also Check if Self- Preparer SSN or PTIN 5858

Paid Preparer X Employed X

5959 Preparer 5959

Use Only 999999999

6060 EIN 6060

6161 Firm Name (or yours if self- X9X9X9X9X9X9X9 X9X9X9X9X9X9X9 XX 99999 999999999 6161

6262 employed), address and ZIP code Phone No. 6262

6363 6363

0606 0707 080 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62(999)999-999963 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 808 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

DO NOT Mail this Document to the Mississippi Department of Revenue