Enlarge image

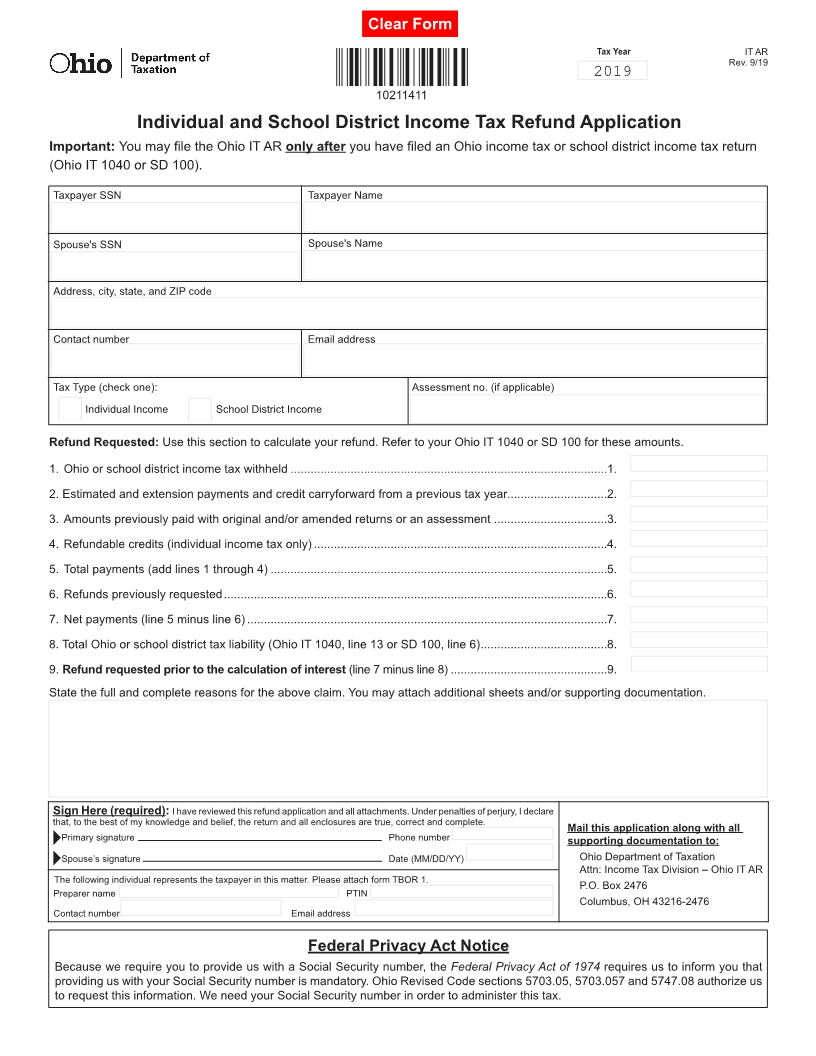

Clear Form

Tax Year IT AR

Rev. 9/19

2019

10211411

Individual and School District Income Tax Refund Application

Important: You may file the Ohio IT AR only after you have filed an Ohio income tax or school district income tax return

(Ohio IT 1040 or SD 100).

Taxpayer SSN Taxpayer Name

Spouse's SSN Spouse's Name

Address, city, state, and ZIP code

Contact number Email address

Tax Type (check one): Assessment no. (if applicable)

Individual Income School District Income

Refund Requested: Use this section to calculate your refund. Refer to your Ohio IT 1040 or SD 100 for these amounts.

1. Ohio or school district income tax withheld ...............................................................................................1.

2. Estimated and extension payments and credit carryforward from a previous tax year..............................2.

3. Amounts previously paid with original and/or amended returns or an assessment ..................................3.

4. Refundable credits (individual income tax only) ........................................................................................4.

5. Total payments (add lines 1 through 4) .....................................................................................................5.

6. Refunds previously requested ...................................................................................................................6.

7. Net payments (line 5 minus line 6) ............................................................................................................7.

8. Total Ohio or school district tax liability (Ohio IT 1040, line 13 or SD 100, line 6) ......................................8.

9. Refund requested prior to the calculation of interest (line 7 minus line 8) ...............................................9.

State the full and complete reasons for the above claim. You may attach additional sheets and/or supporting documentation.

Sign Here (required): I have reviewed this refund application and all attachments. Under penalties of perjury, I declare

that, to the best of my knowledge and belief, the return and all enclosures are true, correct and complete.

Mail this application along with all

Primary signature Phone number supporting documentation to:

Spouse’s signature Date (MM/DD/YY) Ohio Department of Taxation

Attn: Income Tax Division – Ohio IT AR

The following individual represents the taxpayer in this matter. Please attach form TBOR 1. P.O. Box 2476

Preparer name PTIN

Columbus, OH 43216-2476

Contact number Email address

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that

providing us with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us

to request this information. We need your Social Security number in order to administer this tax.