- 9 -

Enlarge image

|

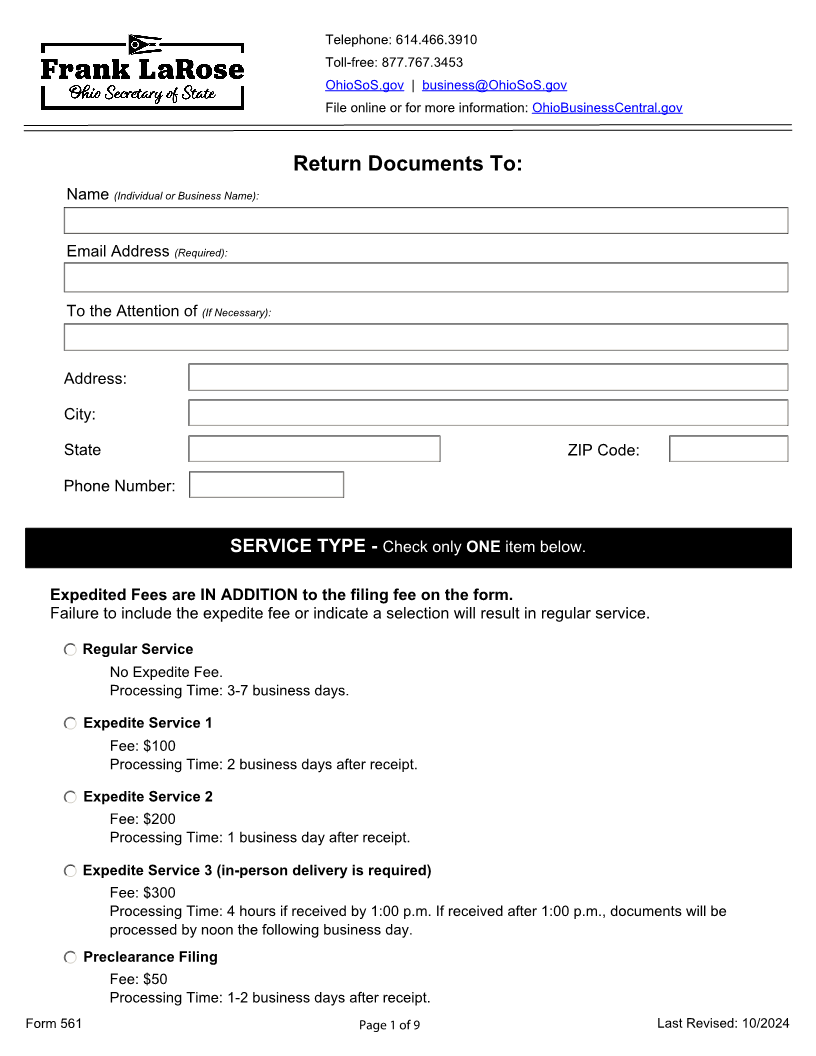

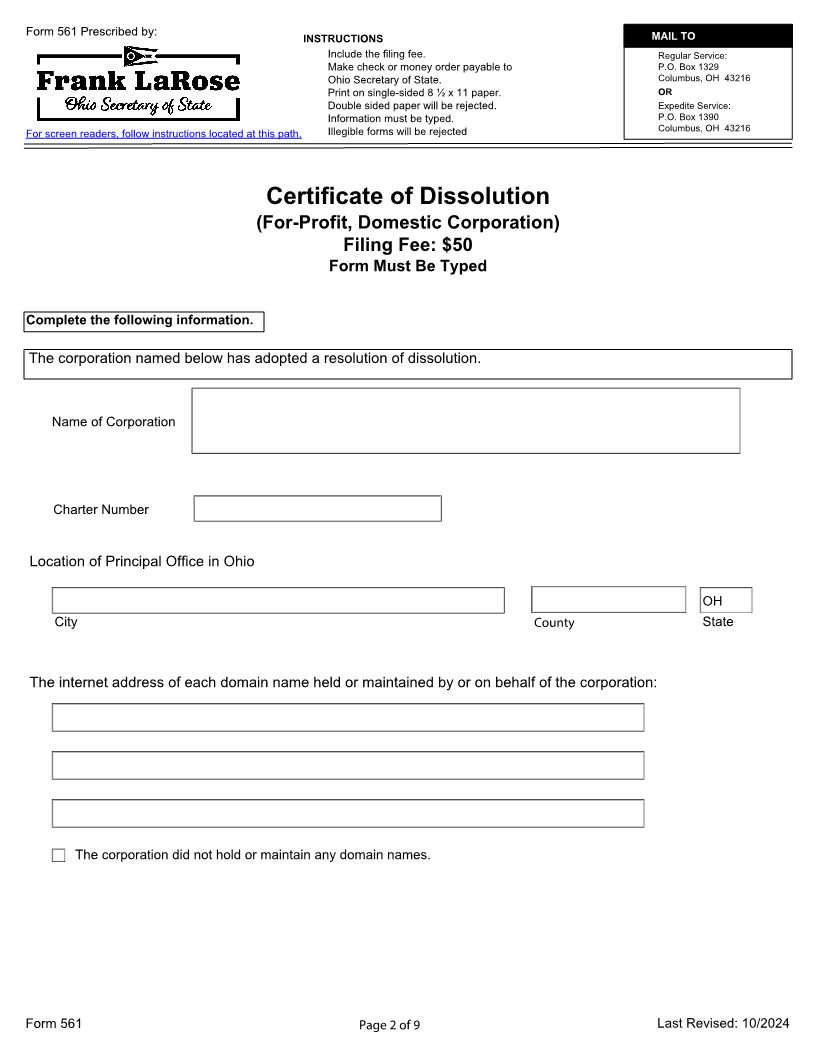

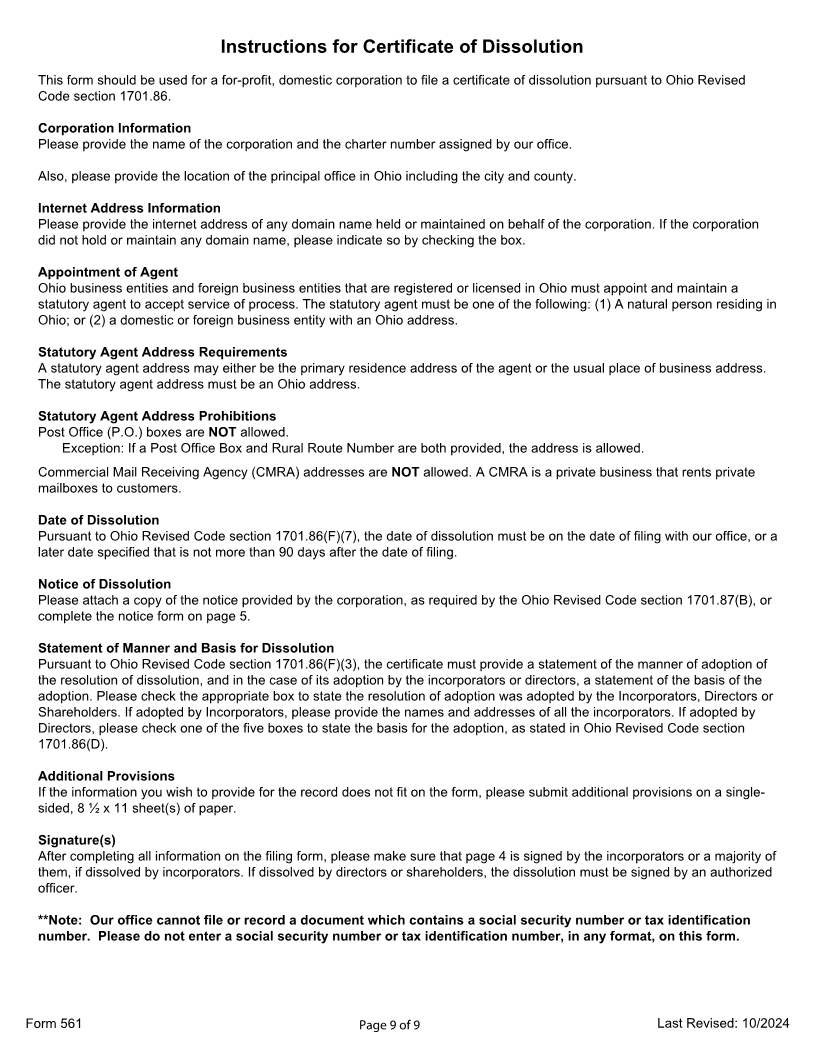

Instructions for Certificate of Dissolution

This form should be used for a for-profit, domestic corporation to file a certificate of dissolution pursuant to Ohio Revised

Code section 1701.86.

Corporation Information

