Enlarge image

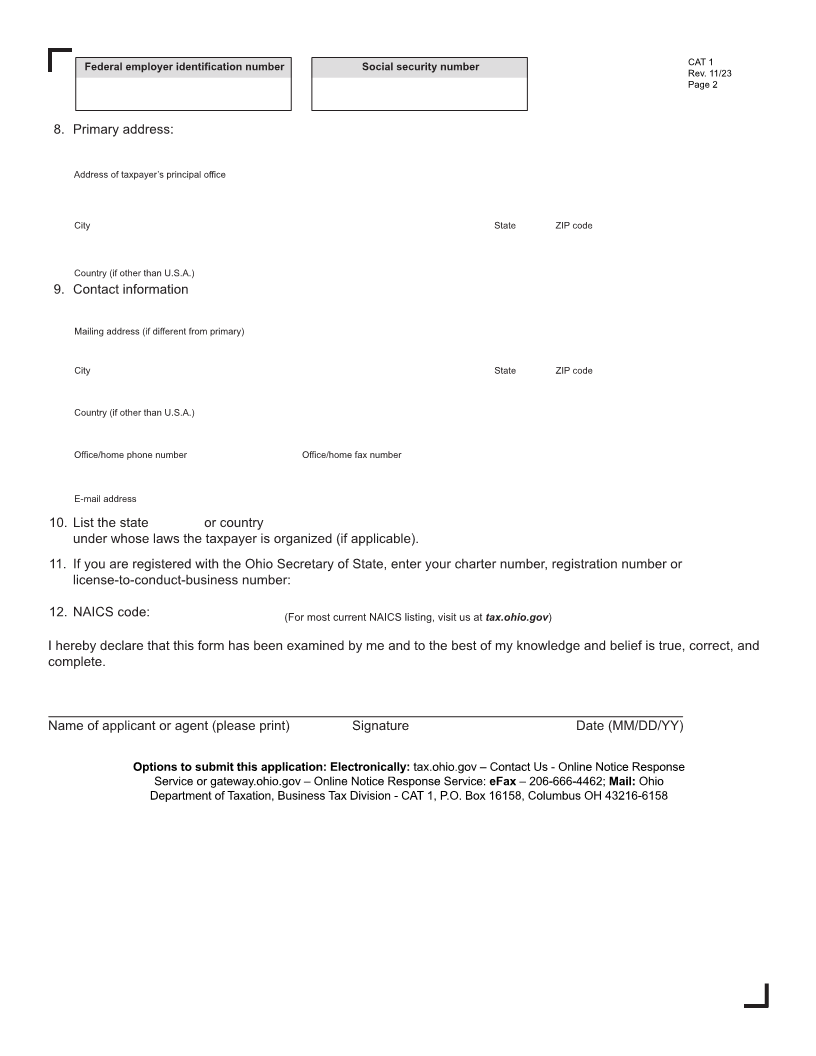

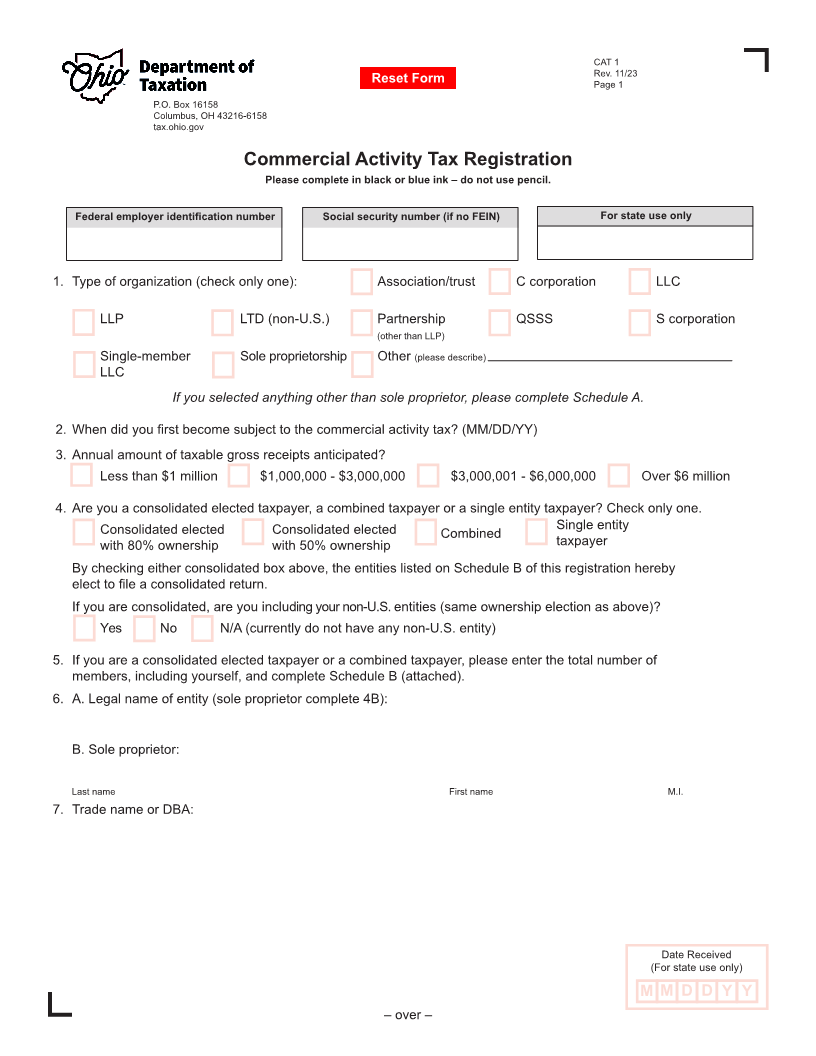

CAT 1

Reset Form Rev. 11/23

Page 1

P.O. Box 16158

Columbus, OH 43216-6158

tax.ohio.gov

Commercial Activity Tax Registration

Please complete in black or blue ink – do not use pencil.

Federal employer identification number Social security number (if no FEIN) For state use only

