Enlarge image

Reset Form

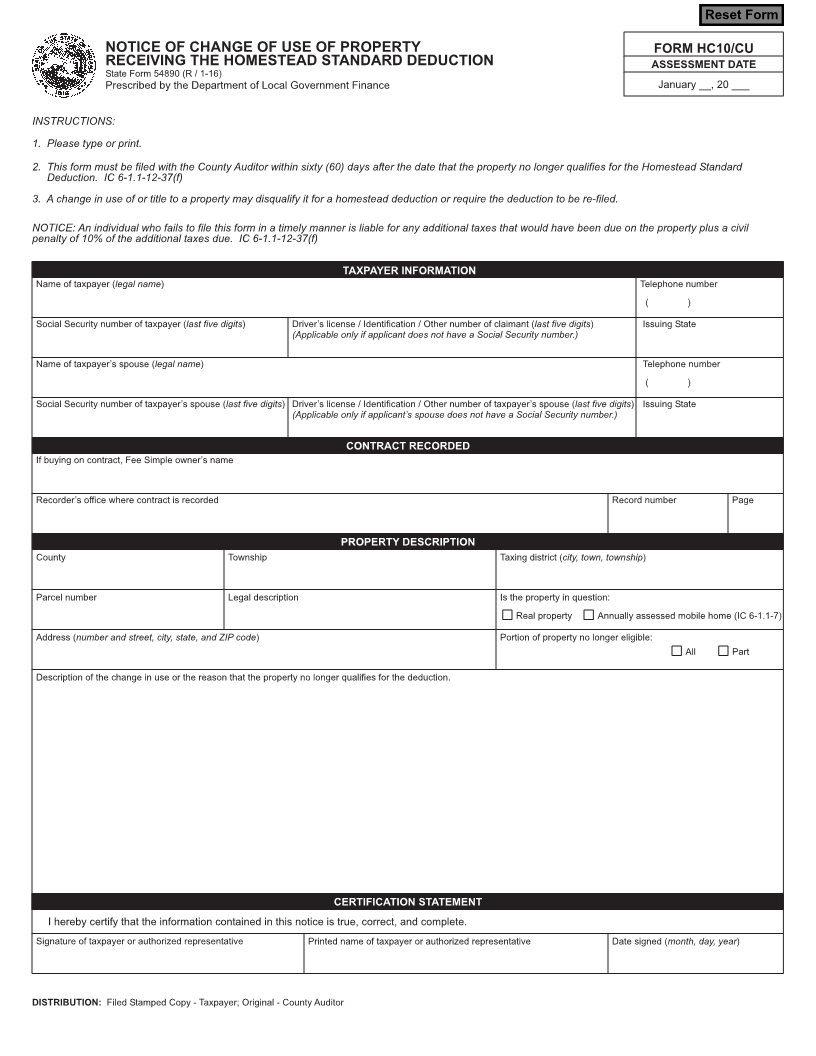

NOTICE OF CHANGE OF USE OF PROPERTY FORM HC10/CU

RECEIVING THE HOMESTEAD STANDARD DEDUCTION ASSESSMENT DATE

State Form 54890 (R / 1-16)

Prescribed by the Department of Local Government Finance January __, 20 ___

INSTRUCTIONS:

1. Please type or print.

2. This form must be filed with the County Auditor within sixty (60) days after the date that the property no longer qualifies for the Homestead Standard

Deduction. IC 6-1.1-12-37(f)

3. A change in use of or title to a property may disqualify it for a homestead deduction or require the deduction to be re-filed.

NOTICE: An individual who fails to file this form in a timely manner is liable for any additional taxes that would have been due on the property plus a civil

penalty of 10% of the additional taxes due. IC 6-1.1-12-37(f)

TAXPAYER INFORMATION

Name of taxpayer (legal name) Telephone number

( )

Social Security number of taxpayer (last five digits) Driver’s license / Identification / Other number of claimant (last five digits) Issuing State

(Applicable only if applicant does not have a Social Security number.)

Name of taxpayer’s spouse (legal name) Telephone number

( )

Social Security number of taxpayer’s spouse (last five digits) Driver’s license / Identification / Other number of taxpayer’s spouse (last five digits) Issuing State

(Applicable only if applicant’s spouse does not have a Social Security number.)

CONTRACT RECORDED

If buying on contract, Fee Simple owner’s name

Recorder’s office where contract is recorded Record number Page

PROPERTY DESCRIPTION

County Township Taxing district (city, town, township)

Parcel number Legal description Is the property in question:

Real property Annually assessed mobile home (IC 6-1.1-7)

Address (number and street, city, state, and ZIP code) Portion of property no longer eligible:

All Part

Description of the change in use or the reason that the property no longer qualifies for the deduction.

CERTIFICATION STATEMENT

I hereby certify that the information contained in this notice is true, correct, and complete.

Signature of taxpayer or authorized representative Printed name of taxpayer or authorized representative Date signed (month, day, year)

DISTRIBUTION: Filed Stamped Copy - Taxpayer; Original - County Auditor