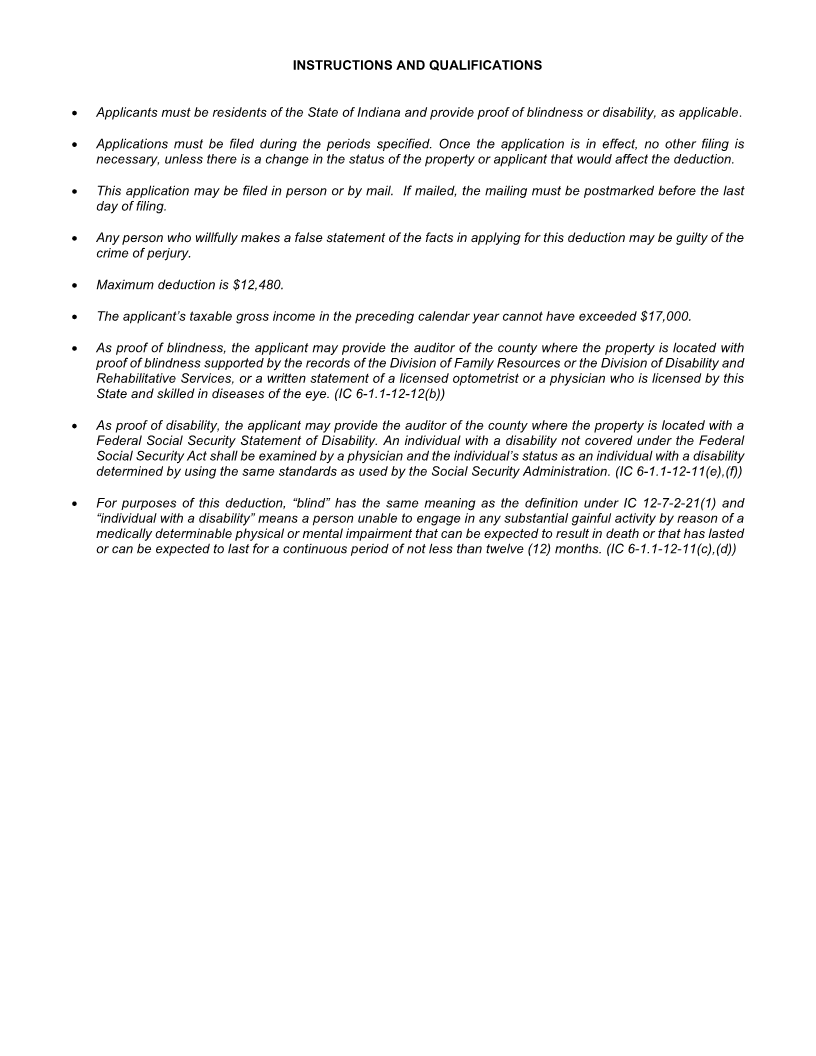

Enlarge image

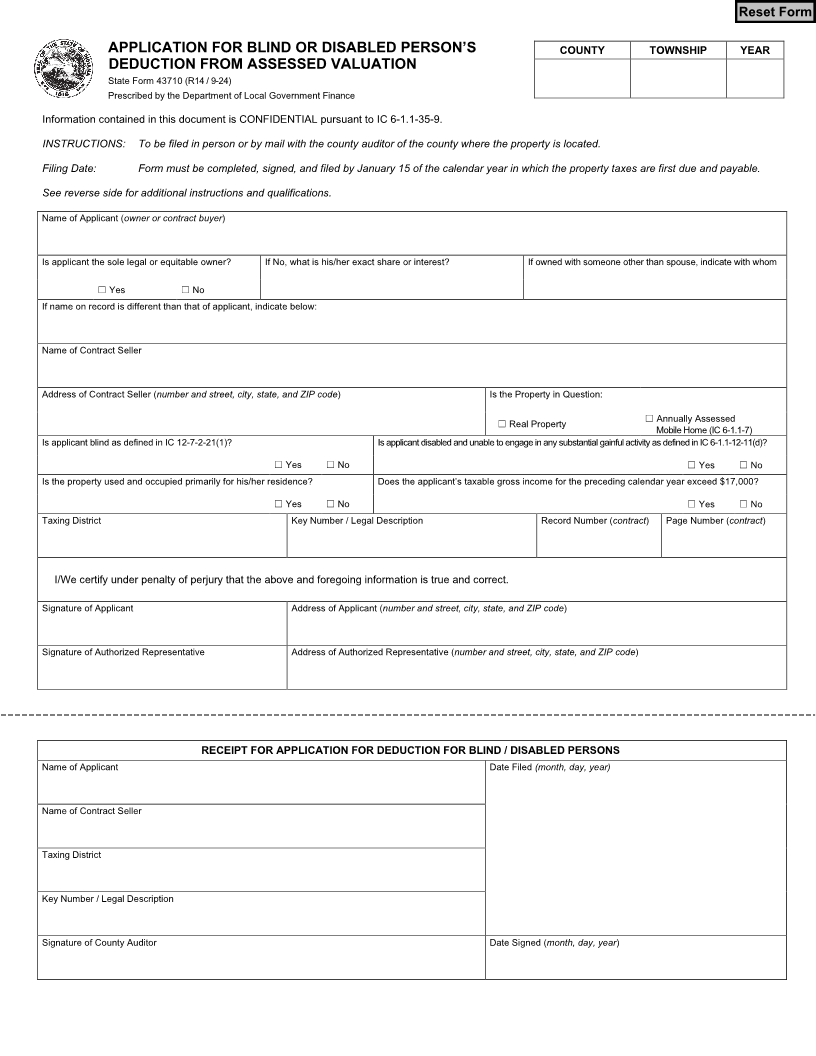

Reset Form

APPLICATION FOR BLIND OR DISABLED PERSON’S COUNTY TOWNSHIP YEAR

DEDUCTION FROM ASSESSED VALUATION

State Form 43710 (R14 / 9-24)

Prescribed by the Department of Local Government Finance

Information contained in this document is CONFIDENTIAL pursuant to IC 6-1.1-35-9.

INSTRUCTIONS: To be filed in person or by mail with the county auditor of the county where the property is located.

Filing Date: Form must be completed, signed, and filed by January 15 of the calendar year in which the property taxes are first due and payable.

See reverse side for additional instructions and qualifications.

Name of Applicant (owner or contract buyer)

Is applicant the sole legal or equitable owner? If No, what is his/her exact share or interest? If owned with someone other than spouse, indicate with whom

☐ Yes ☐ No

If name on record is different than that of applicant, indicate below:

Name of Contract Seller

Address of Contract Seller (number and street, city, state, and ZIP code ) Is the Property in Question:

☐

☐ Real Property Annually Assessed

Mobile Home (IC 6-1.1-7)

Is applicant blind as defined in IC 12-7-2-21(1)? Is applicant disabled and unable to engage in any substantial gainful activity as defined in IC 6-1.1-12-11(d)?

☐ Yes ☐ No ☐ Yes ☐ No

Is the property used and occupied primarily for his/her residence? Does the applicant’s taxable gross income for the preceding calendar year exceed $17,000?

☐ Yes ☐ No ☐ Yes ☐ No

Taxing District Key Number / Legal Description Record Number (contract) Page Number (contract)

I/We certify under penalty of perjury that the above and foregoing information is true and correct.

Signature of Applicant Address of Applicant (number and street, city, state, and ZIP code)

Signature of Authorized Representative Address of Authorized Representative (number and street, city, state, and ZIP code)

RECEIPT FOR APPLICATION FOR DEDUCTION FOR BLIND / DISABLED PERSONS

Name of Applicant Date Filed (month, day, year)

Name of Contract Seller

Taxing District

Key Number / Legal Description

Signature of County Auditor Date Signed (month, day, year)