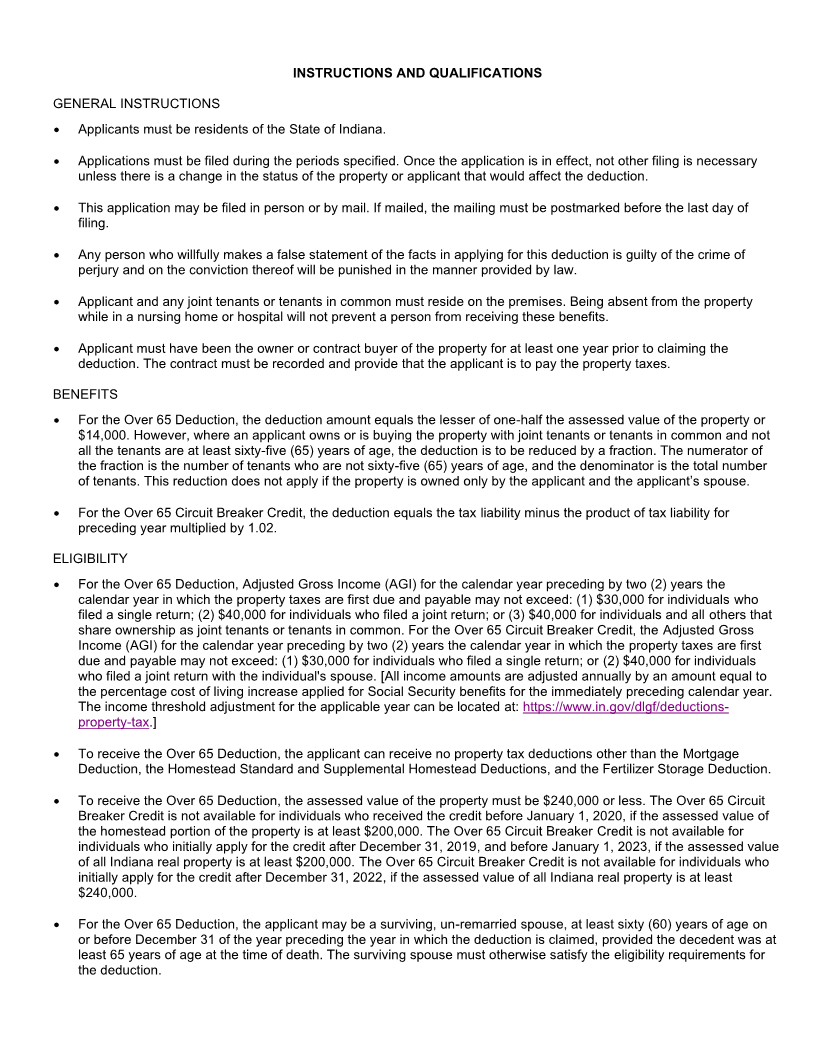

Enlarge image

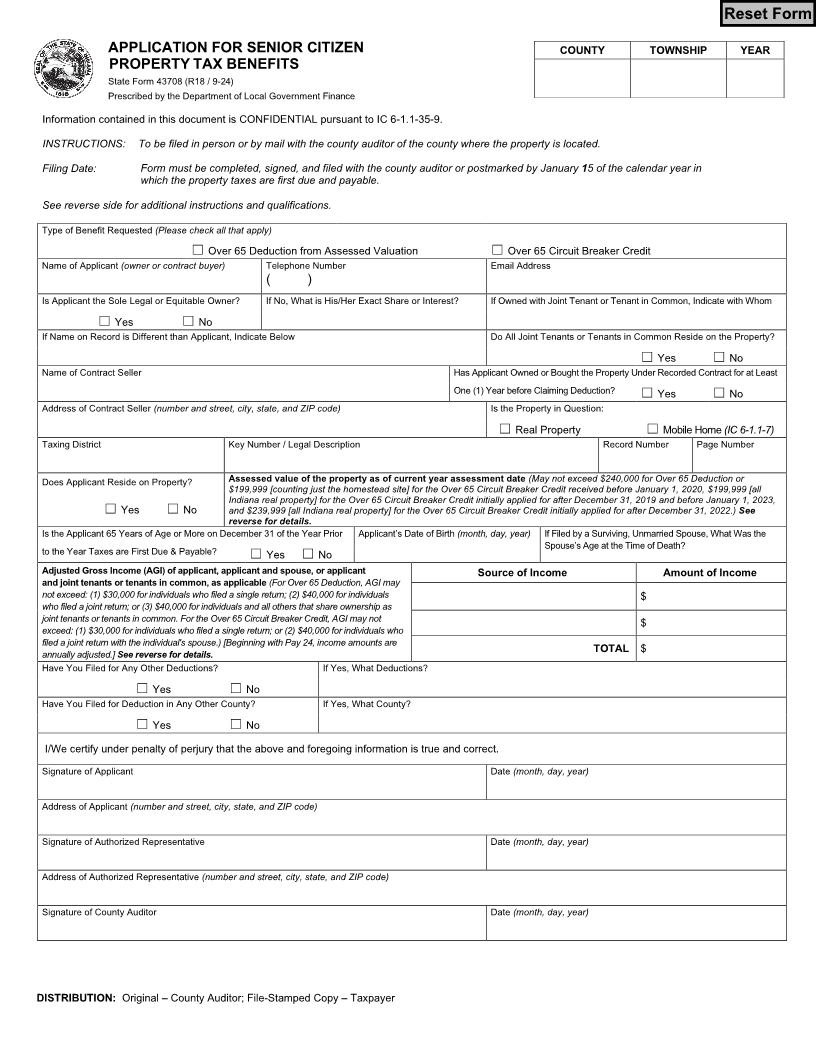

Reset Form

APPLICATION FOR SENIOR CITIZEN COUNTY TOWNSHIP YEAR

PROPERTY TAX BENEFITS

State Form 43708 (R18 / 9-24)

Prescribed by the Department of Local Government Finance

Information contained in this document is CONFIDENTIAL pursuant to IC 6-1.1-35-9.

INSTRUCTIONS: To be filed in person or by mail with the county auditor of the county where the property is located.

Filing Date: Form must be completed, signed, and filed with the county auditor or postmarked by January 15 of the calendar year in

which the property taxes are first due and payable.

See reverse side for additional instructions and qualifications.

Type of Benefit Requested (Please check all that apply)

☐ Over 65 Deduction from Assessed Valuation ☐ Over 65 Circuit Breaker Credit

Name of Applicant (owner or contract buyer) Telephone Number Email Address

( )

Is Applicant the Sole Legal or Equitable Owner? If No, What is His/Her Exact Share or Interest? If Owned with Joint Tenant or Tenant in Common, Indicate with Whom

☐ Yes ☐ No

If Name on Record is Different than Applicant, Indicate Below Do All Joint Tenants or Tenants in Common Reside on the Property?

☐ Yes ☐ No

Name of Contract Seller Has Applicant Owned or Bought the Property Under Recorded Contract for at Least

One (1) Year before Claiming Deduction? ☐ Yes ☐ No

Address of Contract Seller (number and street, city, state, and ZIP code) Is the Property in Question:

☐ Real Property ☐ Mobile Home (IC 6-1.1-7)

Taxing District Key Number / Legal Description Record Number Page Number

Does Applicant Reside on Property? Assessed value of the property as of current year assessment date (May not exceed $240,000 for Over 65 Deduction or

$199,999 [counting just the homestead site] for the Over 65 Circuit Breaker Credit received before January 1, 2020, $199,999 [all

