- 18 -

Enlarge image

|

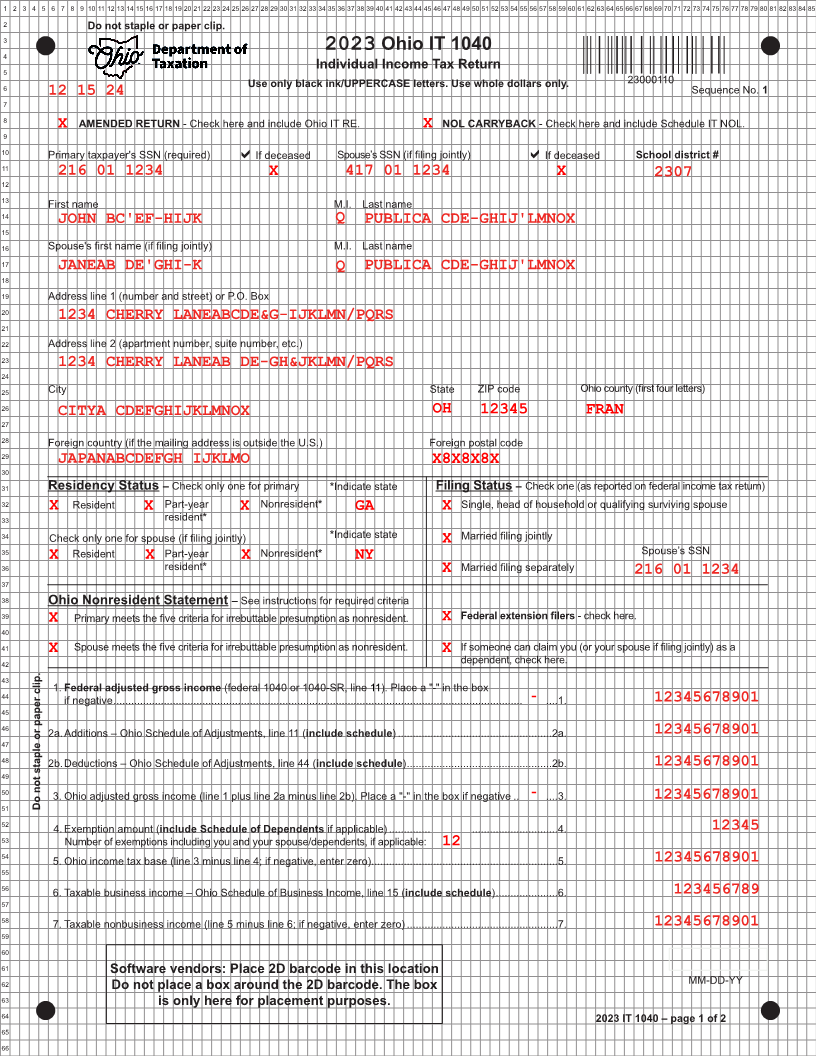

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85

2

3

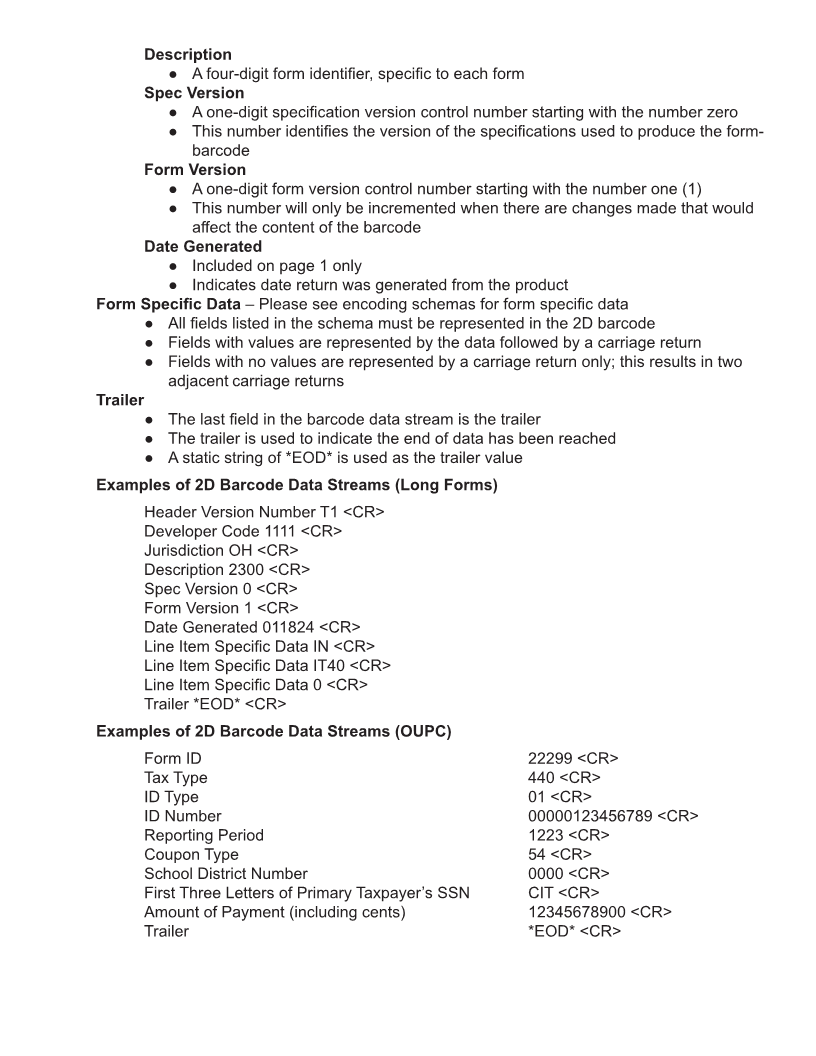

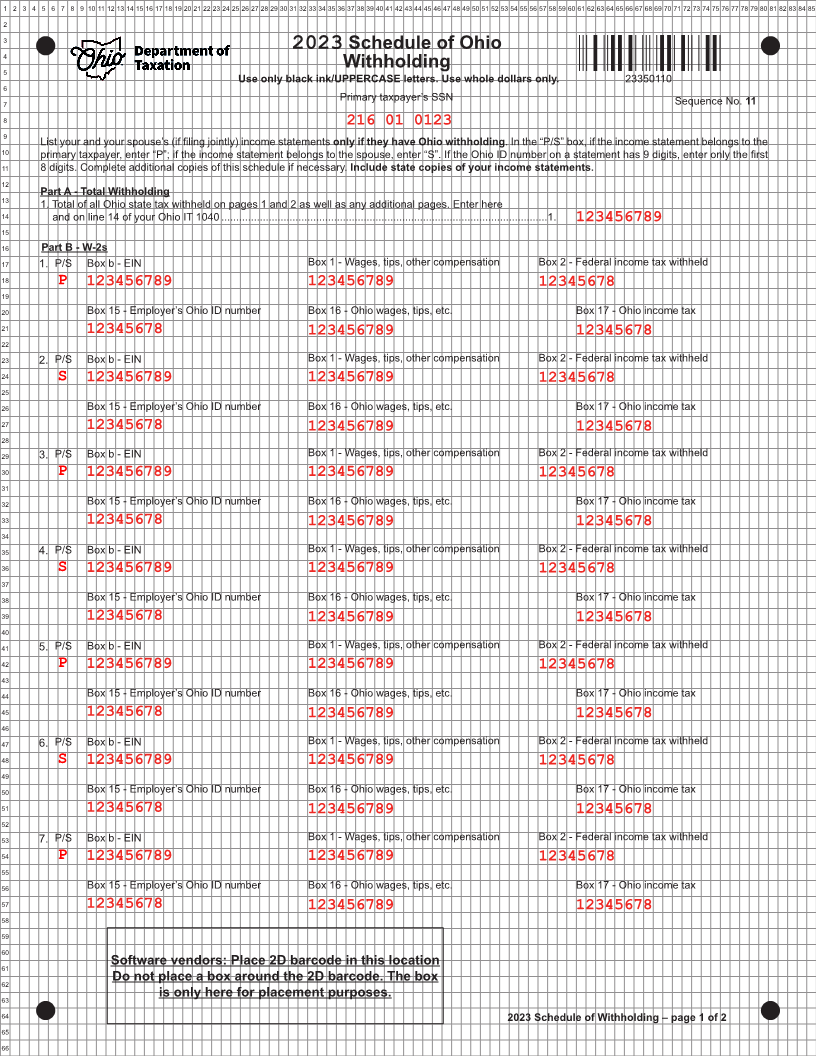

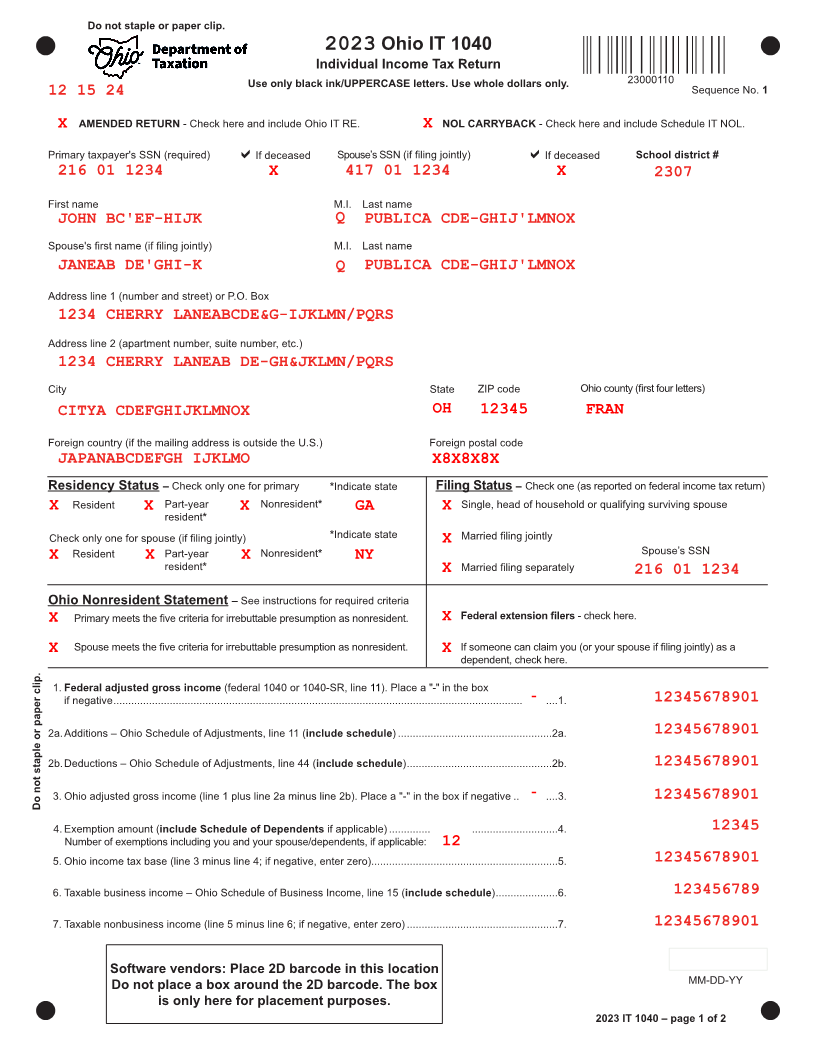

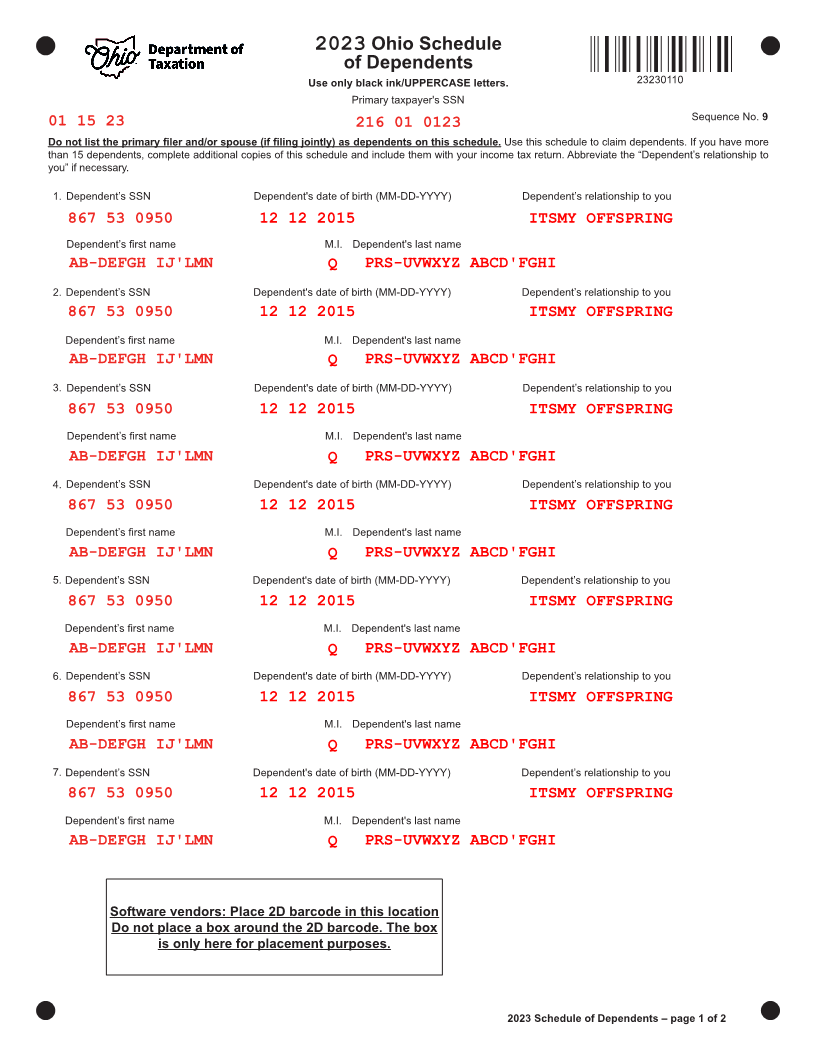

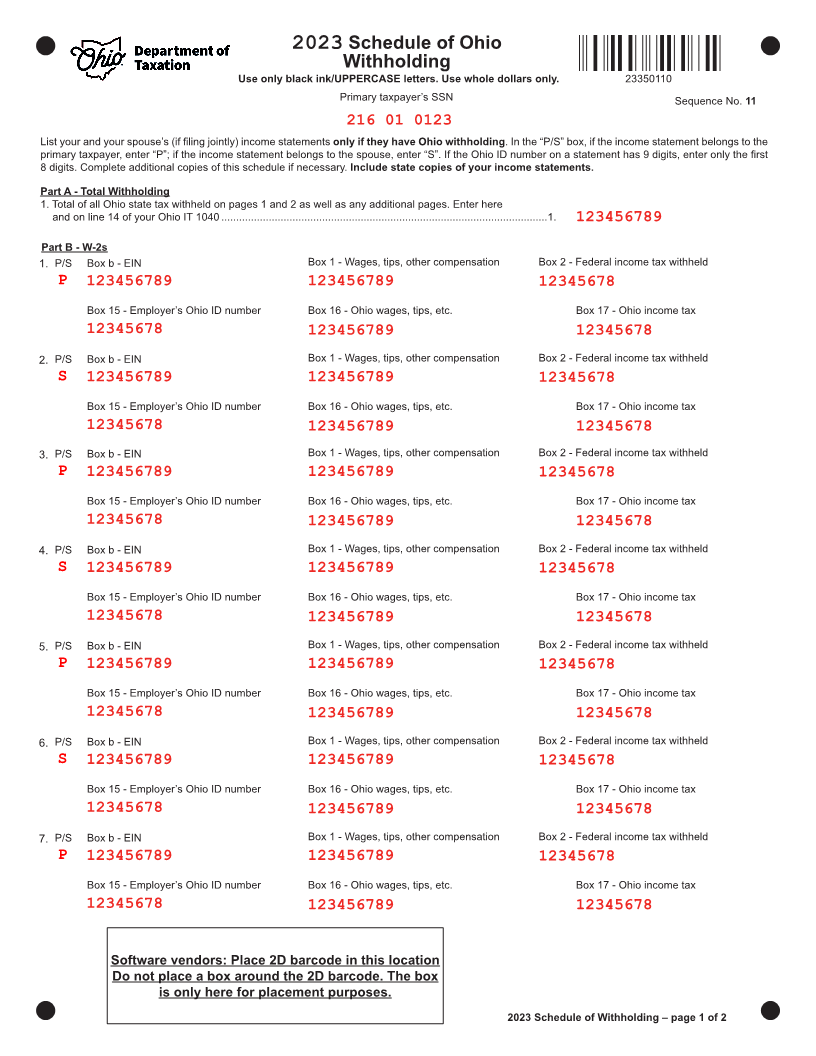

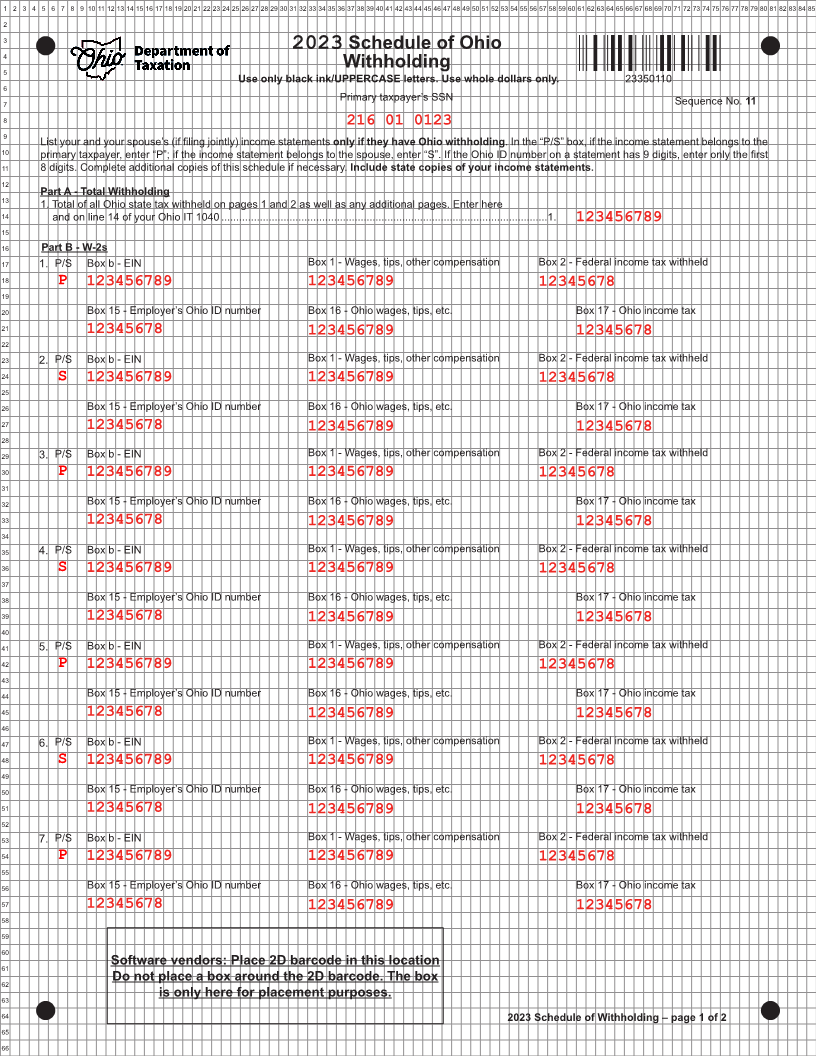

4 2023 Schedule of Ohio

5 Withholding

Use only black ink/UPPERCASE letters. Use whole dollars only. 23350110

6

7 Primary taxpayer’s SSN Sequence No. 11

8

216 01 0123

9

