Enlarge image

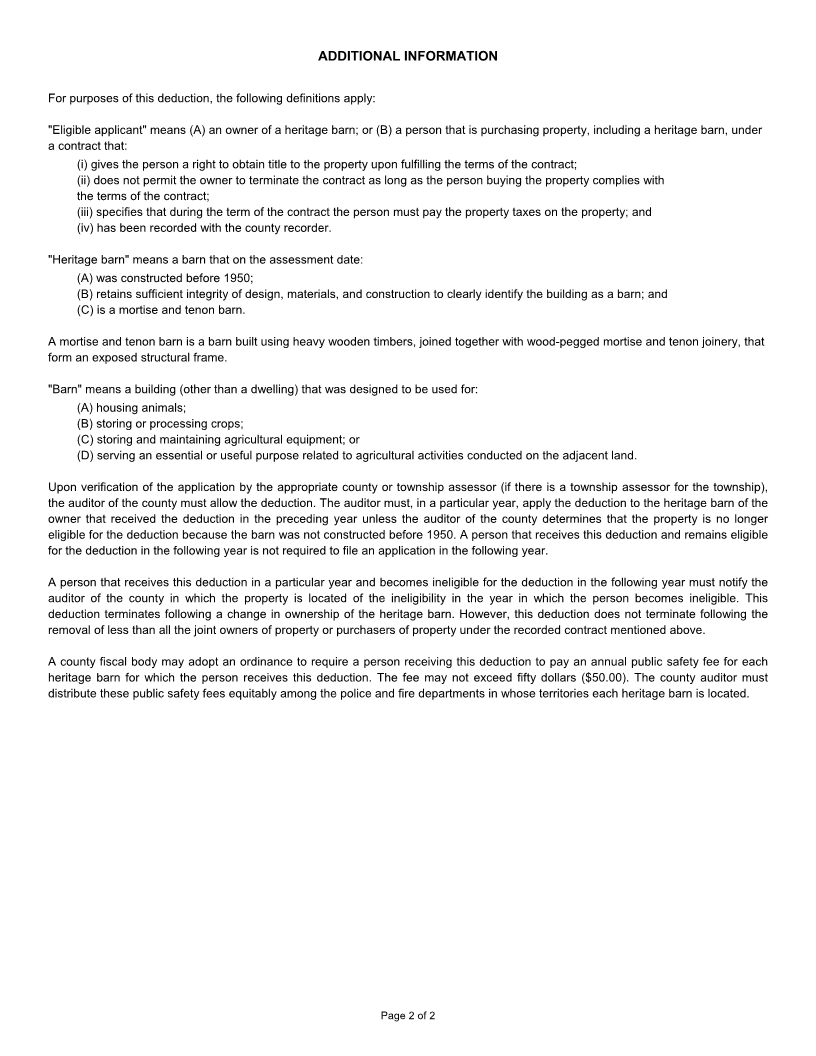

Reset Form

STATEMENT OF DEDUCTION OF ASSESSED VALUATION County

ATTRIBUTED TO HERITAGE BARN Township

State Form 55706 (R / 6-16)

Prescribed by the Department of Local Government Finance

Year

Pay

Indiana Code 6-1.1-12-26.2provides a property tax deduction for heritage barns. Specifically, an eligible applicant is entitled to a deduction against the

assessed value of the structure and foundation of a heritage barn beginning with assessments after 2014. The deduction is equal to 100% of the

assessed value of the structure and foundation of the heritage barn. See page 2 for additional information.

INSTRUCTIONS:An eligible applicant th tadesires to obtain the dedu tionc must cert fyiand file t ishdedu t onc iapplication thwithe auditor of the county in which the

heritage barn is located The. appli ationc may be filed in person or by mail If.mail dethe, mailin mustg be postmarked on or before the last day for filing. The

application must contain the information prescribed below.

FILING DEADLINE: The application must be completed and signed on or before December 31 of the year for which the deduction is sought and filed or

postmarked on or before January 5 of the following year.

CERTIFICATION STATEMENT

I, _________________________________________________ , certify that I own or am buying a property,ncludingi a heritage ba rn, under a

contract that (i) gives me a right to obtain title to the property upon fulfilling the terms of the contract;(ii) does not permi thet owner to terminate the

contract as long as I comply with the terms of the contract;(iii) specifies that during the term of the contrac Itmust pay the property taxes on the

property;and (iv) has been recorded with the county recorder.

I hereby certify that my statements onthis form are true correct, and, complete .

Signature Date (month, day, year)

PROPERTY DESCRIPTION

Address of barn(number and street,city,state and, ZIP code)

Township Legal description or key number Telephone number of applicant

( )

Address of applicant(number and street,city,state and, ZIP code)

On the assessment date for which this deduction would apply,the barn in question:

(A) wasconst uctr debefore 1950 ; Yes No

(B) retained sufficient int gritye o designf materi, ls a , a nd construction to cle rlya id ntifye the bu lding i s aba rna ; and Yes No

(C) was a mortise and tenon barn (see page 2 for a definition of this term). Yes No

FOR AUDITOR’S USE ONLY

Tax cycl toe which d duet onc iwould fir t pplys a Assessed value of the structure and foundation of heritage barn

20 Pay 0 2

VERIFICATION BY ASSESSING OFFICIAL

Is property recomm nde defor d duetion?c Recommended dedu tionc Was the barn constructed before 1950?

Yes No Yes No

Comments, fia ny

Signature of assessing official Date signed (month, day, year)

Printed name of assessing official

FINAL DETERMINATION OF COUNTY AUDITOR

Approved deduction(equal to 100% of the assessed value of the structure and foundation of the heritage barn Tax cycl toe which d duet onc iwould fir t pplys a

[does NOT include land]) 20 Pay 0 2

Signature of auditor Date signed (month, day, year)

Printed name of auditor

If applicable, reason for changing deduction amount recommended by assessing official

Has county fiscal body adopted an ordinance to require a person receiving this deduction to pay an annual public safety fee for each heritage barn for

which the person receives this deduction? The fee may not exceed fifty dollars ($50.00). Yes No

Distribution on date of filing: Original- county auditor; File-stamped copy- applicant; File-stamped copy- assessing official

Distribution on date that final determination is made: Original- county auditor; Copy- applicant; Copy- assessing official

Page 1 of 2