Enlarge image

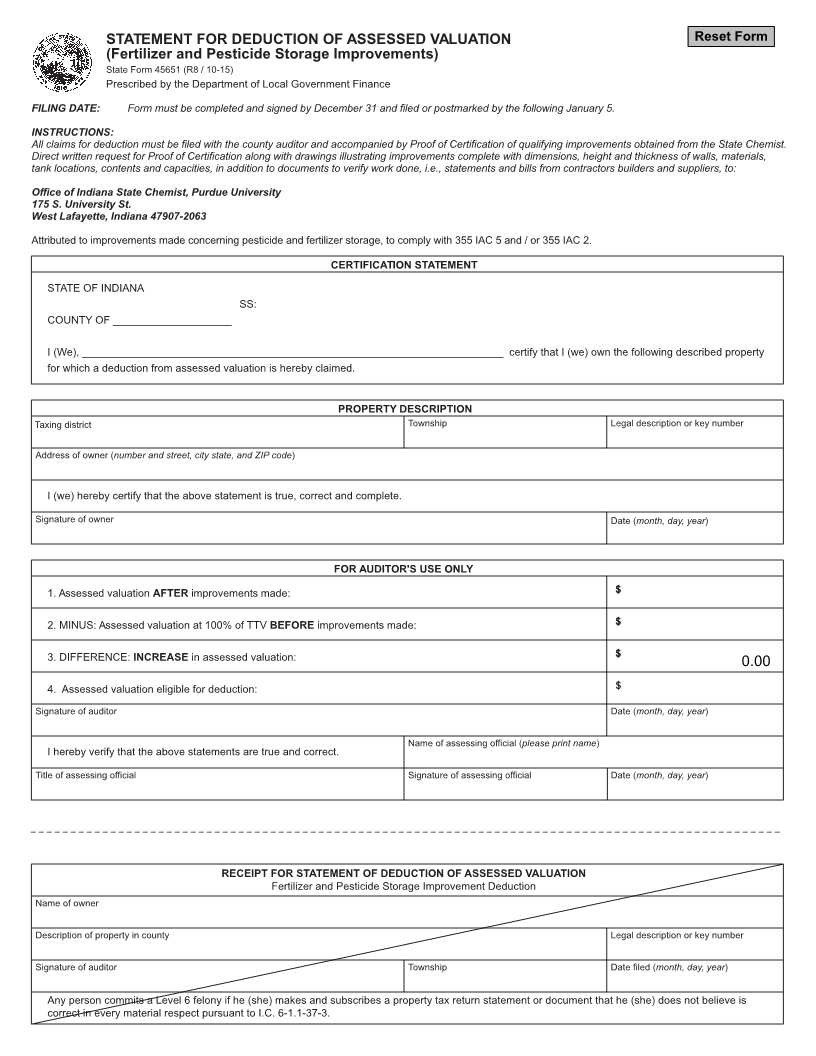

STATEMENT FOR DEDUCTION OF ASSESSED VALUATION Reset Form

(Fertilizer and Pesticide Storage Improvements)

State Form 45651 (R8 / 10-15)

Prescribed by the Department of Local Government Finance

FILING DATE: Form must be completed and signed by December 31 and filed or postmarked by the following January 5.

INSTRUCTIONS:

All claims for deduction must be filed with the county auditor and accompanied by Proof of Certification of qualifying improvements obtained from the State Chemist.

Direct written request for Proof of Certification along with drawings illustrating improvements complete with dimensions, height and thickness of walls, materials,

tank locations, contents and capacities, in addition to documents to verify work done, i.e., statements and bills from contractors builders and suppliers, to:

Office of Indiana State Chemist, Purdue University

175 S. University St.

West Lafayette, Indiana 47907-2063

Attributed to improvements made concerning pesticide and fertilizer storage, to comply with 355 IAC 5 and / or 355 IAC 2.

CERTIFICATION STATEMENT

STATE OF INDIANA

SS:

COUNTY OF ____________________

I (We), _______________________________________________________________________ certify that I (we) own the following described property

for which a deduction from assessed valuation is hereby claimed.

PROPERTY DESCRIPTION

Taxing district Township Legal description or key number

Address of owner (number and street, city state, and ZIP code)

I (we) hereby certify that the above statement is true, correct and complete.

Signature of owner Date (month, day, year)

FOR AUDITOR'S USE ONLY

1. Assessed valuation AFTER improvements made: $$

2. MINUS: Assessed valuation at 100% of TTV BEFORE improvements made: $$

3. DIFFERENCE: INCREASE in assessed valuation: $$

0.00

4. Assessed valuation eligible for deduction: $

Signature of auditor Date (month, day, year)

Name of assessing official (please print name)

I hereby verify that the above statements are true and correct.

Title of assessing official Signature of assessing official Date (month, day, year)

RECEIPT FOR STATEMENT OF DEDUCTION OF ASSESSED VALUATION

Fertilizer and Pesticide Storage Improvement Deduction

Name of owner

Description of property in county Legal description or key number

Signature of auditor Township Date filed (month, day, year)

Any person commits a Level 6 felony if he (she) makes and subscribes a property tax return statement or document that he (she) does not believe is

correct in every material respect pursuant to I.C. 6-1.1-37-3.