Enlarge image

Reset Form

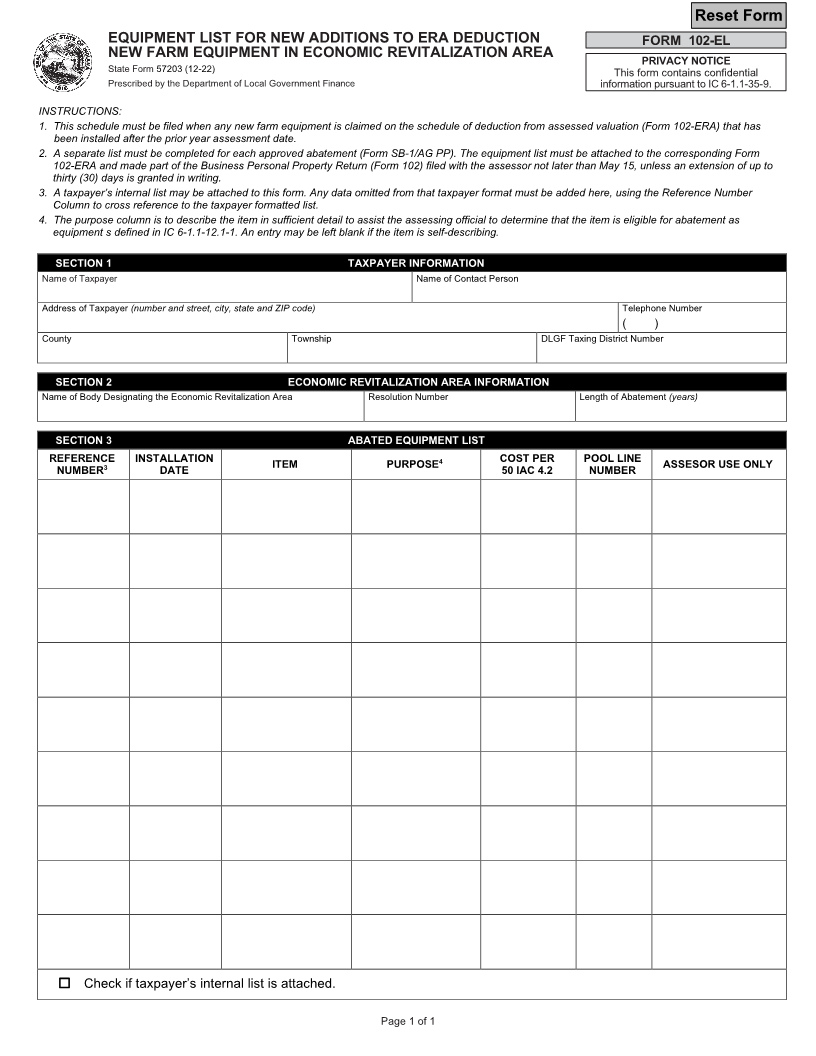

EQUIPMENT LIST FOR NEW ADDITIONS TO ERA DEDUCTION FORM 102-EL

NEW FARM EQUIPMENT IN ECONOMIC REVITALIZATION AREA PRIVACY NOTICE

State Form 57203 (12-22) This form contains confidential

Prescribed by the Department of Local Government Finance information pursuant to IC 6-1.1-35-9.

INSTRUCTIONS:

1. This schedule must be filed when any new farm equipment is claimed on the schedule of deduction from assessed valuation (Form 102-ERA) that has

been installed after the prior year assessment date.

2. A separate list must be completed for each approved abatement (Form SB-1/AG PP). The equipment list must be attached to the corresponding Form

102-ERA and made part of the Business Personal Property Return (Form 102) filed with the assessor not later than May 15, unless an extension of up to

thirty (30) days is granted in writing.

3. A taxpayer’s internal list may be attached to this form. Any data omitted from that taxpayer format must be added here, using the Reference Number

Column to cross reference to the taxpayer formatted list.

4. The purpose column is to describe the item in sufficient detail to assist the assessing official to determine that the item is eligible for abatement as

equipment s defined in IC 6-1.1-12.1-1. An entry may be left blank if the item is self-describing.

SECTION 1 TAXPAYER INFORMATION

Name of Taxpayer Name of Contact Person

Address of Taxpayer (number and street, city, state and ZIP code) Telephone Number

( )

County Township DLGF Taxing District Number

SECTION 2 ECONOMIC REVITALIZATION AREA INFORMATION

Name of Body Designating the Economic Revitalization Area Resolution Number Length of Abatement (years)

SECTION 3 ABATED EQUIPMENT LIST

REFERENCE3 INSTALLATION ITEM PURPOSE 4 COST PER POOL LINE ASSESOR USE ONLY

NUMBER DATE 50 IAC 4.2 NUMBER

☐ Check if taxpayer’s internal list is attached.

Page 1 of 1