Enlarge image

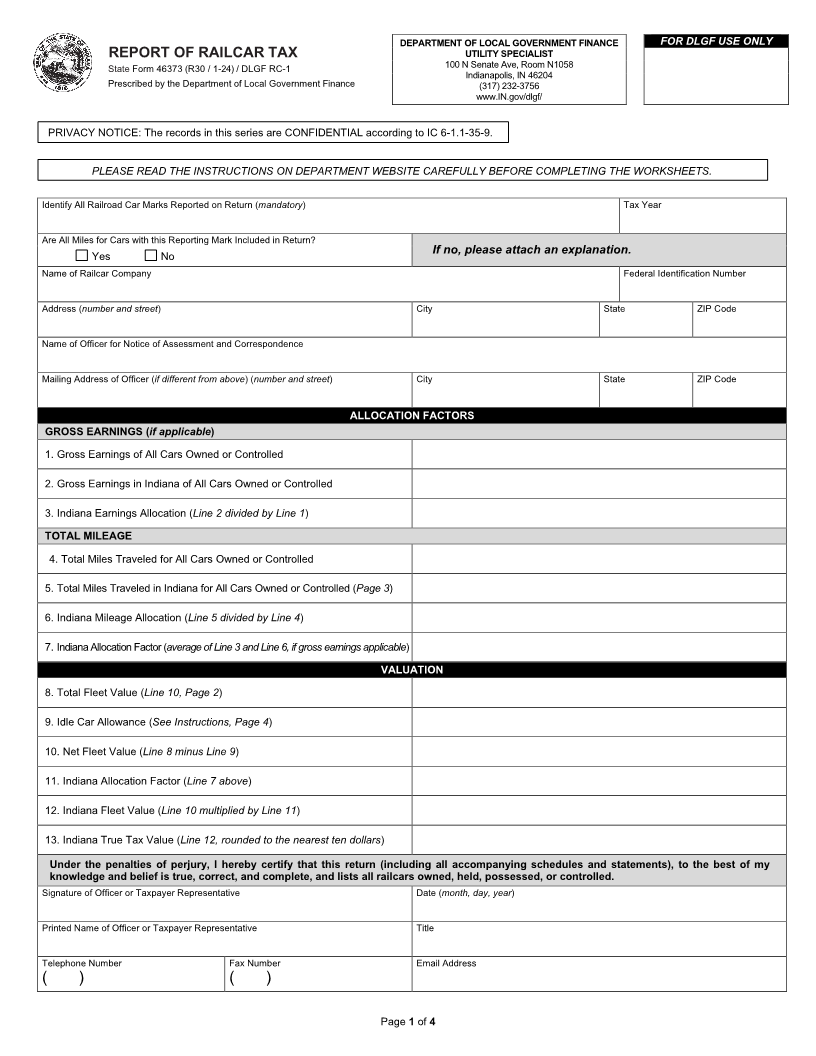

DEPARTMENT OF LOCAL GOVERNMENT FINANCE FOR DLGF USE ONLY

REPORT OF RAILCAR TAX UTILITY SPECIALIST

State Form 46373 (R30 / 1-24) / DLGF RC-1 100 N Senate Ave, Room N1058

Indianapolis, IN 46204

Prescribed by the Department of Local Government Finance (317) 232-3756

www.IN.gov/dlgf/

PRIVACY NOTICE: The records in this series are CONFIDENTIAL according to IC 6-1.1-35-9.

PLEASE READ THE INSTRUCTIONS ON DEPARTMENT WEBSITE CAREFULLY BEFORE COMPLETING THE WORKSHEETS.

Identify All Railroad Car Marks Reported on Return (mandatory ) Tax Year

Are All Miles for Cars with this Reporting Mark Included in Return?

☐ Yes ☐ No If no, please attach an explanation.

Name of Railcar Company Federal Identification Number

Address (number and street ) City State ZIP Code

Name of Officer for Notice of Assessment and Correspondence

Mailing Address of Officer (if different from above ) (number and street ) City State ZIP Code

ALLOCATION FACTORS

GROSS EARNINGS (if applicable )