1. Type of organization (check only one): Association/trust C corporation LLC

LLP LTD (non-U.S.) Partnership QSSS S corporation

(other than LLP)

Single-member Sole proprietorship Other (please describe)

LLC

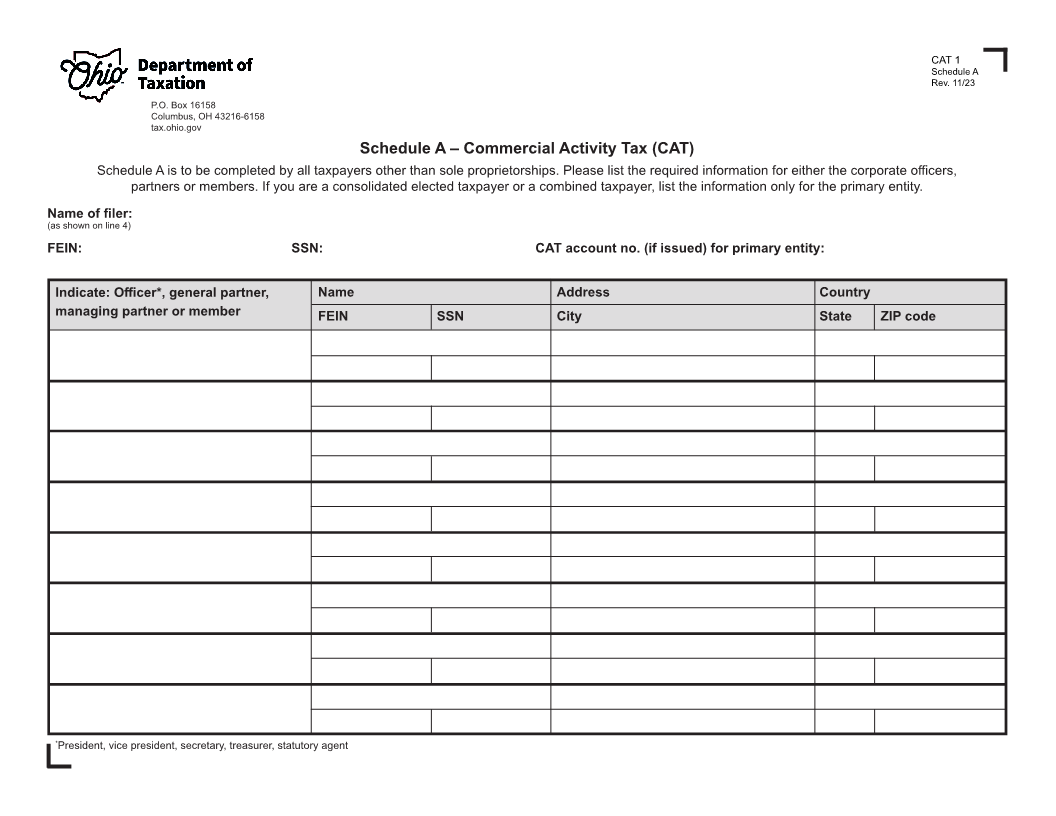

If you selected anything other than sole proprietor, please complete Schedule A.

