Enlarge image

Reset Form

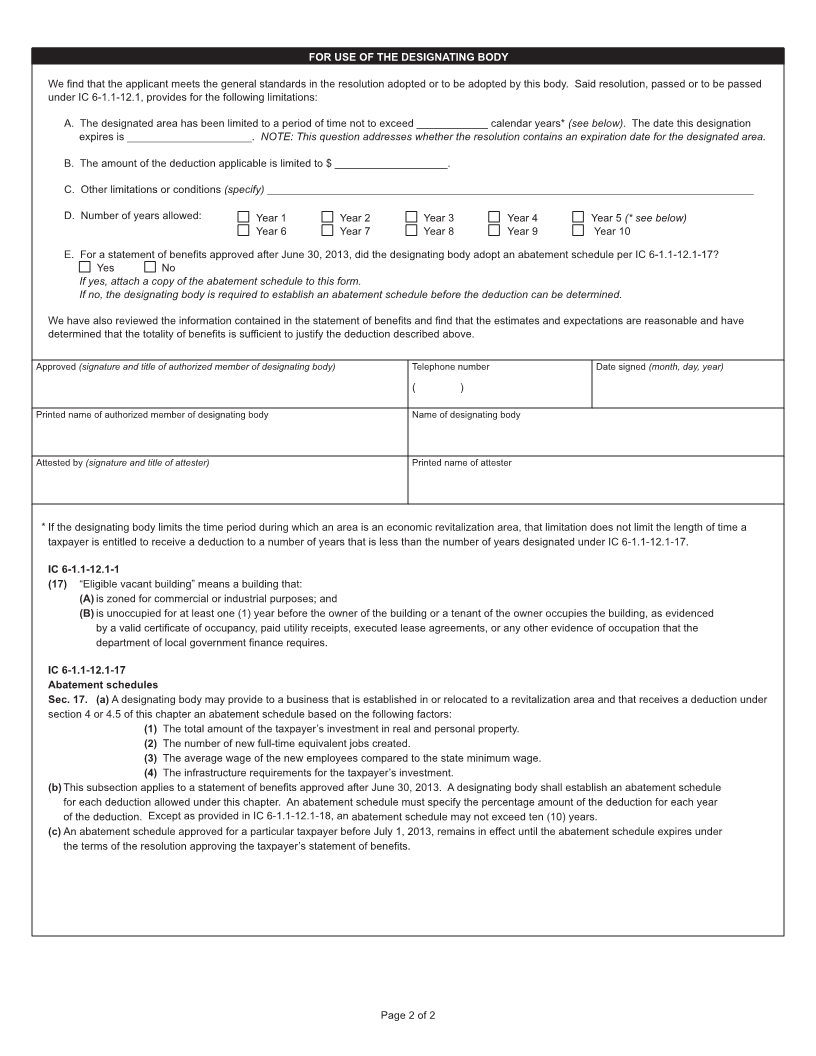

STATEMENT OF BENEFITS 20____ PAY 20____

VACANT BUILDING DEDUCTION

State Form 55182 (R2 / 1-21) FORM SB-1 / VBD

Prescribed by the Department of Local Government Finance

PRIVACY NOTICE

This statement is being completed for real property that qualifies as an “eligible vacant building” as defined by The cost and any specific individual’s

IC 6-1.1-12.1-1(17). salary information is confidential; the

balance of the filing is public record

per IC 6-1.1-12.1-5.1 (c) and (d).

INSTRUCTIONS:

1. This statement must be submitted to the body designating the Economic Revitalization Area prior to the public hearing if the designating body

requires information from the applicant in making its decision about whether to designate an Economic Revitalization Area. Otherwise, this statement

must be submitted to the designating body BEFORE the occupation of the eligible vacant building for which the person wishes to claim a deduction.

2. To obtain a vacant building deduction, a Form 322/VBD must be filed with the county auditor before May 10 in the year in which the property owner

or his tenant occupies the vacant building or not later than thirty (30) days after the assessment notice is mailed to the property owner if it was

mailed after April 10. If the property owner misses the May 10 deadline in the initial year of occupation, he can apply between January 1 and May 10

of a subsequent year.

3. A property owner who files the Form 322/VBD must provide the county auditor and the designating body with a Form CF-1/VBD to show compliance

with the approved Form SB-1/VBD. The Form CF-1/VBD must also be updated each year in which the deduction is applicable.

SECTION 1 TAXPAYER INFORMATION

Name of taxpayer

Address of taxpayer (number and street, city, state, and ZIP code)

Name of contact person Telephone number E-mail address

( )

SECTION 2 LOCATION AND DESCRIPTION OF PROPOSED PROJECT

Name of designating body Resolution number

Location of property County DLGF taxing district number

Description of eligible vacant building that the property owner or tenant will occupy (use additional sheets if necessary). Estimated occupancy date (month, day, year)

Estimated date placed-in-use (month, day, year)

SECTION 3 ESTIMATE OF EMPLOYEES AND SALARIES AS A RESULT OF PROPOSED PROJECT

Current Number Salaries Number Retained Salaries Number Additional Salaries

SECTION ESTIMATED TOTAL COST AND VALUE OF PROPOSED PROJECT

REAL ESTATE IMPROVEMENTS

COST ASSESSED VALUE

Current values

Plus estimated values of proposed project

Less values of any property being replaced

Net estimated values upon completion of project

SECTION 5 EFFORTS TO SELL OR LEASE VACANT BUILDING

Described efforts by the owner or previous owner to sell, lease, or rent the building during period of vacancy:

Show amount for which the building was offered for sale, lease, or rent during period of vacancy.

List any other benefits resulting from the occupancy of the eligible vacant building.

SECTION 6 TAXPAYER CERTIFICATION

I hereby certify that the representations in this statement are true.

Signature of authorized representative Title Date signed (month, day, year)

Page 1 of 2