Please provide the name of the corporation and the charter number assigned by our office.

Also, please provide the location of the principal office in Ohio including the city and county.

Internet Address Information

Please provide the internet address of any domain name held or maintained on behalf of the corporation. If the corporation

did not hold or maintain any domain name, please indicate so by checking the box.

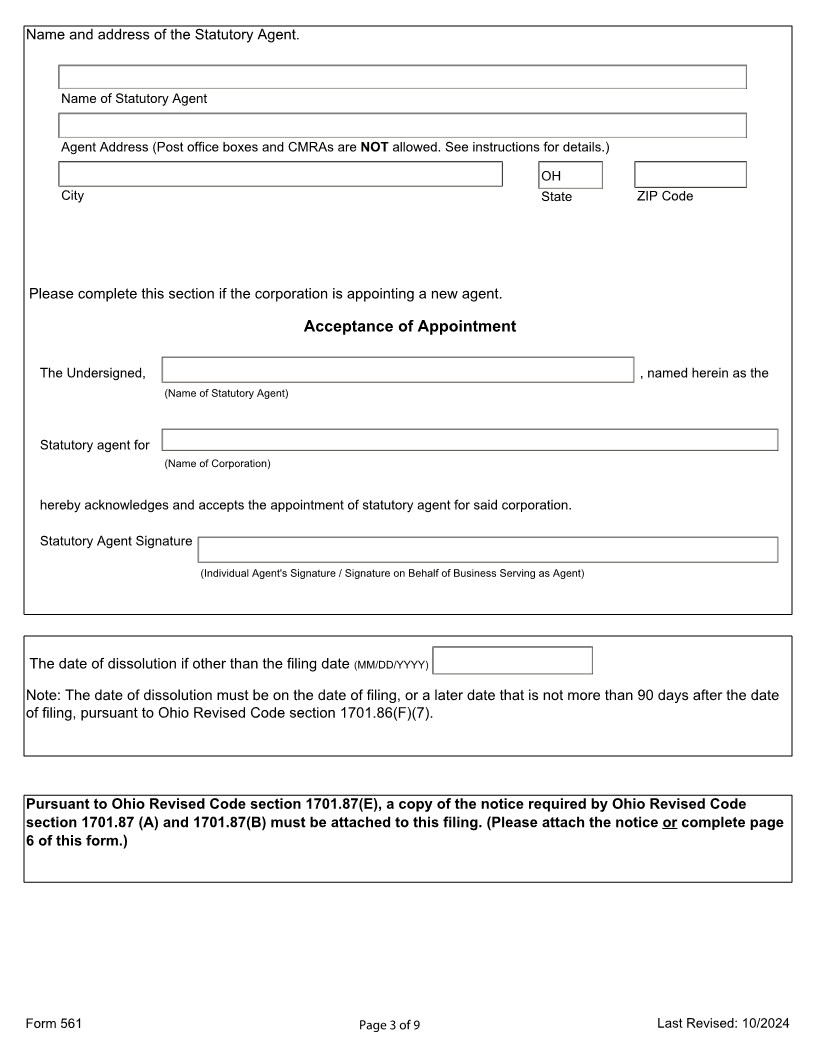

Appointment of Agent

Ohio business entities and foreign business entities that are registered or licensed in Ohio must appoint and maintain a

statutory agent to accept service of process. The statutory agent must be one of the following: (1) A natural person residing in

Ohio; or (2) a domestic or foreign business entity with an Ohio address.