Indiana real property] for the Over 65 Circuit Breaker Credit initially applied for after December 31, 2019 and before January 1, 2023,

☐ Yes ☐ No and $239,999 [all Indiana real property] for the Over 65 Circuit Breaker Credit initially applied for after December 31, 2022.) See

reverse for details.

Is the Applicant 65 Years of Age or More on December 31 of the Year Prior Applicant’s Date of Birth (month, day, year) If Filed by a Surviving, Unmarried Spouse, What Was the

to the Year Taxes are First Due & Payable? ☐ Yes ☐ No Spouse’s Age at the Time of Death?

Adjusted Gross Income (AGI) of applicant, applicant and spouse, or applicant Source of Income Amount of Income

and joint tenants or tenants in common, as applicable (For Over 65 Deduction, AGI may

not exceed: (1) $30,000 for individuals who filed a single return; (2) $40,000 for individuals $

who filed a joint return; or (3) $40,000 for individuals and all others that share ownership as

joint tenants or tenants in common. For the Over 65 Circuit Breaker Credit, AGI may not $

exceed: (1) $30,000 for individuals who filed a single return; or (2) $40,000 for individuals who

filed a joint return with the individual's spouse.) [Beginning with Pay 24, income amounts are

annually adjusted.] See reverse for details. TOTAL $

Have You Filed for Any Other Deductions? If Yes, What Deductions?

☐ Yes ☐ No

Have You Filed for Deduction in Any Other County? If Yes, What County?

☐ Yes ☐ No

I/We certify under penalty of perjury that the above and foregoing information is true and correct.

Signature of Applicant Date (month, day, year)

Address of Applicant (number and street, city, state, and ZIP code)

Signature of Authorized Representative Date (month, day, year)

Address of Authorized Representative (number and street, city, state, and ZIP code)

Signature of County Auditor Date (month, day, year)

DISTRIBUTION: Original – County Auditor; File-Stamped Copy – Taxpayer