Enlarge image

Reset Form

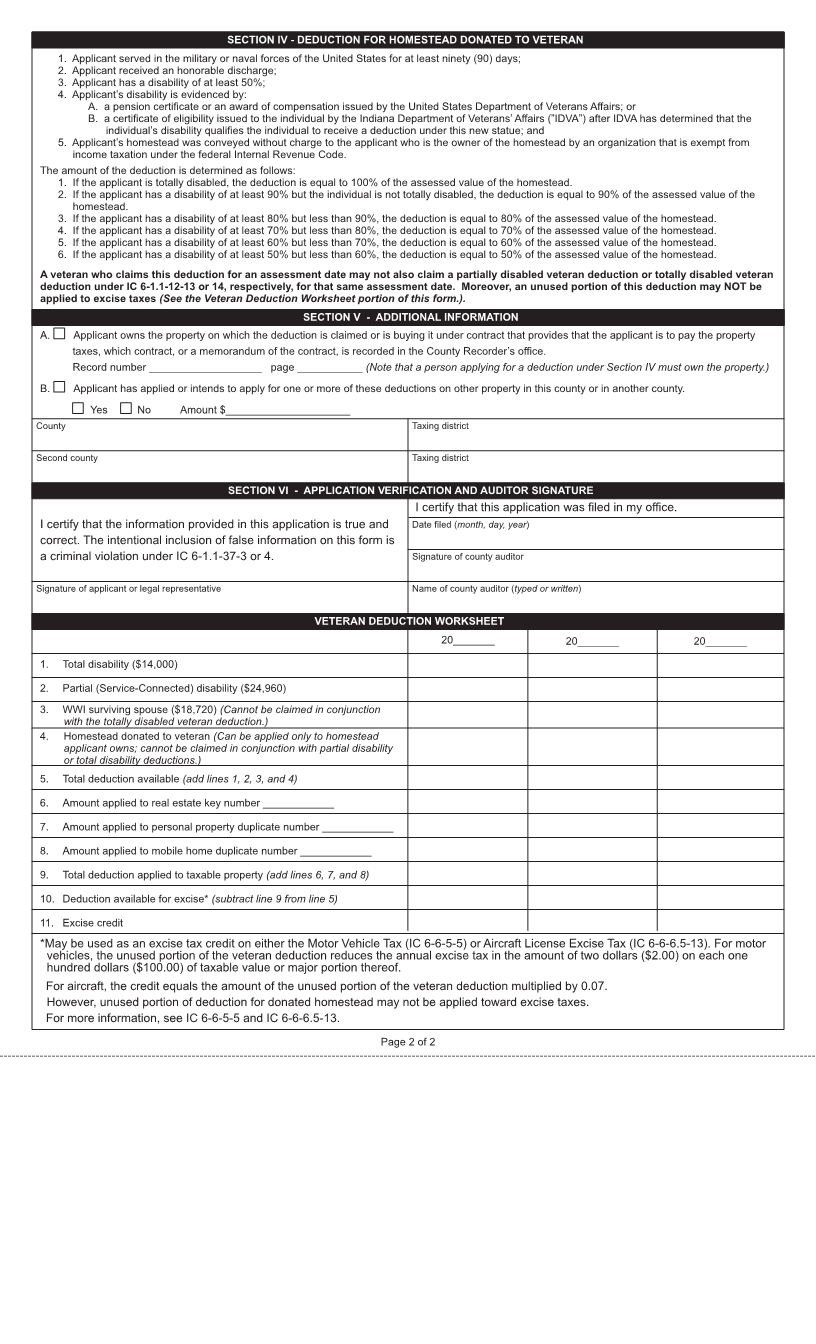

APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS

AND SURVIVING SPOUSES OF CERTAIN VETERANS

State Form 12662 (R17 / 1-20)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: Please check appropriate box(es) pertaining to tax deduction. (More than one (1) box may be checked; however, a surviving spouse who

receives a deduction under Section III may not receive a deduction under Section II.)

