Enlarge image

Reset Form

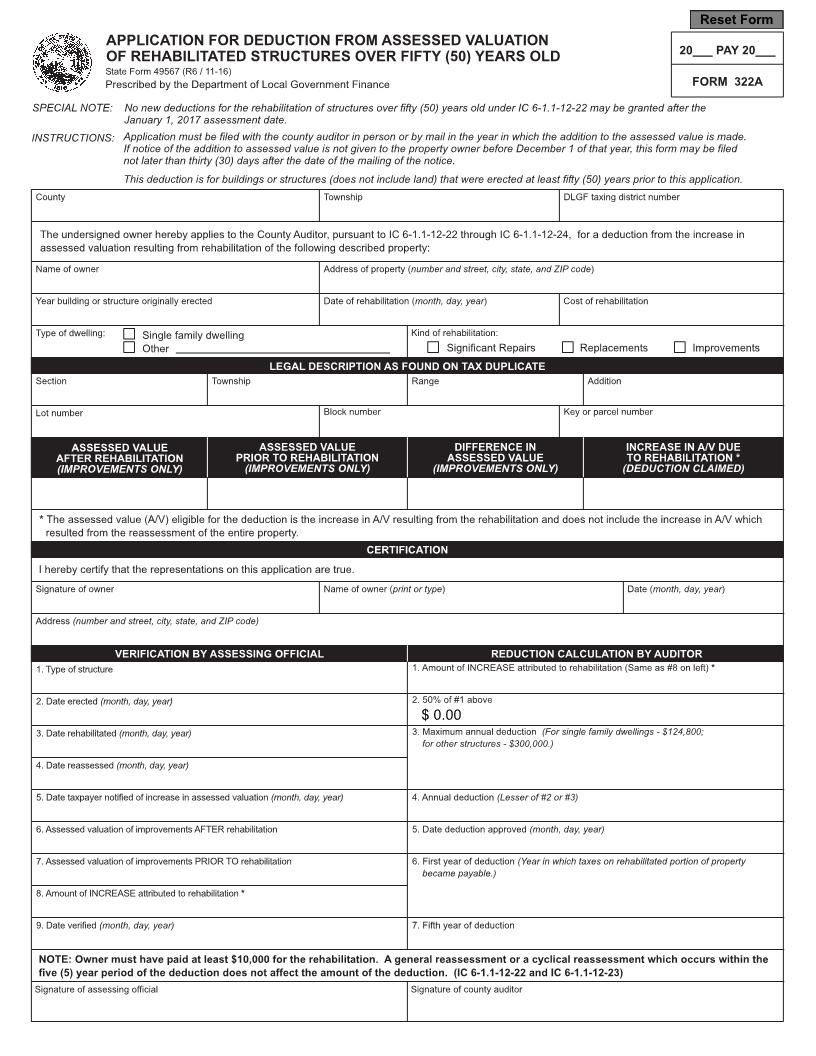

APPLICATION FOR DEDUCTION FROM ASSESSED VALUATION

20___ PAY 20___

OF REHABILITATED STRUCTURES OVER FIFTY (50) YEARS OLD

State Form 49567 (R6 / 11-16)

Prescribed by the Department of Local Government Finance FORM 322A

SPECIAL NOTE: No new deductions for the rehabilitation of structures over fifty (50) years old under IC 6-1.1-12-22 may be granted after the

January 1, 2017 assessment date.

INSTRUCTIONS: Application must be filed with the county auditor in person or by mail in the year in which the addition to the assessed value is made.

If notice of the addition to assessed value is not given to the property owner before December 1 of that year, this form may be filed

not later than thirty (30) days after the date of the mailing of the notice.

This deduction is for buildings or structures (does not include land) that were erected at least fifty (50) years prior to this application.

County Township DLGF taxing district number

The undersigned owner hereby applies to the County Auditor, pursuant to IC 6-1.1-12-22 through IC 6-1.1-12-24, for a deduction from the increase in

assessed valuation resulting from rehabilitation of the following described property:

Name of owner Address of property (number and street, city, state, and ZIP code)

Year building or structure originally erected Date of rehabilitation (month, day, year) Cost of rehabilitation

Type of dwelling: Single family dwelling Kind of rehabilitation:

Other Significant Repairs Replacements Improvements

LEGAL DESCRIPTION AS FOUND ON TAX DUPLICATE

Section Township Range Addition

Lot number Block number Key or parcel number

ASSESSED VALUE ASSESSED VALUE DIFFERENCE IN INCREASE IN A/V DUE

AFTER REHABILITATION PRIOR TO REHABILITATION ASSESSED VALUE TO REHABILITATION *

(IMPROVEMENTS ONLY) (IMPROVEMENTS ONLY) (IMPROVEMENTS ONLY) (DEDUCTION CLAIMED)

* The assessed value (A/V) eligible for the deduction is the increase in A/V resulting from the rehabilitation and does not include the increase in A/V which

resulted from the reassessment of the entire property.

CERTIFICATION

I hereby certify that the representations on this application are true.

Signature of owner Name of owner (print or type) Date (month, day, year)

Address (number and street, city, state, and ZIP code)

VERIFICATION BY ASSESSING OFFICIAL REDUCTION CALCULATION BY AUDITOR

1. Type of structure 1. Amount of INCREASE attributed to rehabilitation (Same as #8 on left) *

2. Date erected (month, day, year) 2. 50% of #1 above

$ 0.00

3. Date rehabilitated (month, day, year) 3. Maximum annual deduction (For single family dwellings - $124,800;

for other structures - $300,000.)

4. Date reassessed (month, day, year)

5. Date taxpayer notified of increase in assessed valuation (month, day, year) 4. Annual deduction (Lesser of #2 or #3)

6. Assessed valuation of improvements AFTER rehabilitation 5. Date deduction approved (month, day, year)

7. Assessed valuation of improvements PRIOR TO rehabilitation 6. First year of deduction (Year in which taxes on rehabilitated portion of property

became payable.)

8. Amount of INCREASE attributed to rehabilitation *

9. Date verified (month, day, year) 7. Fifth year of deduction

NOTE: Owner must have paid at least $10,000 for the rehabilitation. A general reassessment or a cyclical reassessment which occurs within the

five (5) year period of the deduction does not affect the amount of the deduction. (IC 6-1.1-12-22 and IC 6-1.1-12-23)

Signature of assessing official Signature of county auditor