Statutory Agent Address Requirements

A statutory agent address may either be the primary residence address of the agent or the usual place of business address.

The statutory agent address must be an Ohio address.

Statutory Agent Address Prohibitions

Post Office (P.O.) boxes are NOT allowed.

Exception: If a Post Office Box and Rural Route Number are both provided, the address is allowed.

Commercial Mail Receiving Agency (CMRA) addresses are NOT allowed. A CMRA is a private business that rents private

mailboxes to customers.

Date of Dissolution

Pursuant to Ohio Revised Code section 1701.86(F)(7), the date of dissolution must be on the date of filing with our office, or a

later date specified that is not more than 90 days after the date of filing.

Notice of Dissolution

Please attach a copy of the notice provided by the corporation, as required by the Ohio Revised Code section 1701.87(B), or

complete the notice form on page 5.

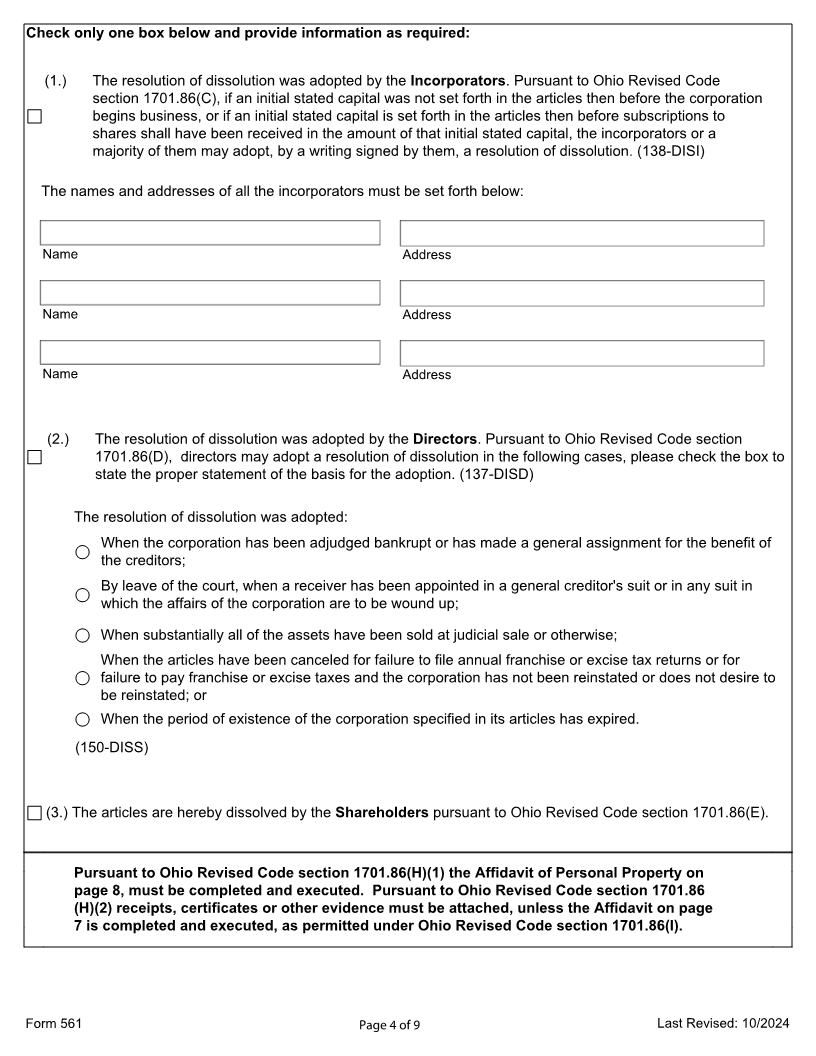

Statement of Manner and Basis for Dissolution

Pursuant to Ohio Revised Code section 1701.86(F)(3), the certificate must provide a statement of the manner of adoption of

the resolution of dissolution, and in the case of its adoption by the incorporators or directors, a statement of the basis of the

adoption. Please check the appropriate box to state the resolution of adoption was adopted by the Incorporators, Directors or

Shareholders. If adopted by Incorporators, please provide the names and addresses of all the incorporators. If adopted by

Directors, please check one of the five boxes to state the basis for the adoption, as stated in Ohio Revised Code section

1701.86(D).

