Enlarge image

Reset Form

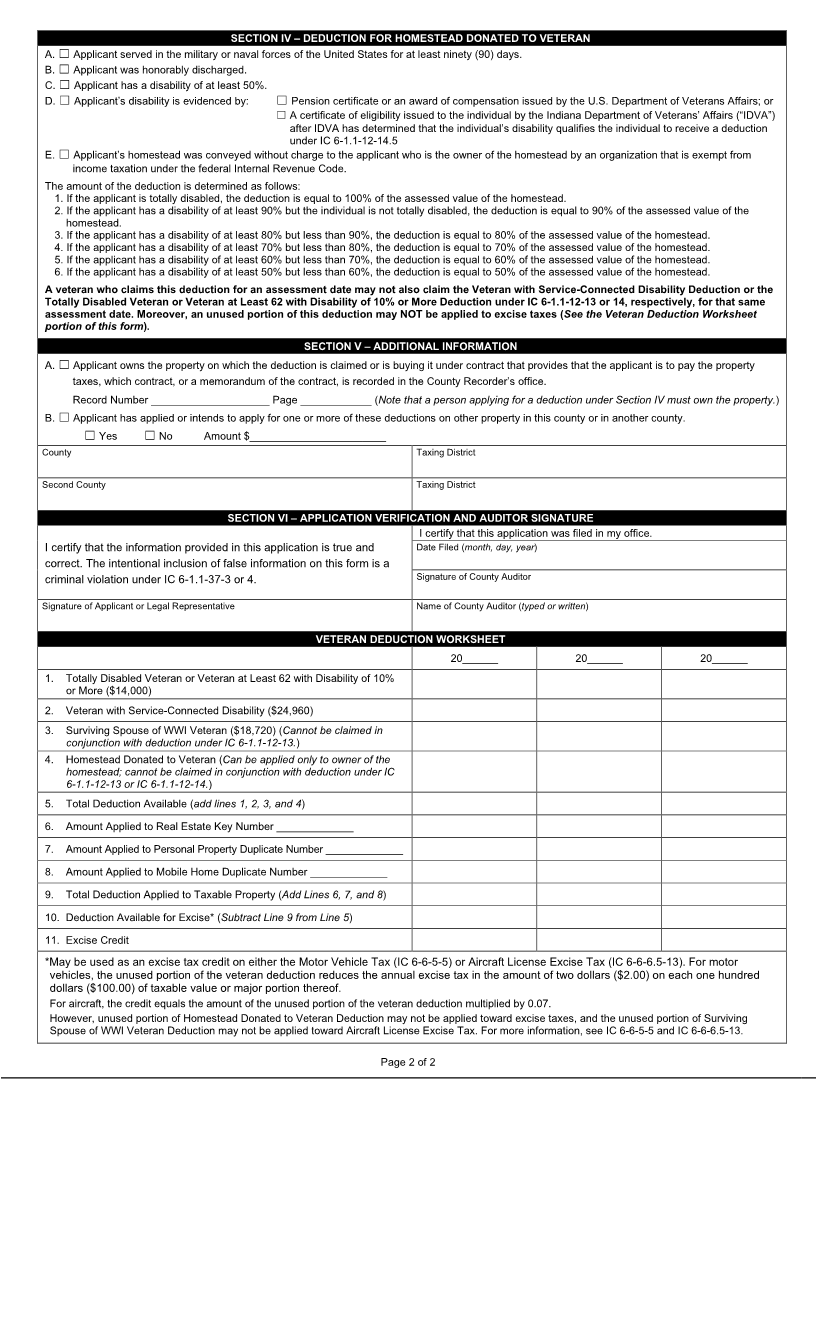

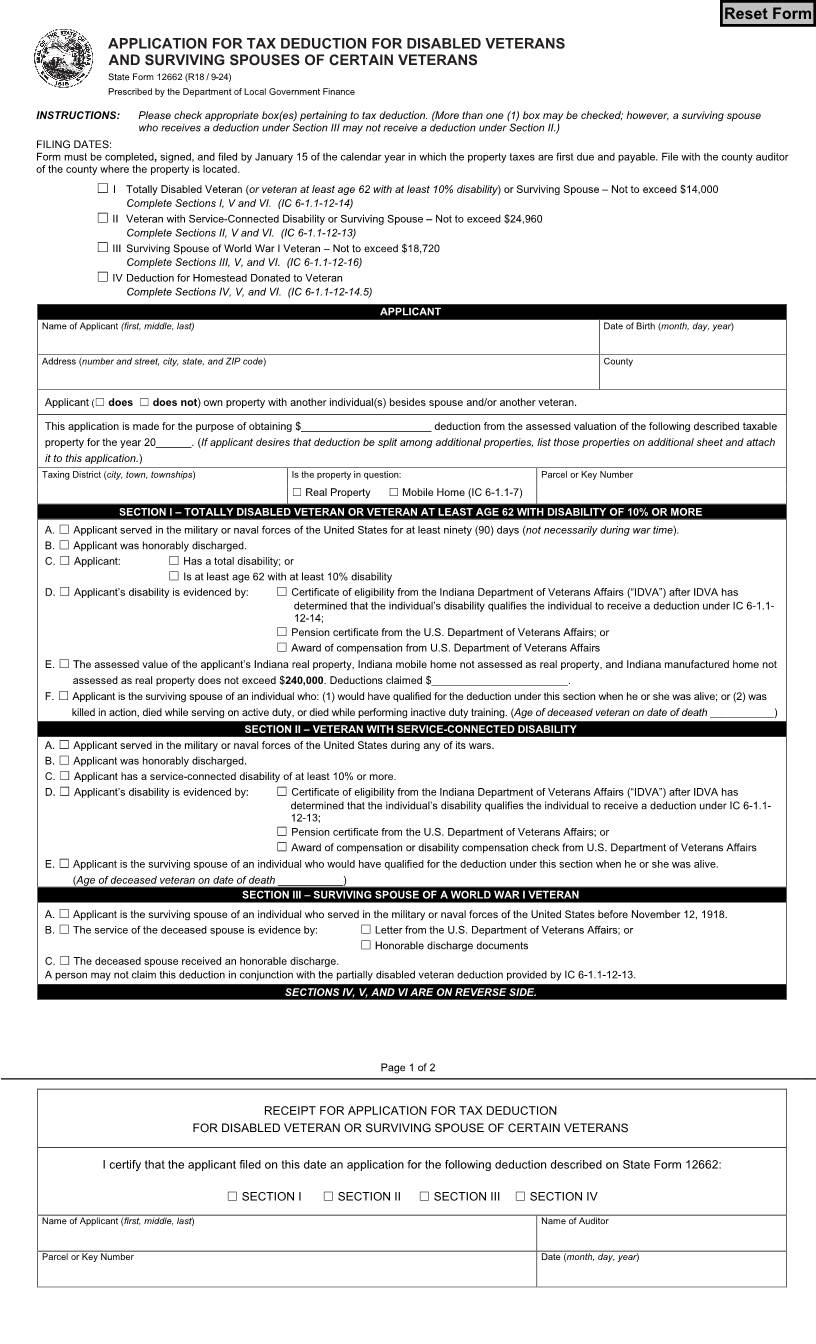

APPLICATION FOR TAX DEDUCTION FOR DISABLED VETERANS

AND SURVIVING SPOUSES OF CERTAIN VETERANS

State Form 12662 (R18 / 9-24)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: Please check appropriate box(es) pertaining to tax deduction. (More than one (1) box may be checked; however, a surviving spouse

who receives a deduction under Section III may not receive a deduction under Section II.)

FILING DATES:

Form must be completed , signed, and filed by January 15 of the calendar year in which the property taxes are first due and payable. File with the county auditor

of the county where the property is located.

