Enlarge image

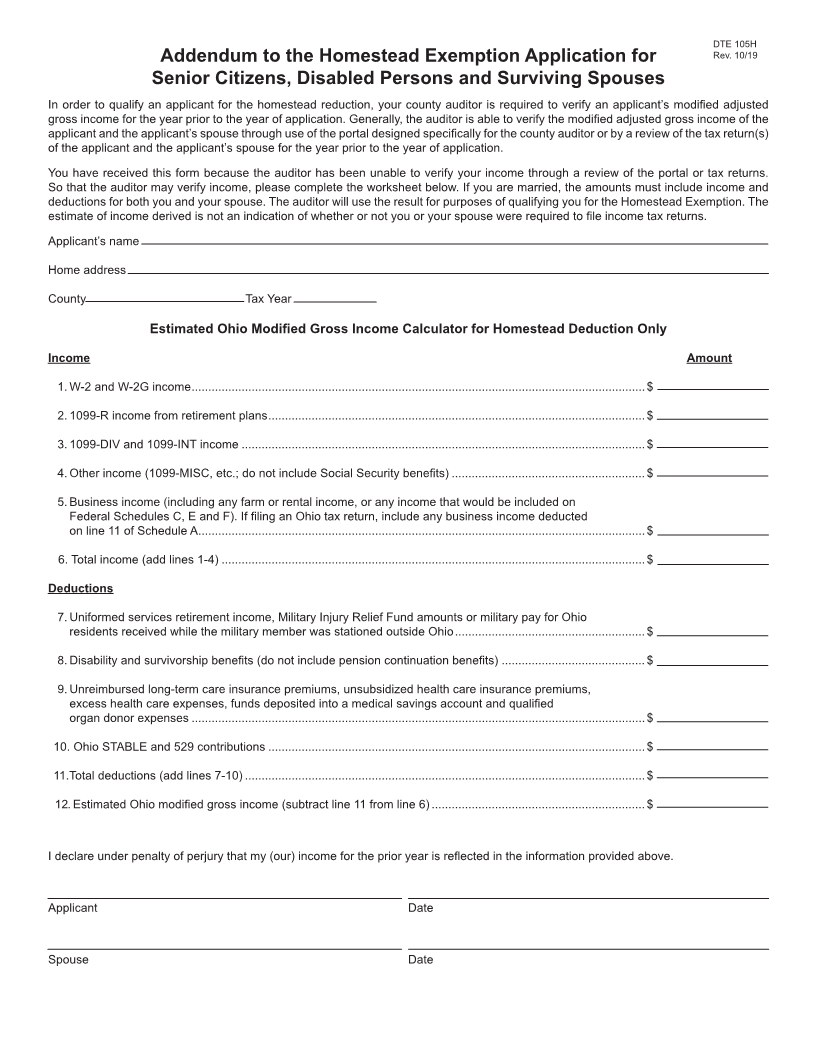

DTE 105H

Rev. 10/19

Addendum to the Homestead Exemption Application for

Senior Citizens, Disabled Persons and Surviving Spouses

In order to qualify an applicant for the homestead reduction, your county auditor is required to verify an applicant’s modified adjusted

gross income for the year prior to the year of application. Generally, the auditor is able to verify the modified adjusted gross income of the

applicant and the applicant’s spouse through use of the portal designed specifically for the county auditor or by a review of the tax return(s)

of the applicant and the applicant’s spouse for the year prior to the year of application.

You have received this form because the auditor has been unable to verify your income through a review of the portal or tax returns.

So that the auditor may verify income, please complete the worksheet below. If you are married, the amounts must include income and

deductions for both you and your spouse. The auditor will use the result for purposes of qualifying you for the Homestead Exemption. The

estimate of income derived is not an indication of whether or not you or your spouse were required to file income tax returns.

Applicant’s name

Home address

County Tax Year

Estimated Ohio Modified Gross Income Calculator for Homestead Deduction Only

Income Amount

1. W-2 and W-2G income ........................................................................................................................................$

2. 1099-R income from retirement plans .................................................................................................................$

3. 1099-DIV and 1099-INT income .........................................................................................................................$

4. Other income (1099-MISC, etc.; do not include Social Security benefits) ..........................................................$

5. Business income (including any farm or rental income, or any income that would be included on

Federal Schedules C, E and F). If filing an Ohio tax return, include any business income deducted

on line 11 of Schedule A ......................................................................................................................................$

6. Total income (add lines 1-4) ...............................................................................................................................$

Deductions

7. Uniformed services retirement income, Military Injury Relief Fund amounts or military pay for Ohio

residents received while the military member was stationed outside Ohio .........................................................$

8. Disability and survivorship benefits (do not include pension continuation benefits) ...........................................$

9. Unreimbursed long-term care insurance premiums, unsubsidized health care insurance premiums,

excess health care expenses, funds deposited into a medical savings account and qualified

organ donor expenses ........................................................................................................................................$

10. Ohio STABLE and 529 contributions .................................................................................................................$

11.Total deductions (add lines 7-10) ........................................................................................................................$

12. Estimated Ohio modified gross income (subtract line 11 from line 6) ................................................................$

I declare under penalty of perjury that my (our) income for the prior year is reflected in the information provided above.

Applicant Date

Spouse Date