List your and your spouse’s (if filing jointly) income statements only if they have Ohio withholding. In the “P/S” box, if the income statement belongs to the

10 primary taxpayer, enter “P”; if the income statement belongs to the spouse, enter “S”. If the Ohio ID number on a statement has 9 digits, enter only the first

11 8 digits. Complete additional copies of this schedule if necessary. Include state copies of your income statements.

12

13 Part A - Total Withholding

1. Total of all Ohio state tax withheld on pages 1 and 2 as well as any additional pages. Enter here

14 and on line 14 of your Ohio IT 1040 ..............................................................................................................1. 123456789

15

16 Part B - W-2s

17 1. P/S Box b - EIN Box 1 - Wages, tips, other compensation Box 2 - Federal income tax withheld

18

P 123456789 123456789 12345678

19

20 Box 15 - Employer’s Ohio ID number Box 16 - Ohio wages, tips, etc. Box 17 - Ohio income tax

21

22 12345678 123456789 12345678

23 2. P/S Box b - EIN Box 1 - Wages, tips, other compensation Box 2 - Federal income tax withheld

24

S 123456789 123456789 12345678

25

26 Box 15 - Employer’s Ohio ID number Box 16 - Ohio wages, tips, etc. Box 17 - Ohio income tax

27

12345678

28 123456789 12345678

29 3. P/S Box b - EIN Box 1 - Wages, tips, other compensation Box 2 - Federal income tax withheld

123456789 123456789

30 P 12345678

31

32 Box 15 - Employer’s Ohio ID number Box 16 - Ohio wages, tips, etc. Box 17 - Ohio income tax

33

12345678 123456789 12345678

34

35 4. P/S Box b - EIN Box 1 - Wages, tips, other compensation Box 2 - Federal income tax withheld

123456789 123456789

36 S 12345678

37