FILING DATES:

FORM MUST BE COMPLETED AND SIGNED BY DECEMBER 31 AND FILED OR POSTMARKED BY THE FOLLOWING JANUARY 5 OF THE CALENDAR

YEAR IN WHICH THE PROPERTY TAXES ARE FIRST DUE AND PAYABLE.

FILE WITH THE COUNTY AUDITOR OF THE COUNTY WHERE THE PROPERTY IS LOCATED.

I Totally disabled veteran (or veteran at least age 62 with at least 10% disability) or surviving spouse - Not to exceed $14,000

Complete sections I, V and VI. (IC 6-1.1-12-14)

II Partially service-connected disabled veteran or surviving spouse - Not to exceed $24,960

Complete sections II, V and VI. (IC 6-1.1-12-13)

III Surviving spouse of World War I Veteran - Not to exceed $18,720

Complete sections III, V, and VI. (IC 6-1.1-12-16)

IV Deduction for homestead donated to veteran

Complete Sections IV, V, and VI. (IC 6-1.1-12-14.5)

APPLICANT

Name of applicant (first, middle, last) Date of birth (month, day, year)

Address (number and street, city, state, and ZIP code) County

Applicant ( does does not) own property with another individual(s) besides spouse and/or another veteran.

This application is made for the purpose of obtaining $____________________ deduction from the assessed valuation of the following described taxable

property for the year 20______. (If applicant desires that deduction be split among additional properties, list those properties on additional sheet and attach

it to this application.)

Taxing District (city, town, township) Is the property in question: Parcel or Key number

Real Property Mobile Home (IC 6-1.1-7)

SECTION I - TOTAL DISABILITY OR AT LEAST AGE 62 WITH AT LEAST 10% DISABILITY

A. Applicant was a member of the U.S. Armed Forces for at least ninety (90) days (not necessarily during war time).

B. Applicant was honorably discharged.

C. Applicant is: Totally disabled; or

At least age 62 with at least 10% disability

D. Applicant’s disability is evidenced by: Certificate of eligibility from the Indiana Department of Veterans Affairs;

Pension certificate;

Award of compensation from Veterans Administration or Department of Defense; or

Veterans Administration Form 20-5455 “Tax Abatement Certificate”

E. The assessed value of the applicant’s Indiana real property, Indiana mobile home not assessed as real property, and Indiana manufactured home not

assessed as real property does not exceed $200,000. Deductions claimed $____________________________.

F. Applicant is the surviving spouse of an individual who: (1) would have qualified for the deduction under this section when he or she was alive; or (2) was

killed in action, died while serving on active duty, or died while performing inactive duty training. (Age of deceased veteran on date of death __________)

SECTION II - PARTIAL DISABILITY (SERVICE-CONNECTED DISABILITY)

A. Applicant was a member of the U.S. Armed Forces during any of its wars.

B. Applicant was honorably discharged.

C. Applicant has a service connected disability of at least 10%

D. Applicant’s disability is evidenced by: Certificate of eligibility from the Indiana Department of Veterans Affairs;

Pension certificate;

Award of compensation from Veterans Administration or Department of Defense; or

Veterans Administration Form 20-5455 “Tax Abatement Certificate”

E. Applicant is the surviving spouse of an individual who would have qualified for the deduction under this section when he or she was alive.

(Age of deceased veteran on date of death___________________)

SECTION III - SURVIVING SPOUSE OF A WORLD WAR I VETERAN

A. Applicant is the surviving spouse of an individual who served in the U.S. Armed Forces before November 12, 1918.

B. The service of the deceased spouse is evidenced by: Letter from the Veterans Administration or the Department of Defense; or

Honorable discharge documents

C. The deceased spouse received an honorable discharge.

A person may not claim this deduction in conjunction with the partially disabled veteran deduction.

SECTIONS IV, V, AND VI ARE ON REVERSE SIDE.