Additional Provisions

If the information you wish to provide for the record does not fit on the form, please submit additional provisions on a single-

sided, 8 ½ x 11 sheet(s) of paper.

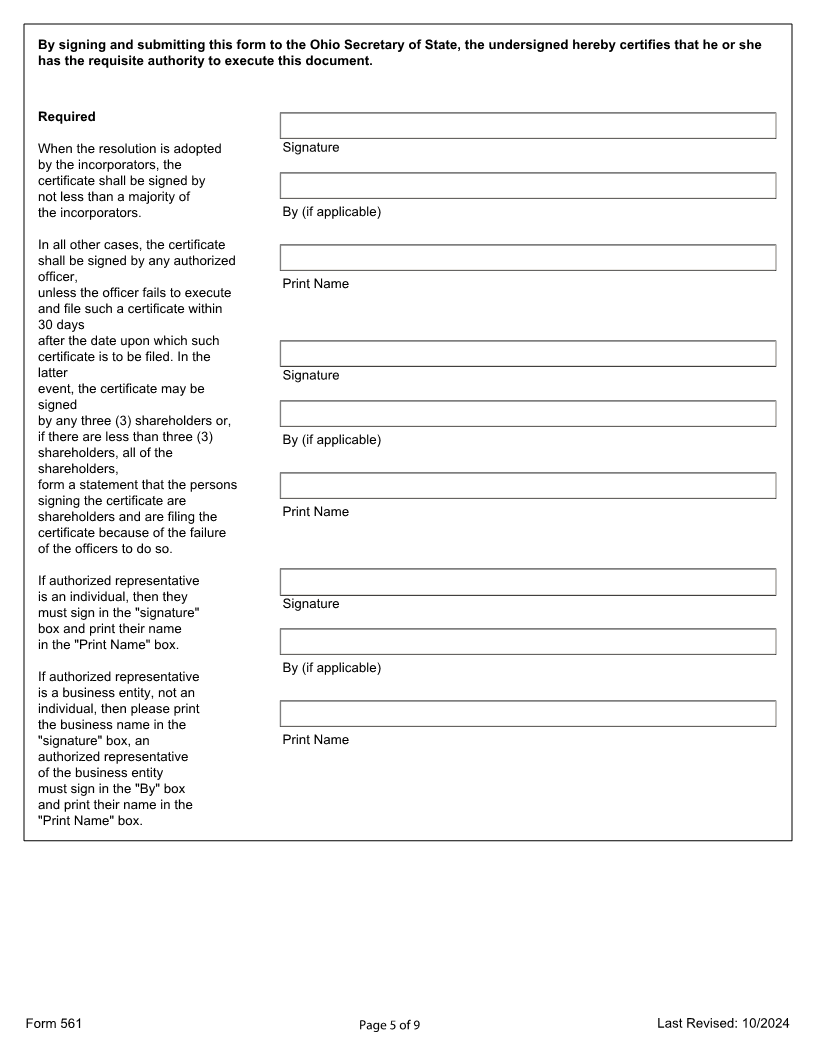

Signature(s)

After completing all information on the filing form, please make sure that page 4 is signed by the incorporators or a majority of

them, if dissolved by incorporators. If dissolved by directors or shareholders, the dissolution must be signed by an authorized

officer.

**Note: Our office cannot file or record a document which contains a social security number or tax identification

number. Please do not enter a social security number or tax identification number, in any format, on this form.

Form 561 Page 9 of 9 Last Revised: 10/2024

|