Enlarge image

Reset Form

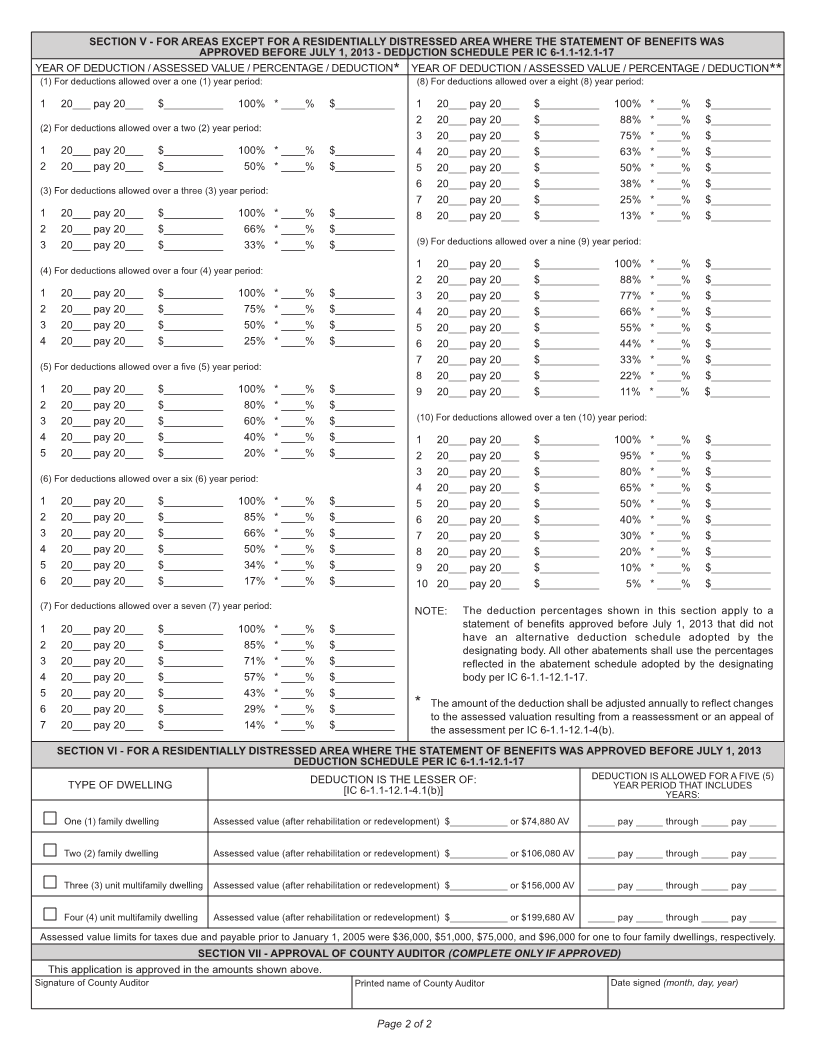

APPLICATION FOR DEDUCTION FROM ASSESSED VALUATION 20____ PAY 20____

OF STRUCTURES IN ECONOMIC REVITALIZATION AREAS (ERA)

State Form 18379 (R14 / 6-16) FORM 322 / RE

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

1. This form is to be filed in person or by mail with the County Auditor of the county in which the property is located.

2. To obtain this deduction, a Form 322 / RE must be filed with the County Auditor before May 10 in the year in which the addition to assessed valuation (or

new assessment) is made, or not later than thirty (30) days after the assessment notice is mailed to the property owner if it was mailed after April 10. If the

property owner misses the May 10 deadline in the initial year of assessment, he can apply between January 1 and May 10 of a subsequent year for the

remainder of the abatement term. (See also IC 6-1.1-12.1-11.3 concerning the failure to file a timely application.)

3. A copy of the Form 11, the approved Form SB-1 / Real Property, the resolution adopted by the designating body, and the Form CF-1 / Real Property must

be attached to this application.

4. The Form CF-1 / Real Property must be updated annually and provided to the County Auditor and the designating body for each assessment year in which

the deduction is applicable.

5. Please see IC 6-1.1-12.1 for further instructions.

6. Taxpayer completes Sections I, II and III below.

7. If property located in an economic revitalization area is also located in an allocation area as defined in IC 36-7-14-39 or IC 36-7-15.1-26, an application for

the property tax deduction may not be approved unless the Commission that designated the allocation area adopts a resolution approving the application

(IC 6-1.1-12.1-2(k)).

8. Except for deductions related to redevelopment or rehabilitation of real property in a county containing a consolidated city, a deduction for the

redevelopment or rehabilitation of real property may not be approved for the following facilities (IC 6-1.1-12.1-3):

a. Private or commercial golf course j. Any facility, the primary purpose of which is (a) retail food and beverage

b. Country club service; (b) automobile sales or service; or (c) other retail; (unless the

c. Massage parlor facility is located in an economic development-target area established

under IC 6-1.1-12.1-7).

d. Tennis club k. Residential, unless the facility is a multi-family facility that contains at

e. Skating facility, including roller skating, skateboarding or ice skating least 20% of the units available for use by low and moderate income

f. Racquet sport facility (including handball or racquet ball court) individuals, or unless the facility is located in an economic development

g. Hot tub facility target area established under IC 6-1.1-12.1-7, or the area is designated

h. Suntan facility as a residentially distressed area which is required to meet conditions as

cited in IC 6-1.1-12.1-2(c)(1 & 2).

i. Racetrack l. Package liquor store [see IC 6-1.1-12.1-3(e)(12)]

SECTION I - DESCRIPTION OF PROPERTY

The owner hereby applies to the County Auditor for a deduction pursuant to IC 6-1.1-12.1-5 beginning with the assessment date January 1, 20 ____.

County Township DLGF taxing district number Key number

Name of owner Legal description from Form 11

Property address (number and street, city, state, and ZIP code) Date of Form 11 (month, day, year)

Type of structure Use of structure

Governing body that approved ERA designation Date ERA designation approved (month, day, year) Resolution number

SECTION II - VERIFICATION OF OWNER OR REPRESENTATIVE

Signature of owner or representative (I hereby certify that the representations on this application are true.) Date signed (month, day, year)

Printed name of owner or representative Address (number and street, city, state, and ZIP code)

SECTION III - STRUCTURES AUDITOR'S USE

A. Rehabilitation structure 1. Assessed valuation AFTER rehabilitation $

2. Assessed valuation BEFORE rehabilitation $

3. Difference in assessed valuation (Line 1 minus Line 2) $

4. Assessed valuation eligible for deduction $

(for the increase in A/V from the rehabilitation, not including

the increase in A/V from the reassessment of the entire

structure)

B. New structure 1. Assessed valuation $

2. Assessed valuation eligible for deduction $

SECTION IV - VERIFICATION OF ASSESSING OFFICIAL

I verify that the above described structure was assessed and the owner was notified on _________________________________________, with the

effective date of the assessment being January 1, 20 _______, and that the assessed valuations in Section III are correct.

Signature of assessing official Printed name of assessing official Date (month, day, year)

Page 1 of 2