Page 1 of 2

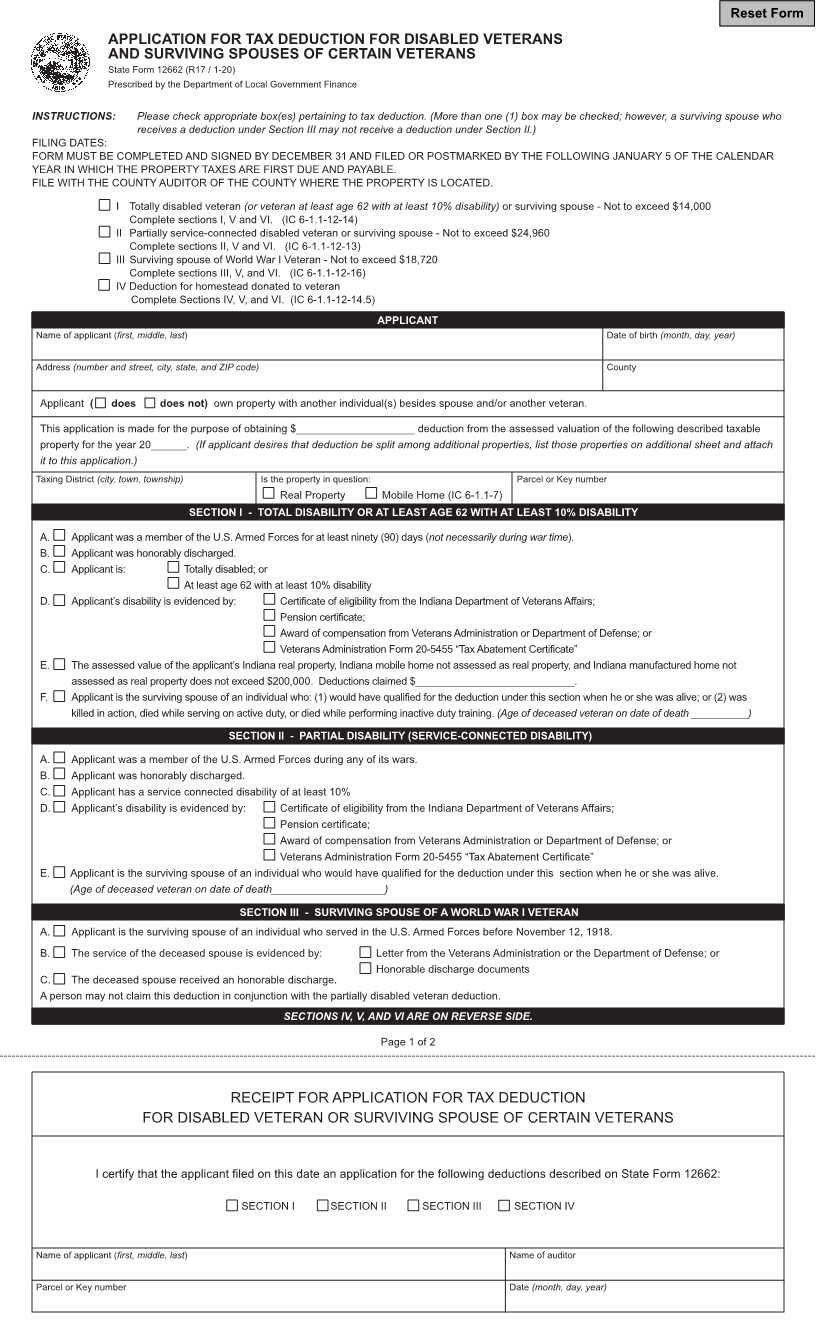

RECEIPT FOR APPLICATION FOR TAX DEDUCTION

FOR DISABLED VETERAN OR SURVIVING SPOUSE OF CERTAIN VETERANS

I certify that the applicant filed on this date an application for the following deductions described on State Form 12662:

SECTION I SECTION II SECTION III SECTION IV

Name of applicant (first, middle, last) Name of auditor

Parcel or Key number Date (month, day, year)