1. Gross Earnings of All Cars Owned or Controlled

2. Gross Earnings in Indiana of All Cars Owned or Controlled

3. Indiana Earnings Allocation (Line 2 divided by Line 1)

TOTAL MILEAGE

4. Total Miles Traveled for All Cars Owned or Controlled

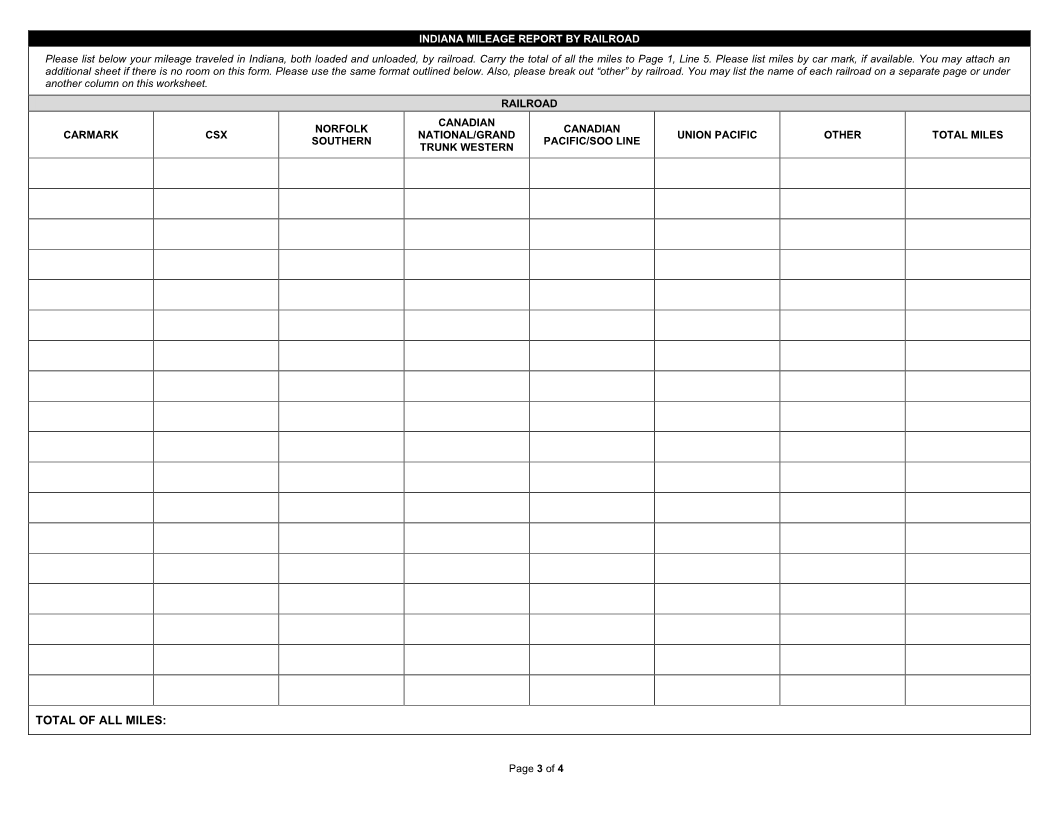

5. Total Miles Traveled in Indiana for All Cars Owned or Controlled (Page 3)

6. Indiana Mileage Allocation (Line 5 divided by Line 4)

7. Indiana Allocation Factoraverage( of Line 3 and Line 6, if gross earnings applicable )

VALUATION

8. Total Fleet Value (Line 10, Page 2)

9. Idle Car Allowance (See Instructions, Page 4)

10. Net Fleet Value (Line 8 minus Line 9)

11. Indiana Allocation Factor (Line 7 above)

12. Indiana Fleet Value (Line 10 multiplied by Line 11)

13. Indiana True Tax Value (Line 12, rounded to the nearest ten dollars)

Under the penalties of perjury, I hereby certify that this return (including all accompanying schedules and statements), to the best of my

knowledge and belief is true, correct, and complete, and lists all railcars owned, held, possessed, or controlled.

Signature of Officer or Taxpayer Representative Date (month, day, year )

Printed Name of Officer or Taxpayer Representative Title

Telephone Number Fax Number Email Address

( ) ( )

