Enlarge image

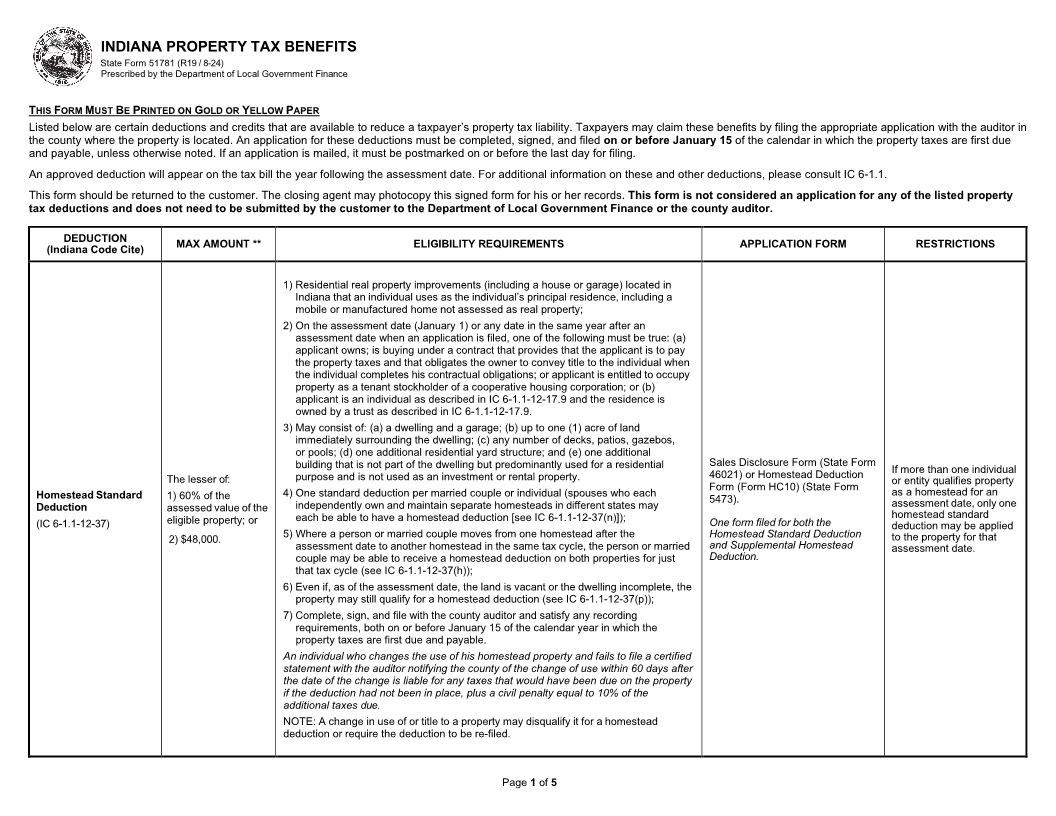

INDIANA PROPERTY TAX BENEFITS

State Form 51781 (R19 / 8-24)

Prescribed by the Department of Local Government Finance

THIS FORM MUST BE PRINTED ON OLDG OR ELLOW Y APERP

Listed below are certain deductions and credits that are available to reduce a taxpayer’s property tax liability. Taxpayers may claim these benefits by filing the appropriate application with the auditor in

the county where the property is located. An application for these deductions must be completed, signed, and filed on or before January 15 of the calendar in which the property taxes are first due

and payable, unless otherwise noted. If an application is mailed, it must be postmarked on or before the last day for filing.

An approved deduction will appear on the tax bill the year following the assessment date. For additional information on these and other deductions, please consult IC 6-1.1.

This form should be returned to the customer. The closing agent may photocopy this signed form for his or her records. This form is not considered an application for any of the listed property

tax deductions and does not need to be submitted by the customer to the Department of Local Government Finance or the county auditor.

