Enlarge image

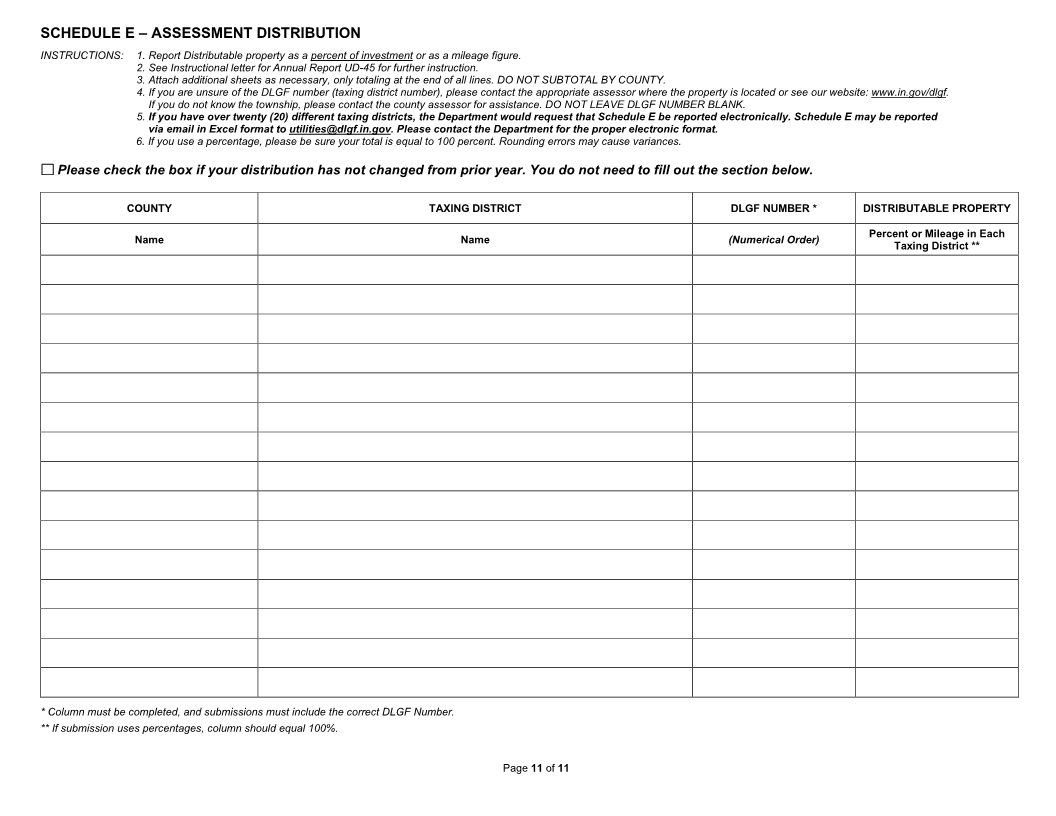

FOR DLGF USE ONLY

ANNUAL REPORT DLGF File Number

State Form 40408 (R23 / 2-23) / U.D. Form 45

Prescribed by the Department of Local Government Finance DLGF Distributable

PRIVACY NOTICE: The records in this series are CONFIDENTIAL according to IC 6-1.1-35-9.

☐ NOTE: For taxpayer with less than $80,000 cost to report within a county, legislation was passed in 2021 which exempts this property. If you are

declaring this exemption, check this box, enter the total acquisition cost of your personal (state distributable) property in the named county or counties,

and complete only Section I, II, and III of this form.

County: Acquisition Cost:

___________________________ ___________________________

___________________________ ___________________________

___________________________ ___________________________

If you own distributable property in multiple counties but not all of the property is eligible for the exemption, you are responsible for backing out any exempt

property from the overall sum you report to the Department. If you own distributable property in just one (1) county (and in only one (1) taxing district in that

county) in Indiana and the total acquisition cost of that property is less than $80,000 and you otherwise would have filed locally rather than with the

Department, file Form 103-Short or Form 103-Long with the applicable assessor and declare the exemption on that form.

