Enlarge image

Reset Form

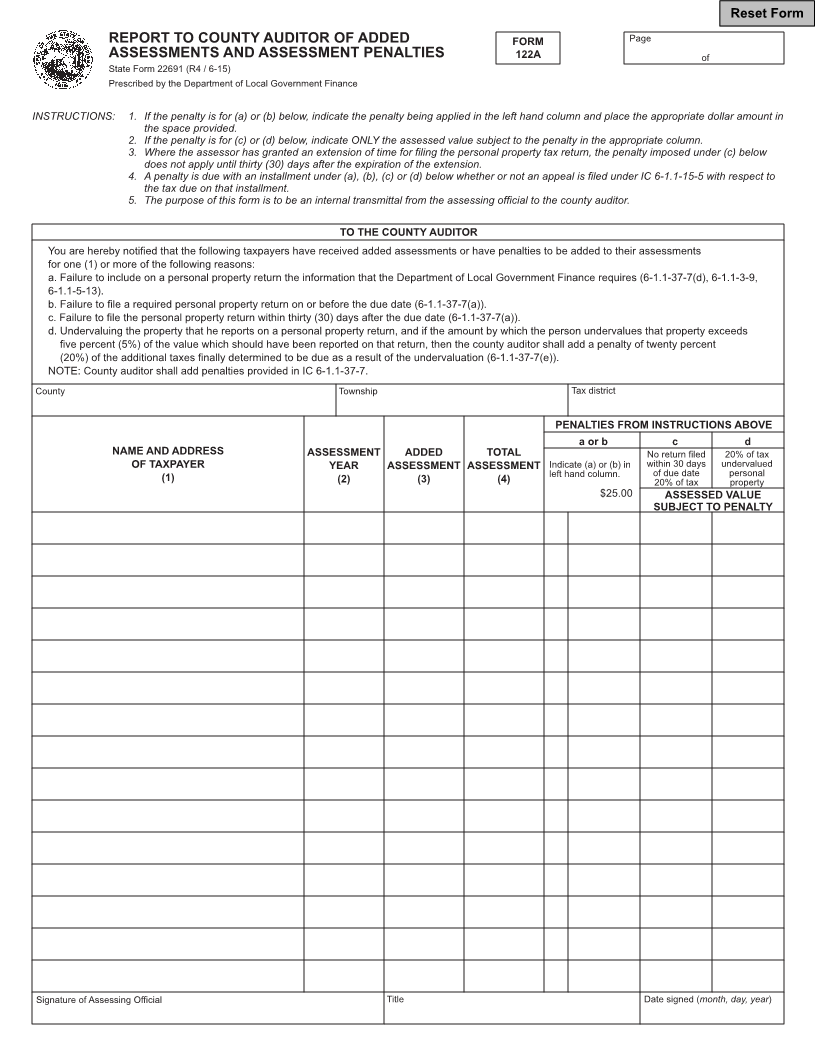

REPORT TO COUNTY AUDITOR OF ADDED FORM Page

ASSESSMENTS AND ASSESSMENT PENALTIES 122A of

State Form 22691 (R4 / 6-15)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: 1. If the penalty is for (a) or (b) below, indicate the penalty being applied in the left hand column and place the appropriate dollar amount in

the space provided.

2. If the penalty is for (c) or (d) below, indicate ONLY the assessed value subject to the penalty in the appropriate column.

3. Where the assessor has granted an extension of time for filing the personal property tax return, the penalty imposed under (c) below

does not apply until thirty (30) days after the expiration of the extension.

4. A penalty is due with an installment under (a), (b), (c) or (d) below whether or not an appeal is filed under IC 6-1.1-15-5 with respect to

the tax due on that installment.

5. The purpose of this form is to be an internal transmittal from the assessing official to the county auditor.

TO THE COUNTY AUDITOR

You are hereby notified that the following taxpayers have received added assessments or have penalties to be added to their assessments

for one (1) or more of the following reasons:

a. Failure to include on a personal property return the information that the Department of Local Government Finance requires (6-1.1-37-7(d), 6-1.1-3-9,

6-1.1-5-13).

b. Failure to file a required personal property return on or before the due date (6-1.1-37-7(a)).

c. Failure to file the personal property return within thirty (30) days after the due date (6-1.1-37-7(a)).

d. Undervaluing the property that he reports on a personal property return, and if the amount by which the person undervalues that property exceeds

five percent (5%) of the value which should have been reported on that return, then the county auditor shall add a penalty of twenty percent

(20%) of the additional taxes finally determined to be due as a result of the undervaluation (6-1.1-37-7(e)).

NOTE: County auditor shall add penalties provided in IC 6-1.1-37-7.

County Township Tax district

PENALTIES FROM INSTRUCTIONS ABOVE

a or b c d

NAME AND ADDRESS ASSESSMENT ADDED TOTAL No return filed 20% of tax

OF TAXPAYER YEAR ASSESSMENT ASSESSMENT Indicate (a) or (b) in within 30 days undervalued

(1) (2) (3) (4) left hand column. of due date personal

20% of tax property

$25.00 ASSESSED VALUE

SUBJECT TO PENALTY

Signature of Assessing Official Title Date signed (month, day, year)