Enlarge image

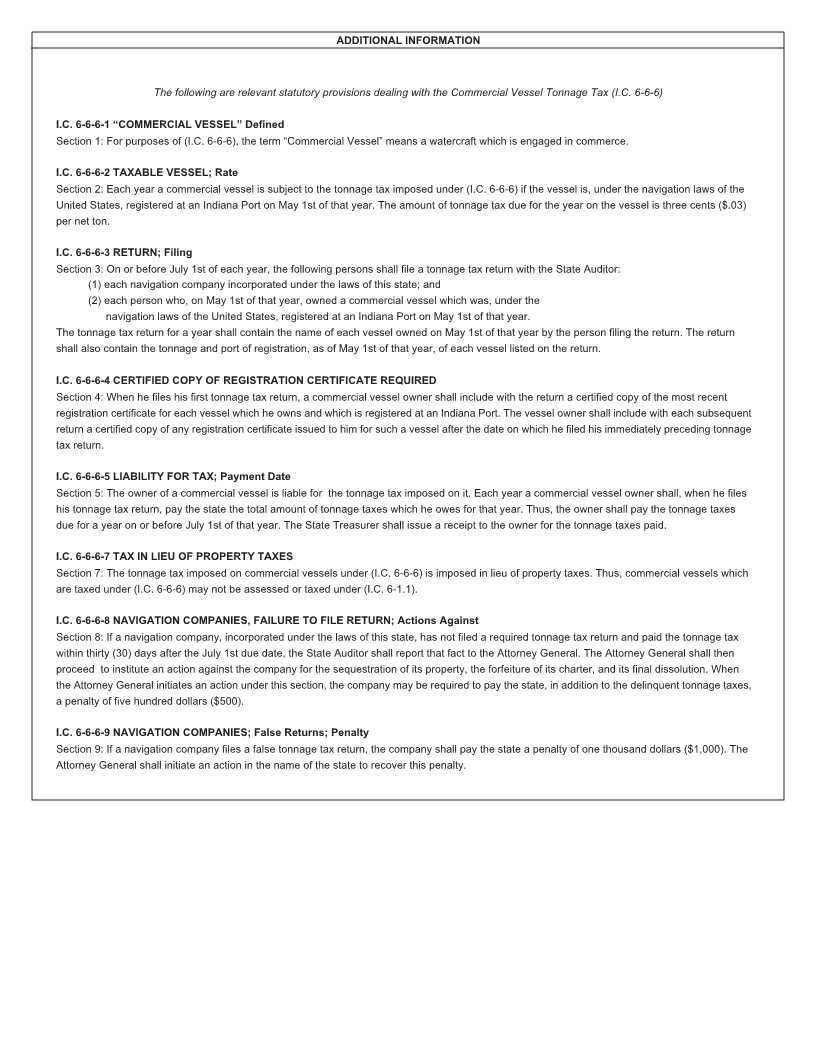

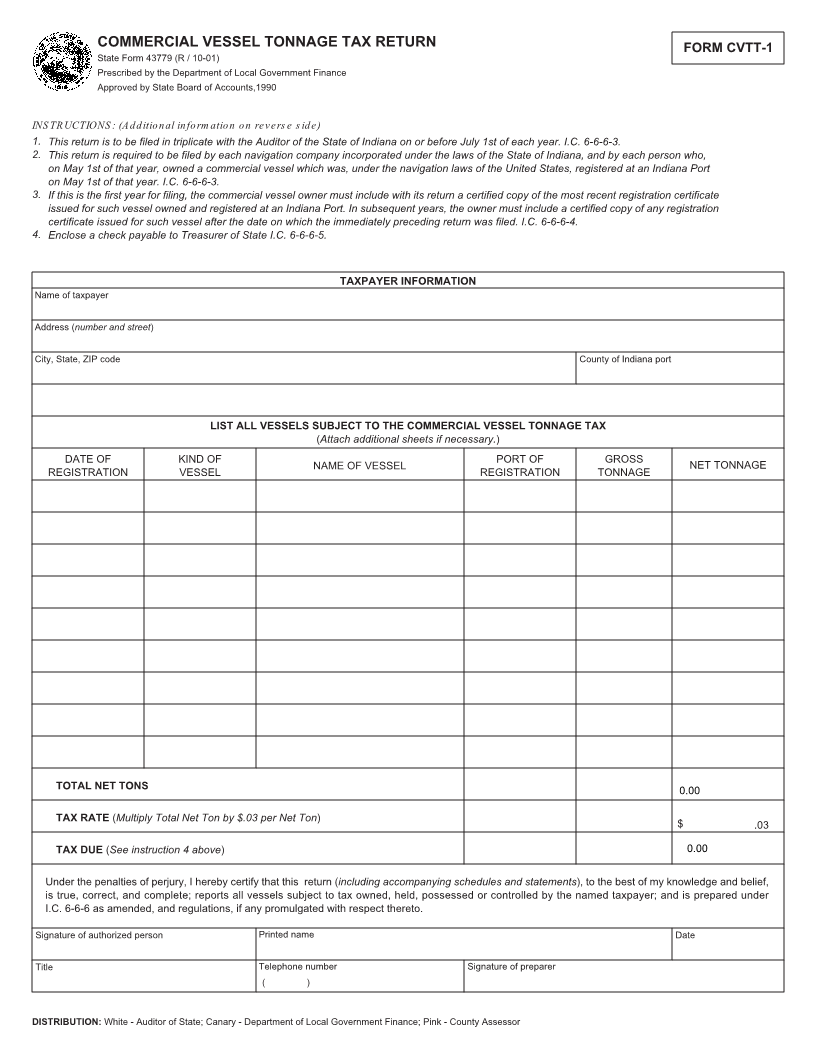

COMMERCIAL VESSEL TONNAGE TAX RETURN FORM CVTT-1

State Form 43779 (R / 10-01)

Prescribed by the Department of Local Government Finance

Approved by State Board of Accounts,1990

INSTRUCTIONS: (Additional information on reverse side)

1. This return is to be filed in triplicate with the Auditor of the State of Indiana on or before July 1st of each year. I.C. 6-6-6-3.

2. This return is required to be filed by each navigation company incorporated under the laws of the State of Indiana, and by each person who,

on May 1st of that year, owned a commercial vessel which was, under the navigation laws of the United States, registered at an Indiana Port

on May 1st of that year. I.C. 6-6-6-3.

3. If this is the first year for filing, the commercial vessel owner must include with its return a certified copy of the most recent registration certificate

issued for such vessel owned and registered at an Indiana Port. In subsequent years, the owner must include a certified copy of any registration

certificate issued for such vessel after the date on which the immediately preceding return was filed. I.C. 6-6-6-4.

4. Enclose a check payable to Treasurer of State I.C. 6-6-6-5.

TAXPAYER INFORMATION

Name of taxpayer

Address (number and street)

City, State, ZIP code County of Indiana port

LIST ALL VESSELS SUBJECT TO THE COMMERCIAL VESSEL TONNAGE TAX

(Attach additional sheets if necessary.)

DATE OF KIND OF PORT OF GROSS NET TONNAGE

NAME OF VESSEL

REGISTRATION VESSEL REGISTRATION TONNAGE

TOTAL NET TONS 0.00

TAX RATE (Multiply Total Net Ton by $.03 per Net Ton)

$ .03

TAX DUE (See instruction 4 above) 0.00

Under the penalties of perjury, I hereby certify that this return (including accompanying schedules and statements), to the best of my knowledge and belief,

is true, correct, and complete; reports all vessels subject to tax owned, held, possessed or controlled by the named taxpayer; and is prepared under

I.C. 6-6-6 as amended, and regulations, if any promulgated with respect thereto.

Signature of authorized person Printed name Date

Title Telephone number Signature of preparer

( )

DISTRIBUTION: White - Auditor of State; Canary - Department of Local Government Finance; Pink - County Assessor