38 Box 15 - Employer’s Ohio ID number Box 16 - Ohio wages, tips, etc. Box 17 - Ohio income tax

39

12345678 123456789 12345678

40

41 5. P/S Box b - EIN Box 1 - Wages, tips, other compensation Box 2 - Federal income tax withheld

123456789 123456789

42 P 12345678

43

44 Box 15 - Employer’s Ohio ID number Box 16 - Ohio wages, tips, etc. Box 17 - Ohio income tax

45

12345678 123456789 12345678

46

47 6. P/S Box b - EIN Box 1 - Wages, tips, other compensation Box 2 - Federal income tax withheld

123456789 123456789

48 S 12345678

49

50 Box 15 - Employer’s Ohio ID number Box 16 - Ohio wages, tips, etc. Box 17 - Ohio income tax

51

12345678 123456789 12345678

52

53 7. P/S Box b - EIN Box 1 - Wages, tips, other compensation Box 2 - Federal income tax withheld

123456789 123456789

54 P 12345678

55

56 Box 15 - Employer’s Ohio ID number Box 16 - Ohio wages, tips, etc. Box 17 - Ohio income tax

57

12345678 123456789 12345678

58

59

60

61 Software vendors: Place 2D barcode in this location

62 Do not place a box around the 2D barcode. The box

63 is only here for placement purposes.

64 2023 Schedule of Withholding – page 1 of 2

65

66

|