Enlarge image

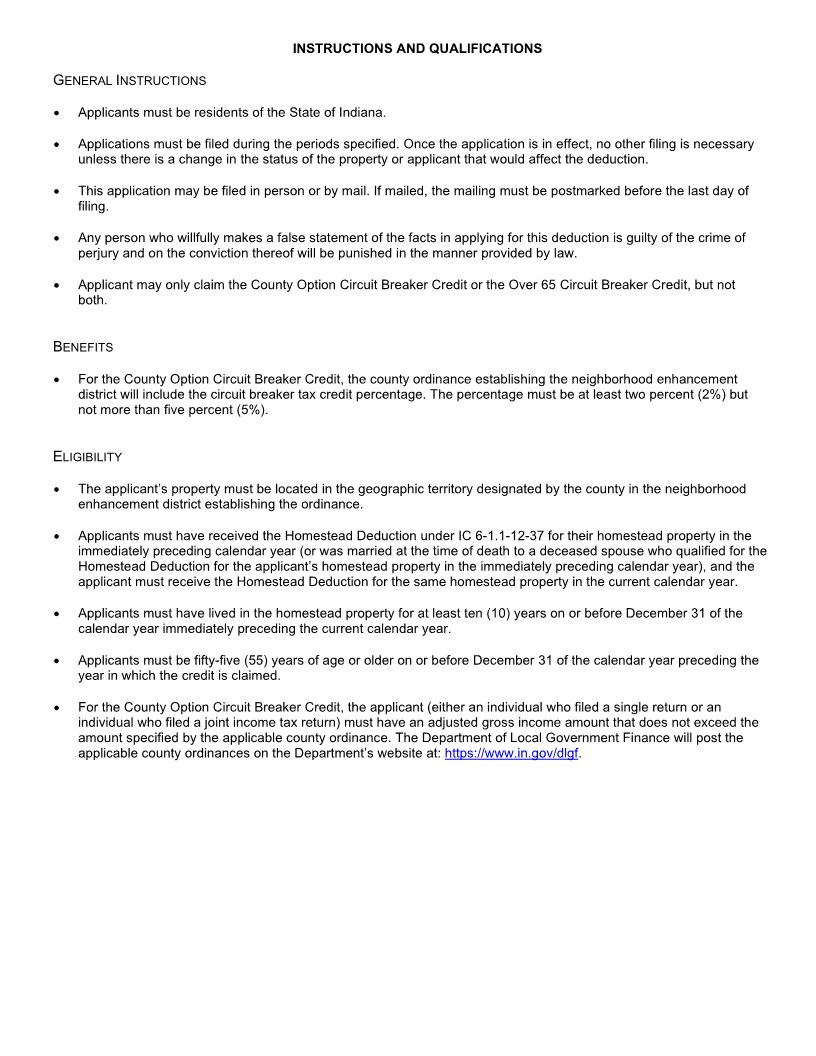

APPLICATION FOR COUNTY OPTION FOR COUNTY USE ONLY

CIRCUIT BREAKER CREDIT ORDINANCE # COUNTY TOWNSHIP YEAR

State Form 57323 (R / 10-23)

Prescribed by the Department of Local Government Finance

Information contained in this document is CONFIDENTIAL pursuant to IC 6-1.1-35-9.

INSTRUCTIONS: To be filed in person or by mail with the county auditor of the county where the property is located.

Filing Date: Form must be completed and signed by December 31 and filed with the county auditor or postmarked by the following

January 5 of the calendar year in which the property taxes are first due and payable.

See the reverse side for additional instructions and qualifications.

Name of Applicant Telephone Number Email Address

( )

If Name on Record is Different than Applicant, Indicate Below

Did Applicant Receive the Homestead Deduction in the Immediately Preceding Year? Will Applicant Receive the Homestead Deduction this Year?

☐ Yes ☐ No ☐ Yes ☐ No

Address of Homestead Property (number and street, city, state, and ZIP code) Parcel Number

Taxing District Key Number / Legal Description Is the Property:

☐ Real Property ☐ Mobile Home

Has Applicant Resided in the Homestead for Ten (10) Years or More? Date Applicant Started Residing at the Homestead

☐ Yes ☐ No

Is the Applicant Fifty Five (55) Years of Age or Older on December 31 of the Year Prior to the Year the Credit is Being Claimed? Applicant’s Date of Birth (month, day, year)

☐ Yes ☐ No

Source of Income Amount of Income

Adjusted Gross Income (AGI) of applicant, applicant and spouse, or applicant and $

joint tenants or tenants in common, as applicable (For County Option Circuit Breaker

Credit, AGI may not exceed: (1) the amount identified in the ordinance adopted by the $

county for individuals who filed a single return; or (2) the amount identified in the ordinance

adopted by the county for individuals who filed a joint return.

$

See reverse for details.

TOTAL $

Have You Filed for the Over 65 Circuit Breaker Credit? If Yes, What County?

☐ Yes ☐ No

Have You Filed for Deduction in Any Other County? If Yes, What County?

☐ Yes ☐ No

I/We certify under penalty of perjury that the above and the foregoing information is true and correct.

Signature of Applicant Date (month, day, year)

Address of Applicant (number and street, city, state, and ZIP code)

Signature of Authorized Representative Date (month, day, year)

Address of Authorized Representative (number and street, city, state, and ZIP code)

Signature of County Auditor Date (month, day, year)

DISTRIBUTION: Original – County Auditor; File-Stamped Copy – Taxpayer