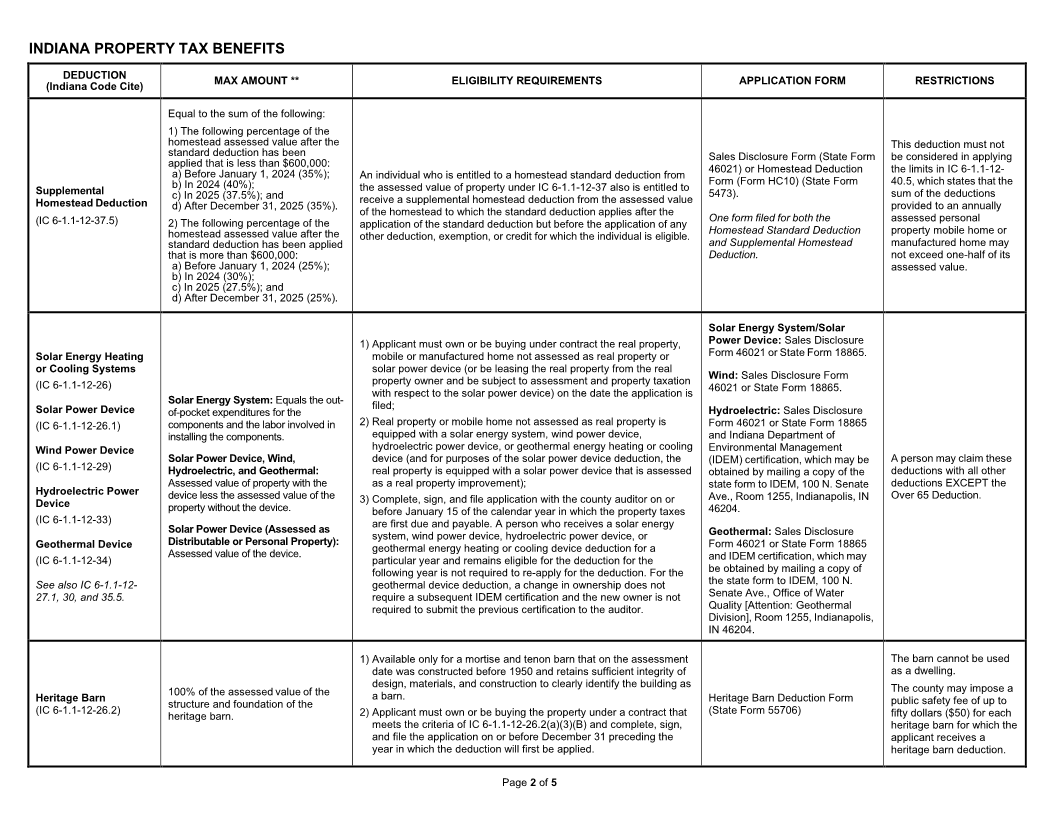

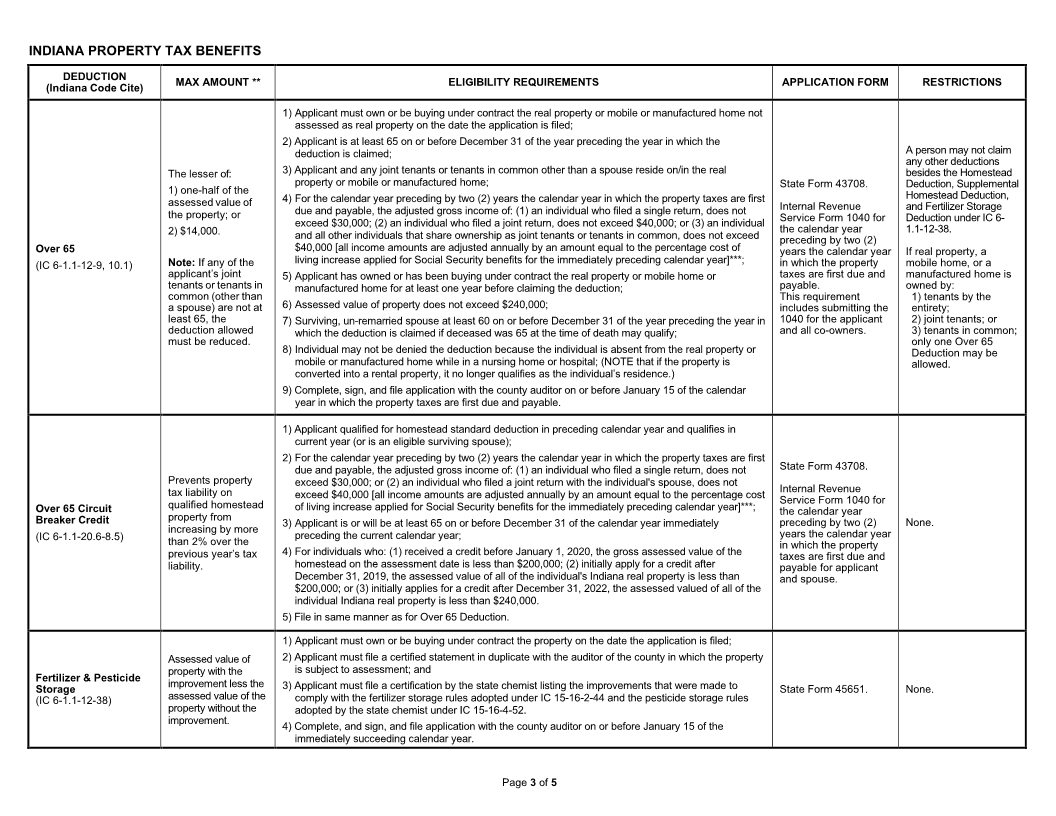

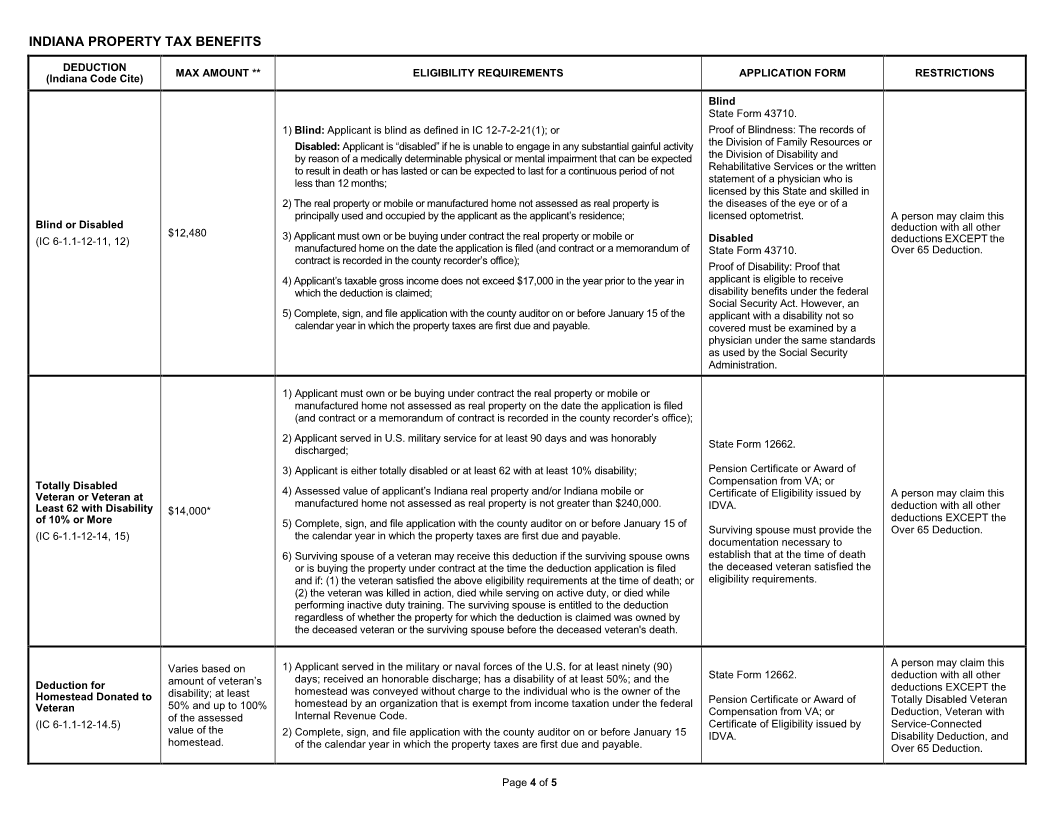

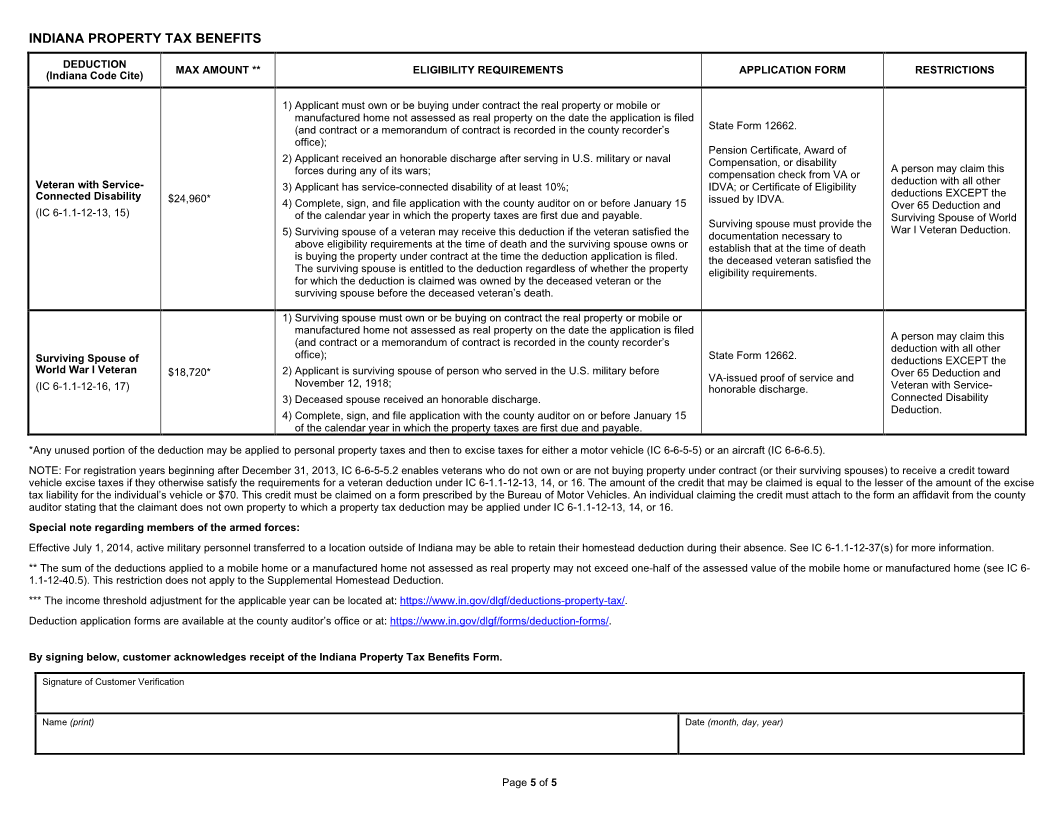

DEDUCTION MAX AMOUNT ** ELIGIBILITY REQUIREMENTS APPLICATION FORM RESTRICTIONS

(Indiana Code Cite)

1) Residential real property improvements (including a house or garage) located in

Indiana that an individual uses as the individual’s principal residence, including a

mobile or manufactured home not assessed as real property;

2) On the assessment date (January 1) or any date in the same year after an

assessment date when an application is filed, one of the following must be true: (a)

applicant owns; is buying under a contract that provides that the applicant is to pay

the property taxes and that obligates the owner to convey title to the individual when

the individual completes his contractual obligations; or applicant is entitled to occupy

property as a tenant stockholder of a cooperative housing corporation; or (b)

applicant is an individual as described in IC 6-1.1-12-17.9 and the residence is

owned by a trust as described in IC 6-1.1-12-17.9.

