Enlarge image

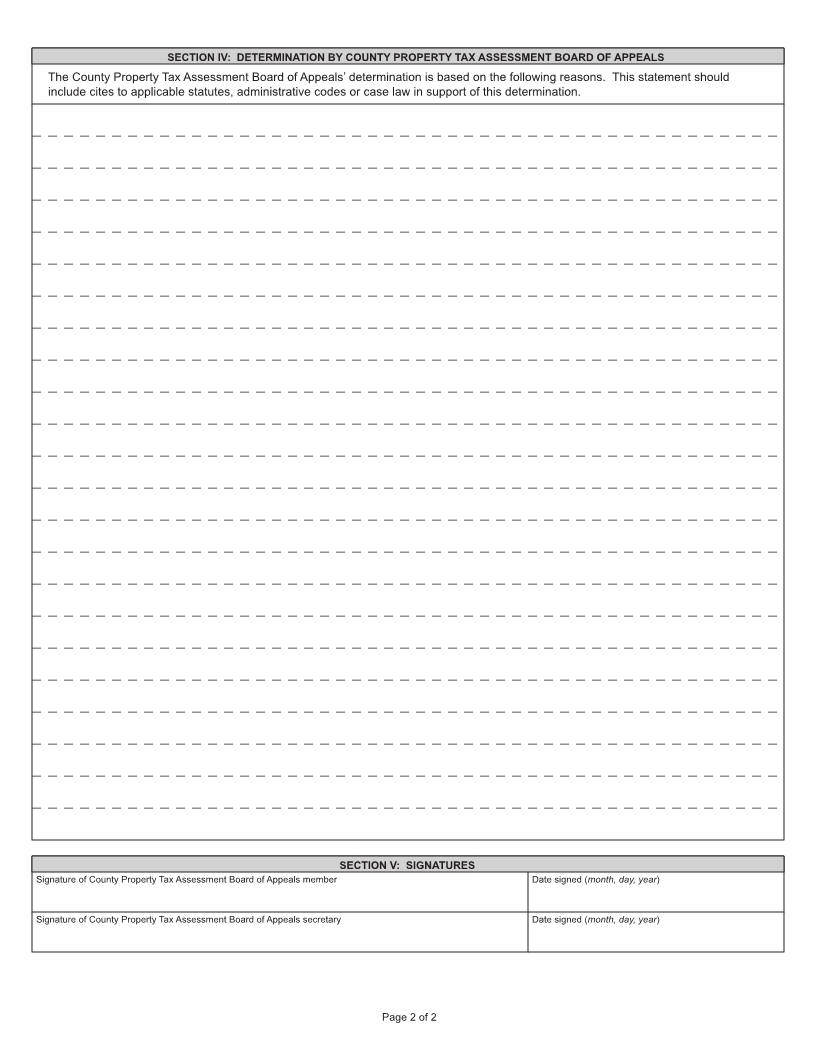

Reset Form

NOTICE OF ACTION ON EXEMPTION APPLICATION FORM 120

State Form 49585 (R6 / 11-16)

Prescribed by the Department of Local Government Finance

NOTES: This is a notice of action on an exemption application by the County Property Tax Assessment Board of Appeals as provided

for pursuant to IC 6-1.1-11-7.

If you do not agree with the action of the County Property Tax Assessment Board of Appeals, the Indiana Board of Tax Review

will review that action if you file a timely Form 132 petition with them and provide a copy of the petition to the County Assessor.

This form can be located on the Indiana Board of Tax Review’s website at www.in.gov/ibtr.

Please check type of property under application: Real Personal Both

SECTION I: PETITIONER INFORMATION

Name of Property Owner / Petitioner (first, middle, last)

Address of Property Owner (number and street) City State ZIP code

Name of Licensed Attorney

Address of Licensed Attorney (number and street) City State ZIP code

SECTION II: DESCRIPTION OF PROPERTY

County Township Parcel or key number

Address of property (number and street) City State ZIP code

Legal description provided on Form 11 or Property Record Card (for real property), or business name (for personal property)

SECTION III: FINAL DETERMINATION

You are hereby notified that your application for a property tax exemption for the property described above has been acted upon by the

______________________________________________ County Property Tax Assessment Board of Appeals in the following manner:

January 1, 20____ assessment date % Exempt % Taxable Total

Land

Improvements

Personal Property

THE COUNTY PROPERTY TAX ASSESSMENT BOARD OF APPEALS SHALL COMPLETE SECTIONS IV AND V OF THIS FORM.

See IC 6-1.1-11-7. (Notice of action by the County Property Tax Assessment Board of Appeals; action by County Assessor and

County Auditor; Appeal)

Date when notification was mailed (month, day, year) Signature of County Assessor

Page 1 of 2