SPECIAL NOTE: This exemption does NOT apply to distributable property that is assessed under IC 6-1.1-8 and is owned by a public utility subject to

regulation by the Indiana Utility Regulatory Commission. Also, a taxpayer who owns, holds, possesses, or controls leased or rented personal/distributable

property and who is filing a Form 103-Short or Form 103-Long locally may, as deemed necessary by the applicable assessor, need to file Form 103-O or

Form 103-N, as applicable, to verify that he is the appropriate taxpayer to claim this exemption. The Department also reserves the right to request a taxpayer

filing a Form UD-45 to disclose information concerning leased property to ensure the proper taxpayer is claiming the exemption.

PLEASE SEE THE GENERAL INSTRUCTIONS FOR EXAMPLES OF HOW AN ELIGIBLE TAXPAYER WOULD PROPERLY FILE.

INSTRUCTIONS:

1. This Annual Report should be prepared in duplicate.

2. Send one (1) copy to: Department of Local Government Finance

Utility Specialist

100 North Senate Ave., Room N1058

Indianapolis, IN 46204

Telephone: (317) 232-3756 or (317) 232-3765

Additional forms and information may be found on our website: www.in.gov/dlgf.

3. One (1) copy is to be kept in the files of the taxpayer as a part of its permanent records.

NOTICE: All public utility companies, including all water, sewage, electric, pipeline, telephone, telegraph, and bus companies are required to file annual

reports under IC 6-1.1-8-19. Failure to file the required reports by the due date will result in penalties.

SECTION I

Name of Utility Company Tax Year

Street Address (number and street, city, state, and ZIP code)

Name of Officer to Whom Notice of Assessment and Correspondence Should Be Sent Telephone Number

( )

Mailing Address of Officer (if different from above) (number and street) Email Address

City, State, and ZIP Code Fax Number

( )

Type of Utility

(select all that apply) ☐ Electric ☐ Solar ☐ Wind Power ☐ Hydroelectric ☐ Gas ☐ Water ☐ Sewage ☐ Pipeline ☐ Telephone ☐ Bus ☐ REMC

SECTION II QUESTIONS

Fiscal Year End Federal Income Tax Year End

If Federal Return is Filed as Part of Consolidated Group, Name Filed Under Location of Accounting Records

Form of Business

☐ Partnership or Joint Venture ☐ Sole Proprietorship ☐ Corporation

☐ Other (describe) _____________________________________________________________ FEIN: _______________________________________

