Enlarge image

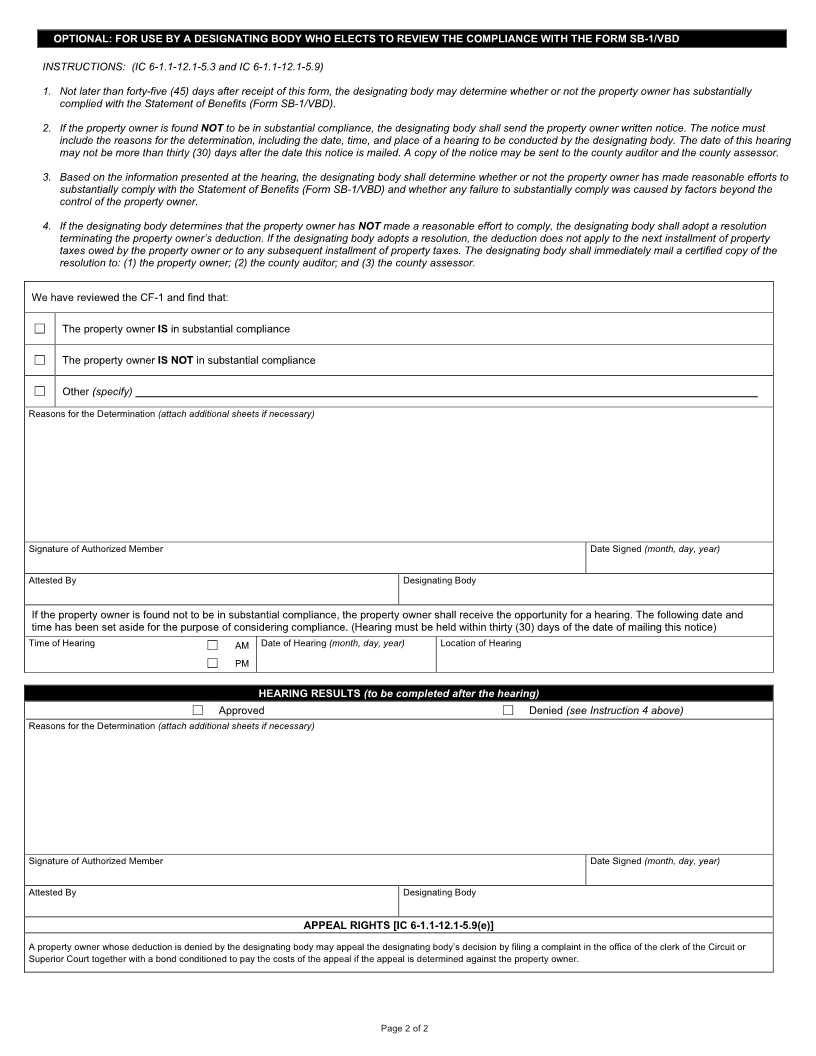

Reset Form

COMPLIANCE WITH STATEMENT OF BENEFITS PRIVACY NOTICE 20___ PAY 20___

The cost and any specific individual’s

VACANT BUILDING DEDUCTION salary information is confidential; the

State Form 55183 (R3 / 12-22) balance of the filing is public record FORM CF-1 / VBD

Prescribed by the Department of Local Government Finance per IC 6-1.1-12.1-5.3 (k) and (l).

INSTRUCTIONS: 1. Property owners must file this form with the county auditor and the designating body for their review regarding the compliance of the qualifying

property with the Statement of Benefits (Form SB-1/VBD).

2. This form must accompany the initial deduction application (Form 322-VBD) that is filed with the county auditor.

3. This form must also be updated each year in which the deduction is applicable. It is filed with the county auditor and the designating body before

May 15th or by the due date of the real property owner’s personal property return that is filed in the township where the property is located. (IC

6-1.1-12.1-5.3(j))

SECTION 1 TAXPAYER INFORMATION

Name of Taxpayer County

Address of Taxpayer (number and street, city, state, and ZIP code) DLGF Taxing District Number

Name of Contact Person Telephone Number Email Address

( )

SECTION 2 LOCATION AND DESCRIPTION OF PROPERTY

Name of Designating Body Resolution Number Estimated Occupancy Date (month, day, year)

Location of Property Actual Occupancy Date (month, day, year)

Description of eligible vacant building that the property owner or tenant will occupy Estimated Date Placed-In-Use (month, day, year)

Actual Date Placed-In-Use (month, day, year)

SECTION 3 EMPLOYEES AND SALARIES

EMPLOYEES AND SALARIES AS ESTIMATED ON SB-1 ACTUAL

Current Number of Employees

Salaries

Number of Employees Retained

Salaries

Number of Additional Employees

Salaries

SECTION 4 COST AND VALUES

COST AND VALUES REAL ESTATE IMPROVEMENTS

AS ESTIMATED ON SB-1 COST ASSESSED VALUE

Values Before Project $ $

Plus: Values of Proposed Project $ $

Less: Values of Any Property Being Replaced $ $

Net Values Upon Completion of Project $ $

ACTUAL COST ASSESSED VALUE

Values Before Project $ $

Plus: Values of Proposed Project $ $

Less: Values of Any Property Being Replaced $ $

Net Values Upon Completion of Project $ $

SECTION 5 UPDATES TO THE ANSWERS PROVIDED IN SECTION 5 OF THE FORM SB-1/VBD, IF ANY

(Attach additional sheet(s) if necessary)

SECTION 6 TAXPAYER CERTIFICATION

I hereby certify that the representations in this statement are true.

Signature of Authorized Representative Title Date Signed (month, day, year)

Page 1 of 2