☐ I Totally Disabled Veteran (or veteran at least age 62 with at least 10% disability) or Surviving Spouse – Not to exceed $14,000

Complete Sections I, V and VI. (IC 6-1.1-12-14)

☐ II Veteran with Service-Connected Disability or Surviving Spouse – Not to exceed $24,960

Complete Sections II, V and VI. (IC 6-1.1-12-13)

☐ III Surviving Spouse of World War I Veteran – Not to exceed $18,720

Complete Sections III, V, and VI. (IC 6-1.1-12-16)

☐ IV Deduction for Homestead Donated to Veteran

Complete Sections IV, V, and VI. (IC 6-1.1-12-14.5)

APPLICANT

Name of Applicant (first, middle, last) Date of Birth (month, day, year)

Address (number and street, city, state, and ZIP code) County

Applicant (☐ does ☐ does not) own property with another individual(s) besides spouse and/or another veteran.

This application is made for the purpose of obtaining $______________________ deduction from the assessed valuation of the following described taxable

property for the year 20______. (If applicant desires that deduction be split among additional properties, list those properties on additional sheet and attach

it to this application.)

Taxing District (city, town, townships) Is the property in question: Parcel or Key Number

☐ Real Property ☐ Mobile Home (IC 6-1.1-7)

SECTION I – TOTALLY DISABLED VETERAN OR VETERAN AT LEAST AGE 62 WITH DISABILITY OF 10% OR MORE

A. ☐ Applicant served in the military or naval forces of the United States for at least ninety (90) days (not necessarily during war time).

B. ☐ Applicant was honorably discharged.

C. ☐ Applicant: ☐ Has a total disability; or

☐ Is at least age 62 with at least 10% disability

D. ☐ Applicant’s disability is evidenced by: ☐ Certificate of eligibility from the Indiana Department of Veterans Affairs (“IDVA”) after IDVA has

determined that the individual’s disability qualifies the individual to receive a deduction under IC 6-1.1-

12-14;

☐ Pension certificate from the U.S. Department of Veterans Affairs; or

☐ Award of compensation from U.S. Department of Veterans Affairs

E. ☐ The assessed value of the applicant’s Indiana real property, Indiana mobile home not assessed as real property, and Indiana manufactured home not

assessed as real property does not exceed $240,000. Deductions claimed $_______________________.

F. ☐ Applicant is the surviving spouse of an individual who: (1) would have qualified for the deduction under this section when he or she was alive; or (2) was

killed in action, died while serving on active duty, or died while performing inactive duty training. (Age of deceased veteran on date of death ___________)

SECTION II – VETERAN WITH SERVICE-CONNECTED DISABILITY

A. ☐ Applicant served in the military or naval forces of the United States during any of its wars.

B. ☐ Applicant was honorably discharged.

C. ☐ Applicant has a service-connected disability of at least 10% or more.

D. ☐ Applicant’s disability is evidenced by: ☐ Certificate of eligibility from the Indiana Department of Veterans Affairs (“IDVA”) after IDVA has

determined that the individual’s disability qualifies the individual to receive a deduction under IC 6-1.1-

12-13;

☐ Pension certificate from the U.S. Department of Veterans Affairs; or

☐ Award of compensation or disability compensation check from U.S. Department of Veterans Affairs

E. ☐ Applicant is the surviving spouse of an individual who would have qualified for the deduction under this section when he or she was alive.

(Age of deceased veteran on date of death ___________)

SECTION III – SURVIVING SPOUSE OF A WORLD WAR I VETERAN

A. ☐ Applicant is the surviving spouse of an individual who served in the military or naval forces of the United States before November 12, 1918.

B. ☐ The service of the deceased spouse is evidence by: ☐ Letter from the U.S. Department of Veterans Affairs; or

☐ Honorable discharge documents

C. ☐ The deceased spouse received an honorable discharge.

A person may not claim this deduction in conjunction with the partially disabled veteran deduction provided by IC 6-1.1-12-13.

SECTIONS IV, V, AND VI ARE ON REVERSE SIDE.

Page 1 of 2

RECEIPT FOR APPLICATION FOR TAX DEDUCTION

FOR DISABLED VETERAN OR SURVIVING SPOUSE OF CERTAIN VETERANS

I certify that the applicant filed on this date an application for the following deduction described on State Form 12662:

☐ SECTION I ☐ SECTION II ☐ SECTION III ☐ SECTION IV

Name of Applicant (first, middle, last) Name of Auditor

Parcel or Key Number Date (month, day, year)