Enlarge image

Reset Form

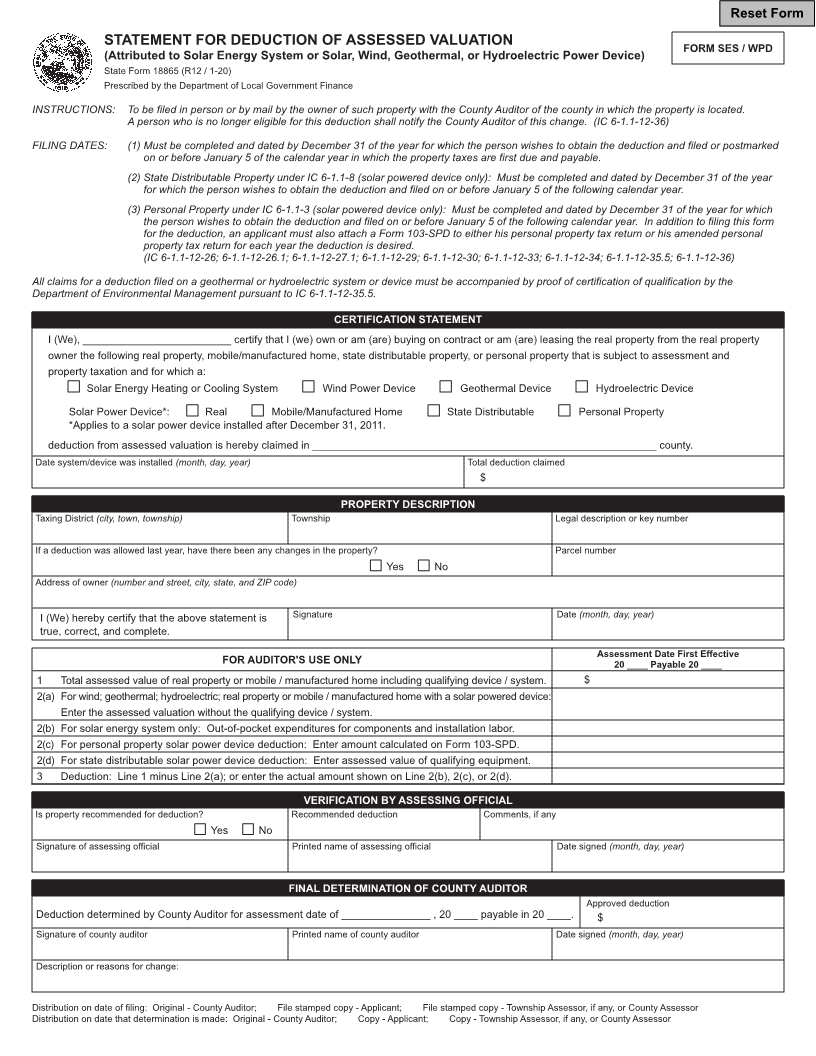

STATEMENT FOR DEDUCTION OF ASSESSED VALUATION FORM SES / WPD

(Attributed to Solar Energy System or Solar, Wind, Geothermal, or Hydroelectric Power Device)

State Form 18865 (R12 / 1-20)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: To be filed in person or by mail by the owner of such property with the County Auditor of the county in which the property is located.

A person who is no longer eligible for this deduction shall notify the County Auditor of this change. (IC 6-1.1-12-36)

FILING DATES: (1) Must be completed and dated by December 31 of the year for which the person wishes to obtain the deduction and filed or postmarked

on or before January 5 of the calendar year in which the property taxes are first due and payable.

(2) State Distributable Property under IC 6-1.1-8 (solar powered device only): Must be completed and dated by December 31 of the year

for which the person wishes to obtain the deduction and filed on or before January 5 of the following calendar year.

(3) Personal Property under IC 6-1.1-3 (solar powered device only): Must be completed and dated by December 31 of the year for which

the person wishes to obtain the deduction and filed on or before January 5 of the following calendar year. In addition to filing this form

for the deduction, an applicant must also attach a Form 103-SPD to either his personal property tax return or his amended personal

property tax return for each year the deduction is desired.

(IC 6-1.1-12-26; 6-1.1-12-26.1; 6-1.1-12-27.1; 6-1.1-12-29; 6-1.1-12-30; 6-1.1-12-33; 6-1.1-12-34; 6-1.1-12-35.5; 6-1.1-12-36)

All claims for a deduction filed on a geothermal or hydroelectric system or device must be accompanied by proof of certification of qualification by the

Department of Environmental Management pursuant to IC 6-1.1-12-35.5.

CERTIFICATION STATEMENT

I (We), _________________________ certify that I (we) own or am (are) buying on contract or am (are) leasing the real property from the real property

owner the following real property, mobile/manufactured home, state distributable property, or personal property that is subject to assessment and

property taxation and for which a:

Solar Energy Heating or Cooling System Wind Power Device Geothermal Device Hydroelectric Device

Solar Power Device*: Real Mobile/Manufactured Home State Distributable Personal Property

*Applies to a solar power device installed after December 31, 2011.

deduction from assessed valuation is hereby claimed in __________________________________________________________ county.

Date system/device was installed (month, day, year) Total deduction claimed

$

PROPERTY DESCRIPTION

Taxing District (city, town, township) Township Legal description or key number

If a deduction was allowed last year, have there been any changes in the property? Parcel number

Yes No

Address of owner (number and street, city, state, and ZIP code)

I (We) hereby certify that the above statement is Signature Date (month, day, year)

true, correct, and complete.

Assessment Date First Effective

FOR AUDITOR'S USE ONLY 20 ____ Payable 20 ____

1 Total assessed value of real property or mobile / manufactured home including qualifying device / system. $

2(a) For wind; geothermal; hydroelectric; real property or mobile / manufactured home with a solar powered device:

Enter the assessed valuation without the qualifying device / system.

2(b) For solar energy system only: Out-of-pocket expenditures for components and installation labor.

2(c) For personal property solar power device deduction: Enter amount calculated on Form 103-SPD.

2(d) For state distributable solar power device deduction: Enter assessed value of qualifying equipment.

3 Deduction: Line 1 minus Line 2(a); or enter the actual amount shown on Line 2(b), 2(c), or 2(d).

VERIFICATION BY ASSESSING OFFICIAL

Is property recommended for deduction? Recommended deduction Comments, if any

Yes No

Signature of assessing official Printed name of assessing official Date signed (month, day, year)

FINAL DETERMINATION OF COUNTY AUDITOR

Approved deduction

Deduction determined by County Auditor for assessment date of _______________ , 20 ____ payable in 20 ____. $

Signature of county auditor Printed name of county auditor Date signed (month, day, year)

Description or reasons for change:

Distribution on date of filing: Original - County Auditor; File stamped copy - Applicant; File stamped copy - Township Assessor, if any, or County Assessor

Distribution on date that determination is made: Original - County Auditor; Copy - Applicant; Copy - Township Assessor, if any, or County Assessor