Enlarge image

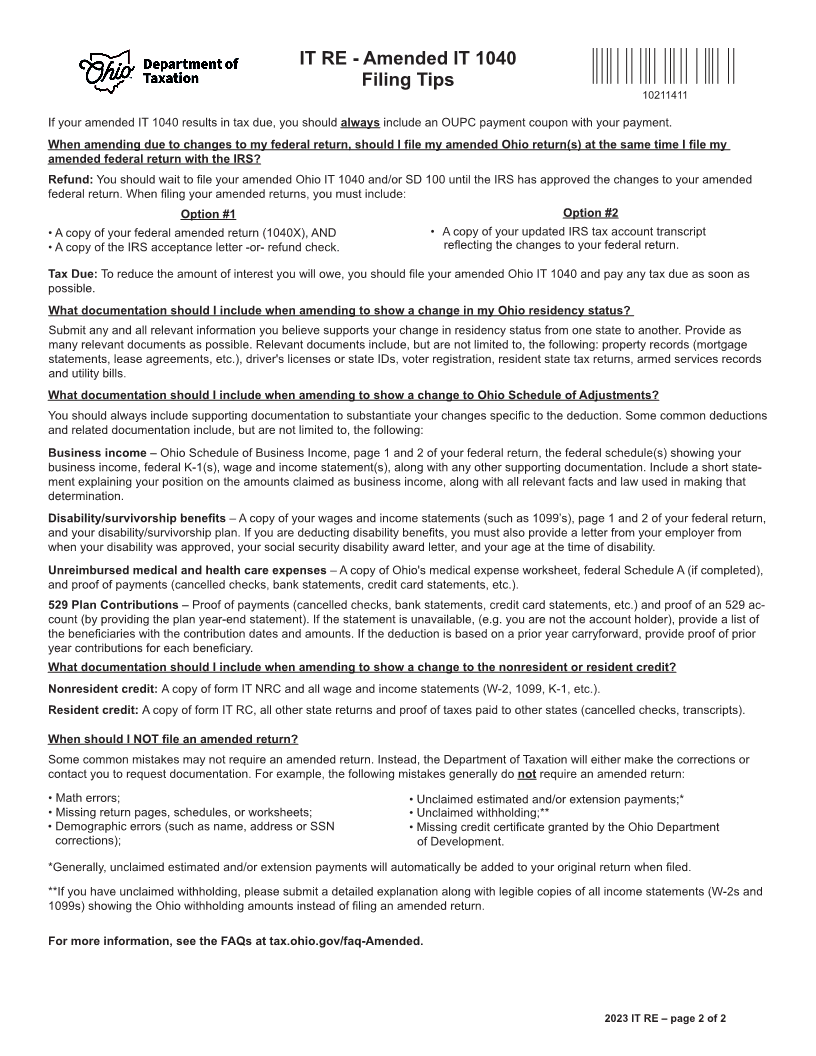

2023 Ohio IT RE

Explanation of Corrections

23270102

Note: For amended individual return only

Primary taxpayer's SSN

Complete the Ohio IT 1040 and indicate that it is amended by checking the box at the top of page 1. You must include this form and

documentation to support the adjustments on your amended return.

Reason(s):

Federal adjusted gross income decreased Filing status changed

Exemptions increased (include Schedule of Dependents)

If you checked any of the boxes above, do not file your Ohio amended return until the IRS has accepted the changes on your federal

amended return.

Federal adjusted gross income increased Ohio Schedule of Credits, nonresident credit increased

Exemptions decreased (include Schedule of Dependents) Ohio Schedule of Credits, nonresident credit decreased

Residency status changed Ohio Schedule of Credits, resident credit increased

Ohio Schedule of Adjustments, additions to income Ohio Schedule of Credits, resident credit decreased

Ohio Schedule of Adjustments, deductions from income Ohio Schedule of Credits, refundable credit(s) increased

Ohio Schedule of Credits, nonrefundable credit(s) increased Ohio Schedule of Credits, refundable credit(s) decreased

Ohio Schedule of Credits, nonrefundable credit(s) decreased Other (describe the reason below)

Note: Include any worksheets and/or documentation necessary to support your changes. See the filing tips on the next page as well as

the Ohio Individual and School District income tax instructions.

Detailed explanation of adjusted items (include additional sheet[s] if necessary):

E-mail address Telephone number

Federal Privacy Act Notice: Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform you that providing us

with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and 5747.08 authorize us to request this information. We need your Social

Security number in order to administer this tax.

2023 IT RE – page 1 of 2