Enlarge image

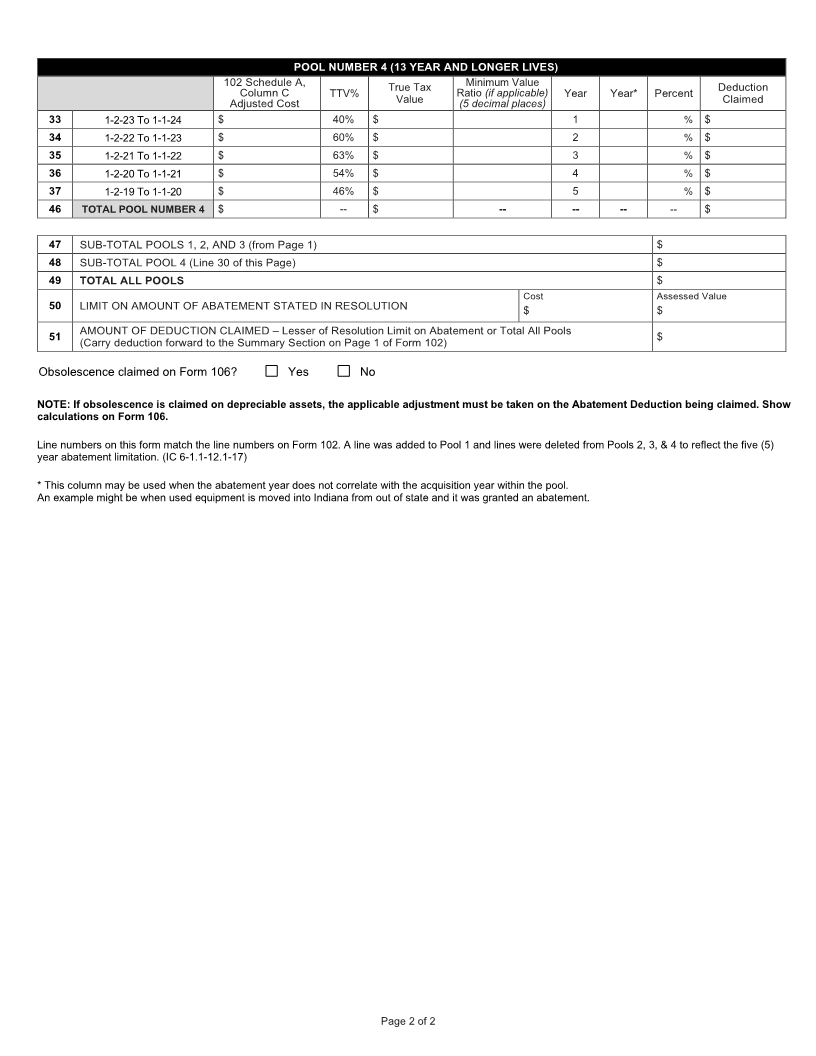

SCHEDULE OF DEDUCTION FROM ASSESSED FORM 102 – ERA JANUARY 1, 2024

VALUATION NEW FARM EQUIPMENT IN PRIVACY NOTICE For Assessor's Use Only

ECONOMIC REVITALIZATION AREA This form contains confidential

State Form 57204 (R2 / 1-24) information pursuant to IC 6-1.1-35-9.

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. In order to receive a deduction, this schedule must be submitted with a timely filed Form 102.

2. A separate schedule must be completed and attached to Form 102 for each approved Form SB-1/PP for the abatement.

3. Attach a copy of the applicable Form CF-1 to this schedule. First-time filings must also include the SB-1 and the resolution from the designating body.

4. For any acquisitions included herein since the last assessment date, attach a list of the newly included equipment on Page 2 of this form. (Form 102 – EL)

SECTION 1

Name of Taxpayer Name of Contact Person

Full Address (number and street, city, state, and ZIP code) Email Address of Contact Person Telephone

( )

County Township Taxing District Fax Number

( )

SECTION 2 ECONOMIC REVITALIZATION AREA INFORMATION

Name of Body Designating the Economic Revitalization Area Resolution Number Length of Abatement (years)

Does resolution limit dollar amount of deduction? ☐ No ☐ Yes – Based on Equipment. ☐ Yes – Based on Cost ☐ Yes – Based on Assessed Value

Date Designation Approved (month, day, year) Date Designation will Terminate (if any)

SECTION 3 ABATED EQUIPMENT POOLING SCHEDULE

The total cost of depreciable assets is to be reported on Form 102. This schedule includes only the values attributable to the new farm equipment

under abatement per the resolution and IC 6-1.1-12.1.

The Minimum Value Ratio applies if Line Box 1 – Enter Amount on Form 102, Line 51 Box 2 – Enter Amount on Form 102, Line 50 Box 3 – Divide Box 1 by Box 2 (rounded to .00001)

51 is greater than Line 50 on Page 3 of

Form 102 [IC 6-1.1-12.1-4.5(g)]

POOL NUMBER 1 (1 TO 4 YEAR LIFE)

102 Schedule A, True Tax Minimum Value Deduction

Column C TTV% Value Ratio (if applicable) Year Year* Percent Claimed

Adjusted Cost (5 decimal places)

8 1-2-23 To 1-1-24 $ 65% $ 1 % $

9 1-2-22 To 1-1-23 $ 50% $ 2 % $

10 1-2-21 To 1-1-22 $ 35% $ 3 % $

11A 1-2-20 To 1-1-21 $ 20% $ 4 % $

11B 1-2-19 To 1-1-20 $ 20% $ 5 % $

12 TOTAL POOL NUMBER 1 $ -- $ -- -- -- -- $

POOL NUMBER 2 (5 TO 8 YEAR LIFE)

102 Schedule A, True Tax Minimum Value Deduction

Column C TTV% Value Ratio (if applicable) Year Year* Percent Claimed

Adjusted Cost (5 decimal places)

13 1-2-23 To 1-1-24 $ 40% $ 1 % $

14 1-2-22 To 1-1-23 $ 56% $ 2 % $

15 1-2-21 To 1-1-22 $ 42% $ 3 % $

16 1-2-20 To 1-1-21 $ 32% $ 4 % $

17 1-2-19 To 1-1-20 $ 24% $ 5 % $

20 TOTAL POOL NUMBER 2 $ -- $ -- -- -- -- $

POOL NUMBER 3 (9 TO 12 YEAR LIFE)

102 Schedule A, True Tax Minimum Value Deduction

Column C TTV% Value Ratio (if applicable) Year Year* Percent Claimed

Adjusted Cost (5 decimal places)

21 1-2-23 To 1-1-24 $ 40% $ 1 % $

22 1-2-22 To 1-1-23 $ 60% $ 2 % $

23 1-2-21 To 1-1-22 $ 55% $ 3 % $

24 1-2-20 To 1-1-21 $ 45% $ 4 % $

25 1-2-19 To 1-1-20 $ 37% $ 5 % $

32 TOTAL POOL NUMBER 3 $ -- $ -- -- -- -- $

SUB-TOTAL – POOLS 1, 2, AND 3 (Total Lines 12, 20, and 32. Enter to the right and on Page 2) $

Page 1 of 2