2. When did you first become subject to the commercial activity tax? (MM/DD/YY)

3. Annual amount of taxable gross receipts anticipated?

Less than $1 million $1,000,000 - $3,000,000 $3,000,001 - $6,000,000 Over $6 million

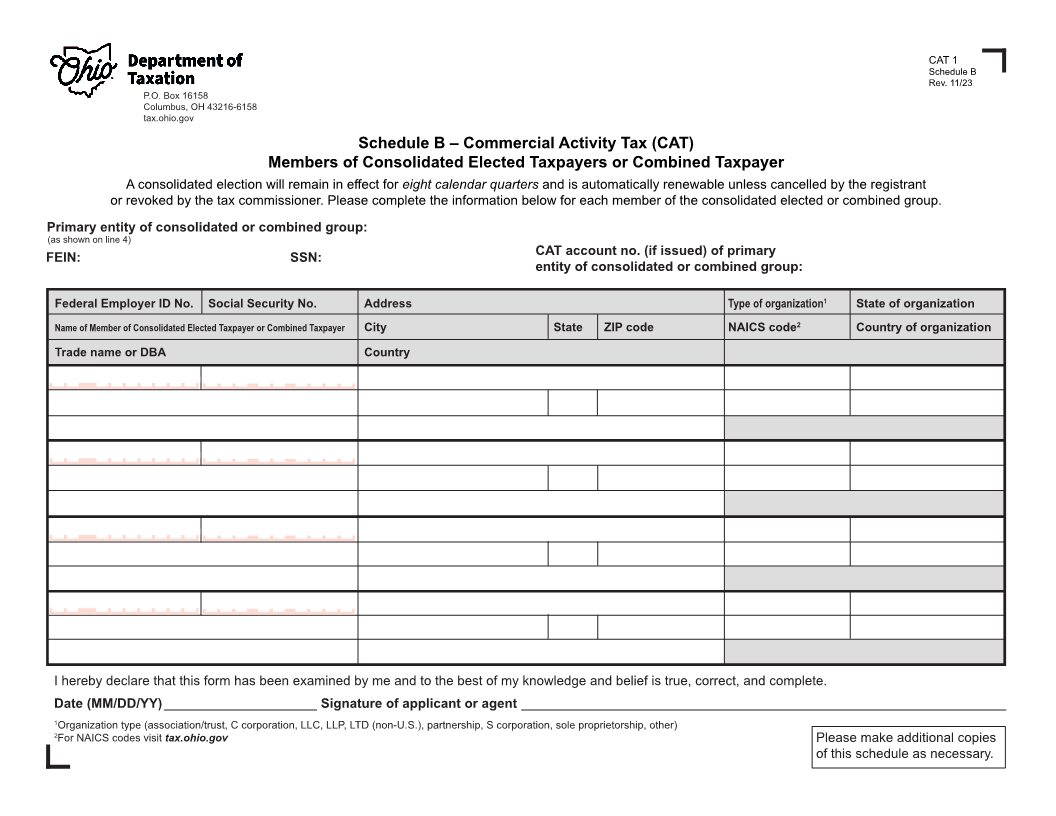

4. Are you a consolidated elected taxpayer, a combined taxpayer or a single entity taxpayer? Check only one.

Single entity

Consolidated elected Consolidated elected Combined

with 80% ownership with 50% ownership taxpayer

By checking either consolidated box above, the entities listed on Schedule B of this registration hereby

elect to file a consolidated return.

If you are consolidated, are you including your non-U.S. entities (same ownership election as above)?

Yes No N/A (currently do not have any non-U.S. entity)

5. If you are a consolidated elected taxpayer or a combined taxpayer, please enter the total number of

members, including yourself, and complete Schedule B (attached).

6. A. Legal name of entity (sole proprietor complete 4B):

B. Sole proprietor:

Last name First name M.I.

7. Trade name or DBA:

Date Received

(For state use only)

M M D D Y Y

– over –