3) May consist of: (a) a dwelling and a garage; (b) up to one (1) acre of land

immediately surrounding the dwelling; (c) any number of decks, patios, gazebos,

or pools; (d) one additional residential yard structure; and (e) one additional

building that is not part of the dwelling but predominantly used for a residential Sales Disclosure Form (State Form

The lesser of: purpose and is not used as an investment or rental property. 46021) or Homestead Deduction If more than one individual

Homestead Standard 1) 60% of the 4) One standard deduction per married couple or individual (spouses who each Form (Form HC10) (State Form or entity qualifies property

as a homestead for an

Deduction assessed value of the independently own and maintain separate homesteads in different states may 5473). assessment date, only one

(IC 6-1.1-12-37) eligible property; or each be able to have a homestead deduction [see IC 6-1.1-12-37(n)]); homestead standard

One form filed for both the deduction may be applied

2) $48,000. 5) Where a person or married couple moves from one homestead after the Homestead Standard Deduction to the property for that

assessment date to another homestead in the same tax cycle, the person or married and Supplemental Homestead assessment date.

couple may be able to receive a homestead deduction on both properties for just Deduction.

that tax cycle (see IC 6-1.1-12-37(h));

6) Even if, as of the assessment date, the land is vacant or the dwelling incomplete, the

property may still qualify for a homestead deduction (see IC 6-1.1-12-37(p));

7) Complete, sign, and file with the county auditor and satisfy any recording

requirements, both on or before January 15 of the calendar year in which the

property taxes are first due and payable.

An individual who changes the use of his homestead property and fails to file a certified

statement with the auditor notifying the county of the change of use within 60 days after

the date of the change is liable for any taxes that would have been due on the property

if the deduction had not been in place, plus a civil penalty equal to 10% of the

additional taxes due.

NOTE: A change in use of or title to a property may disqualify it for a homestead

deduction or require the deduction to be re-filed.

Page 1of 5