Enlarge image

Toll Free: 877.767.3453 | Central Ohio: 614.466.3910

OhioSoS.gov | business@OhioSoS.gov

File online or for more information: OhioBusinessCentral.gov

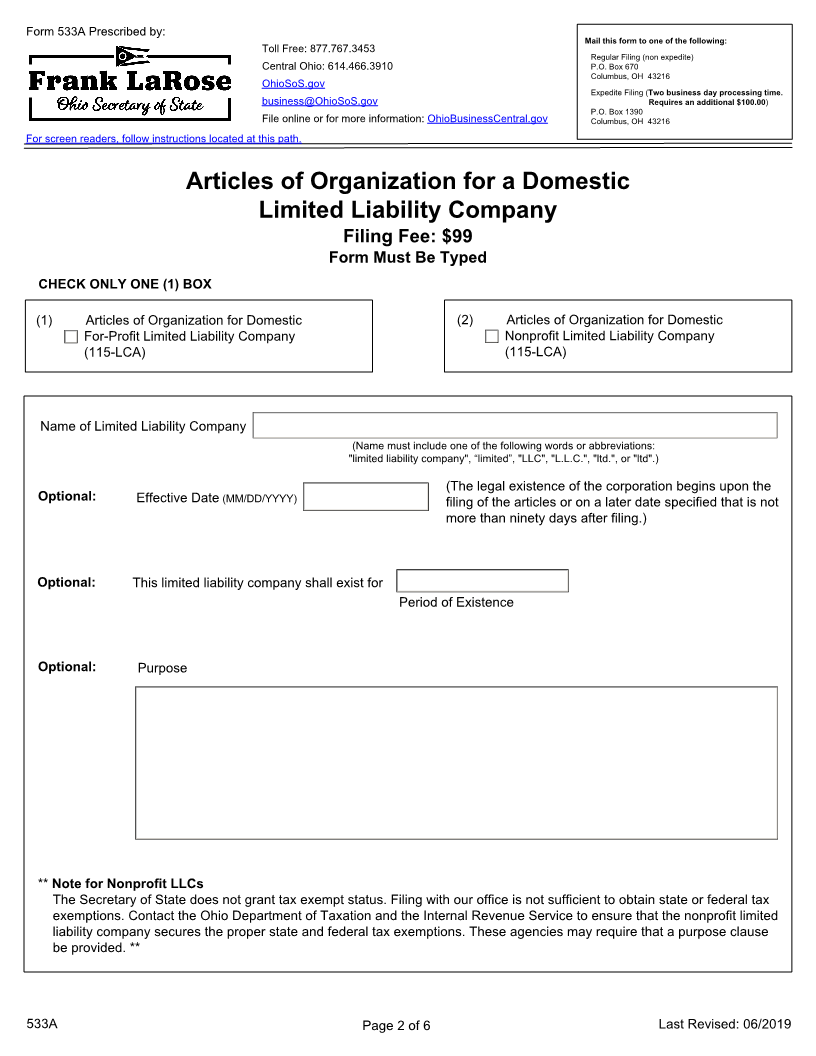

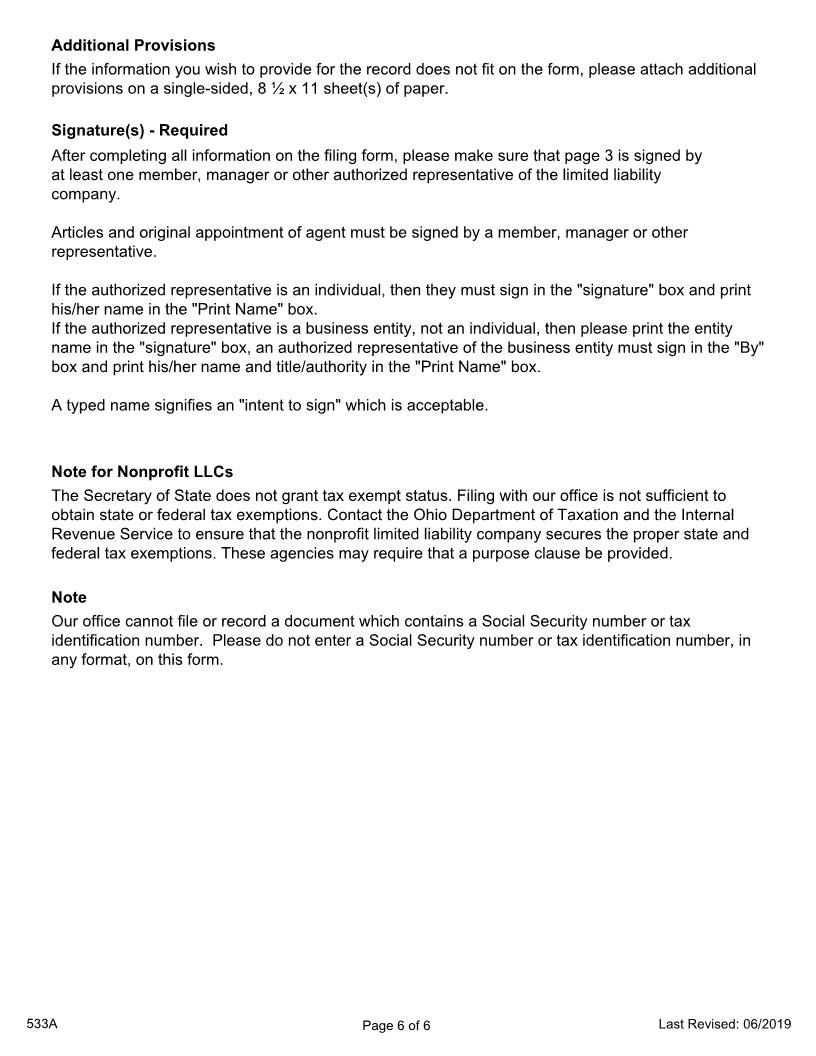

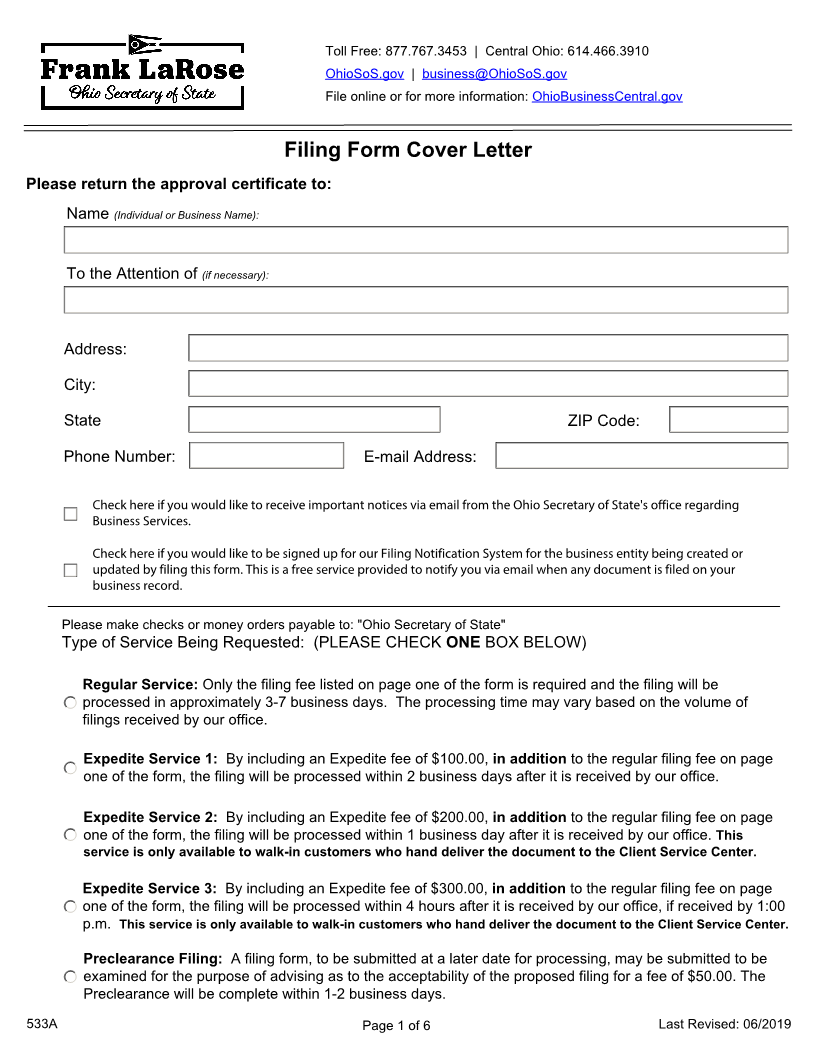

Filing Form Cover Letter

Please return the approval certificate to:

Name (Individual or Business Name):

To the Attention of (if necessary):

Address:

City:

State ZIP Code:

Phone Number: E-mail Address:

Check here if you would like to receive important notices via email from the Ohio Secretary of State's office regarding

Business Services.

Check here if you would like to be signed up for our Filing Notification System for the business entity being created or

updated by filing this form. This is a free service provided to notify you via email when any document is filed on your

business record.

Please make checks or money orders payable to: "Ohio Secretary of State"

Type of Service Being Requested: (PLEASE CHECK ONE BOX BELOW)

Regular Service: Only the filing fee listed on page one of the form is required and the filing will be

processed in approximately 3-7 business days. The processing time may vary based on the volume of

filings received by our office.

Expedite Service 1: By including an Expedite fee of $100.00, in addition to the regular filing fee on page

one of the form, the filing will be processed within 2 business days after it is received by our office.

Expedite Service 2: By including an Expedite fee of $200.00, in addition to the regular filing fee on page

one of the form, the filing will be processed within 1 business day after it is received by our office. This

service is only available to walk-in customers who hand deliver the document to the Client Service Center.

Expedite Service 3: By including an Expedite fee of $300.00, in addition to the regular filing fee on page

one of the form, the filing will be processed within 4 hours after it is received by our office, if received by 1:00

p.m. This service is only available to walk-in customers who hand deliver the document to the Client Service Center.

Preclearance Filing: A filing form, to be submitted at a later date for processing, may be submitted to be

examined for the purpose of advising as to the acceptability of the proposed filing for a fee of $50.00. The

Preclearance will be complete within 1-2 business days.

533A Page 1 of 6 Last Revised: 06/2019