Enlarge image

Telephone: 614.466.3910

Toll-free: 877.767.3453

OhioSoS.gov | business@OhioSoS.gov

File online or for more information: OhioBusinessCentral.gov

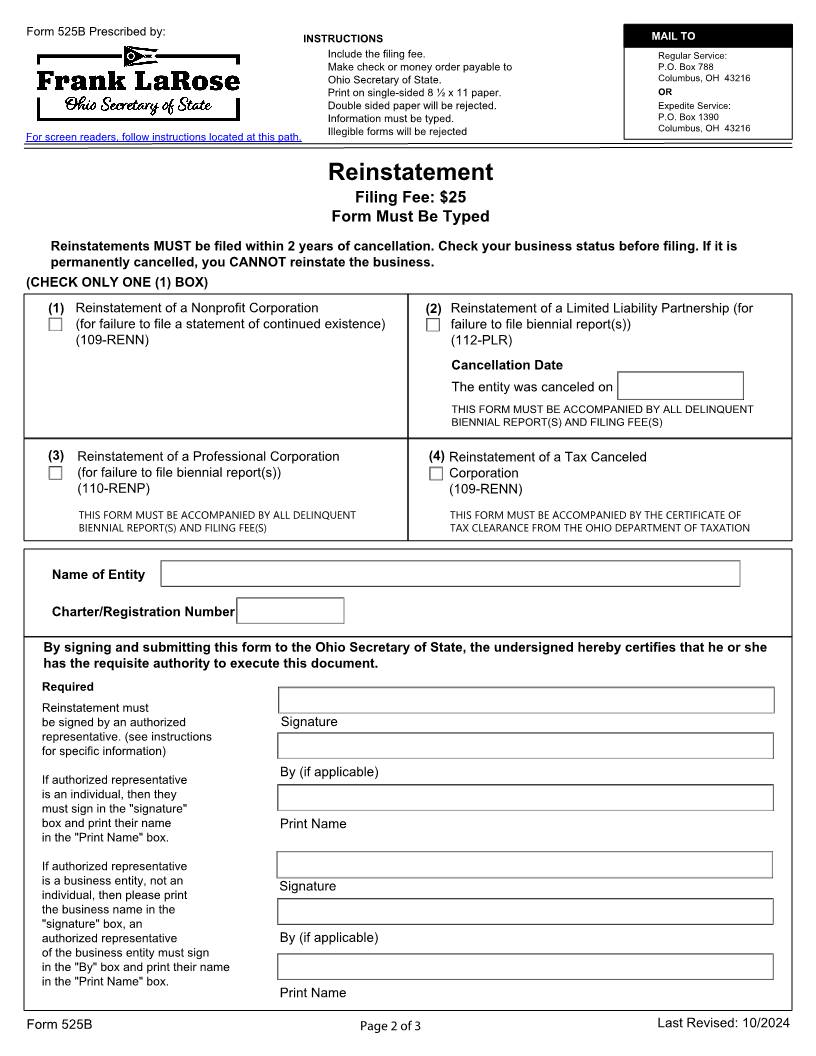

Return Documents To:

Name (Individual or Business Name):

Email Address (Required):

To the Attention of (If Necessary):

Address:

City:

State ZIP Code:

Phone Number:

SERVICE TYPE - Check only ONE item below.

Expedited Fees are IN ADDITION to the filing fee on the form.

Failure to include the expedite fee or indicate a selection will result in regular service.

Regular Service

· No Expedite Fee.

· Processing Time: 3-7 business days.

Expedite Service 1

· Fee: $100

· Processing Time: 2 business days after receipt.

Expedite Service 2

· Fee: $200

· Processing Time: 1 business day after receipt.

Expedite Service 3 (in-person delivery is required)

· Fee: $300

· Processing Time: 4 hours if received by 1:00 p.m. If received after 1:00 p.m., documents will be

processed by noon the following business day.

Preclearance Filing

· Fee: $50

· Processing Time: 1-2 business days after receipt.

Form 525B Page 1 of 3 Last Revised: 10/2024