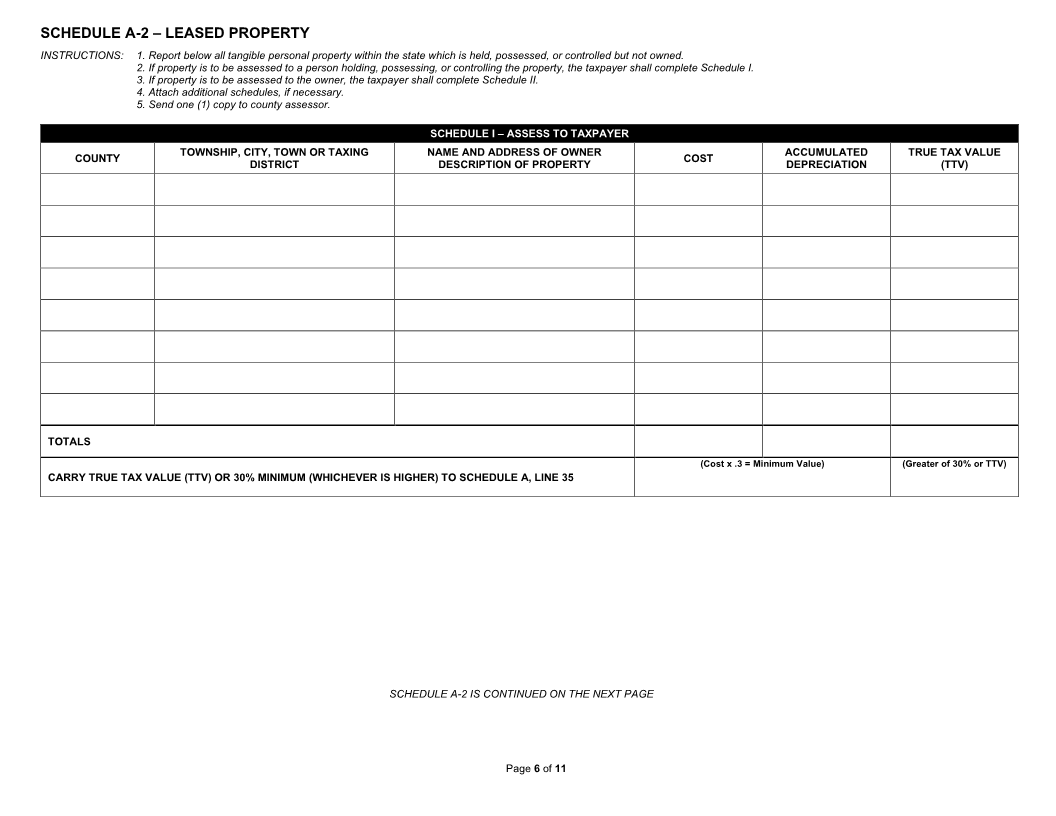

Did You Own, Hold, Possess, or Control Any Leased or Rented Depreciable Property on January 1? ☐ Yes ☐ No

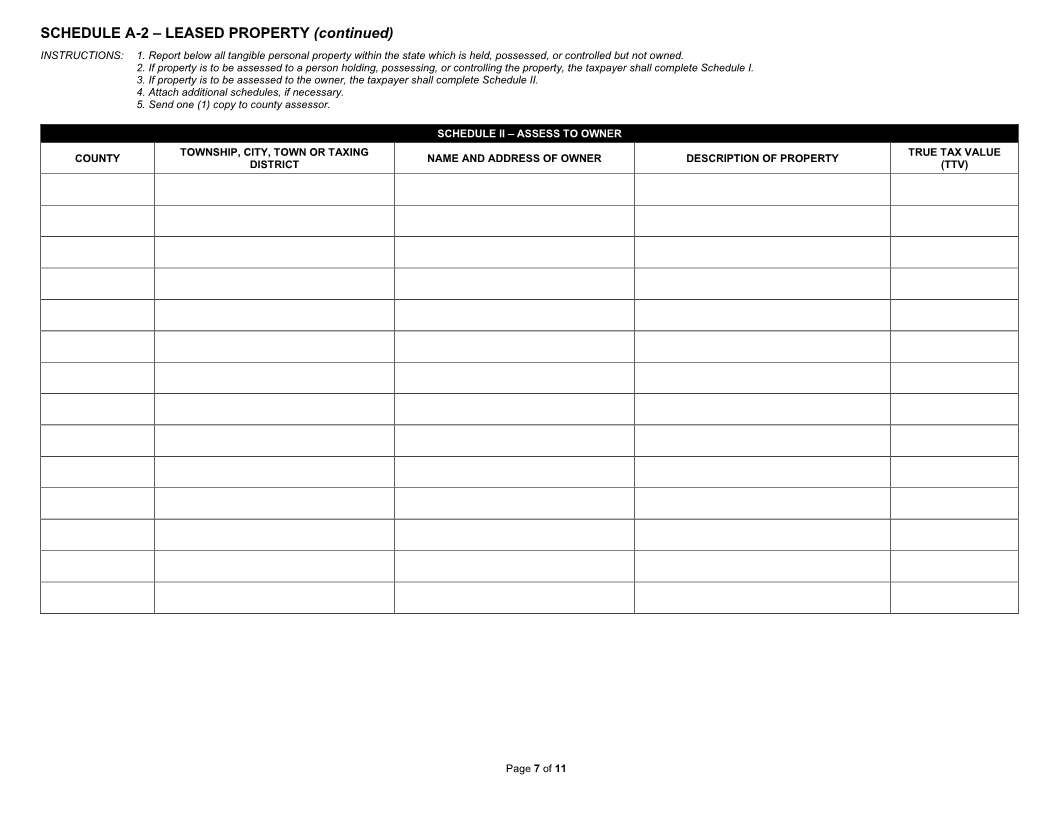

If yes, then report the local fixed personal property on Form 103-N to the local assessor and list on Part I-A or Part II of Schedule A-2 of this report. Report the leased personal property used

as distributable on Part I-B or Part II of Schedule A-2 of this report.

SECTION III CERTIFICATION

Under penalties of perjury, I hereby certify that the report (including any accompanying schedules and statements), to the best of my knowledge and belief, is true,

correct, and complete; if applicable, reports all taxable property owned, held, possessed, or controlled by the named taxpayer on the assessment date, as required by

law; and is prepared in accordance with IC 6-1.1-8 and regulations promulgated with respect hereto.

Signature of Authorized Person Printed Name of Authorized Person Title Date Signed (month, day, year)

Page 1of 11