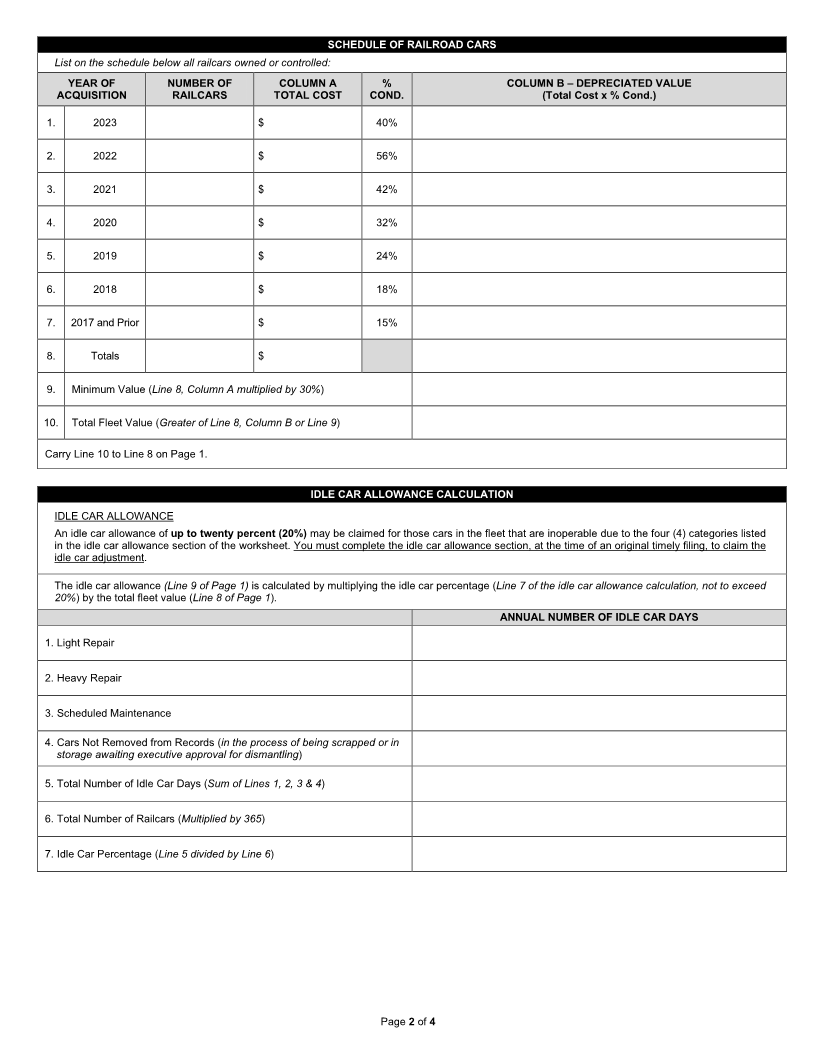

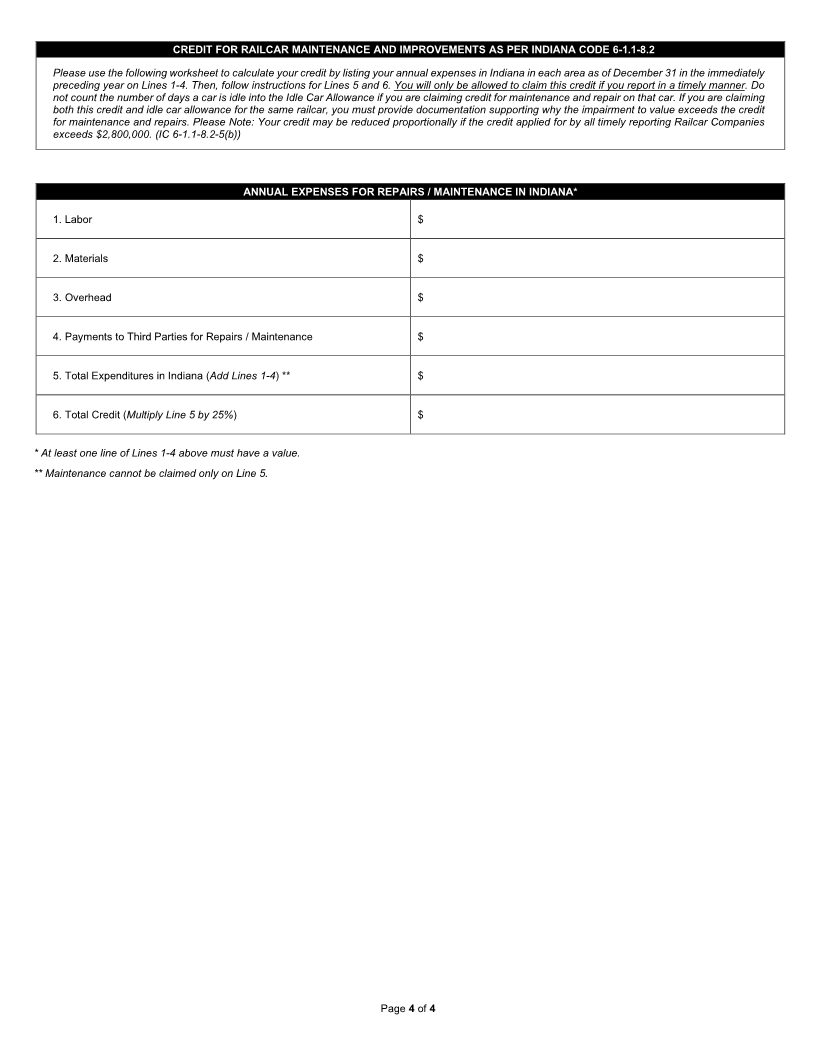

Page 1of 4