Enlarge image

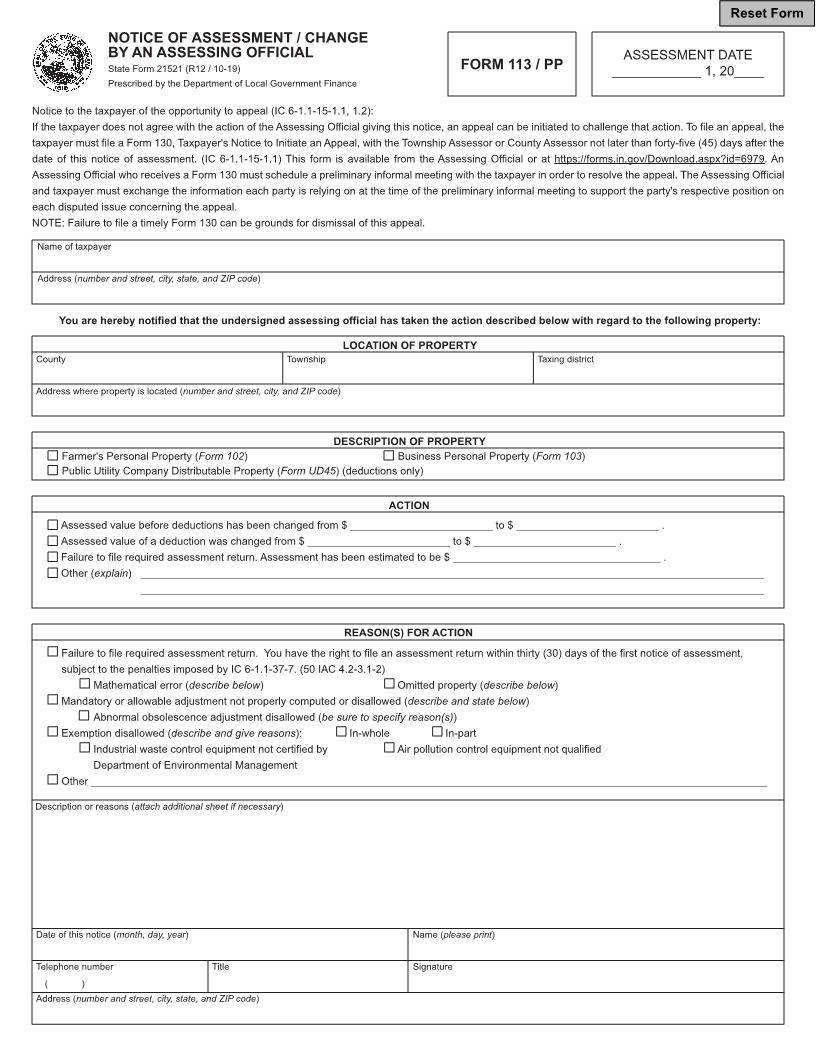

Reset Form

NOTICE OF ASSESSMENT / CHANGE

BY AN ASSESSING OFFICIAL ASSESSMENT DATE

State Form 21521 (R12 / 10-19) FORM 113 / PP ____________ 1, 20____

Prescribed by the Department of Local Government Finance

Notice to the taxpayer of the opportunity to appeal (IC 6-1.1-15-1.1, 1.2):

If the taxpayer does not agree with the action of the Assessing Official giving this notice, an appeal can be initiated to challenge that action. To file an appeal, the

taxpayer must file a Form 130, Taxpayer's Notice to Initiate an Appeal, with the Township Assessor or County Assessor not later than forty-five (45) days after the

date of this notice of assessment. (IC 6-1.1-15-1.1) This form is available from the Assessing Official or at https://forms.in.gov/Download.aspx?id=6979. An

Assessing Official who receives a Form 130 must schedule a preliminary informal meeting with the taxpayer in order to resolve the appeal. The Assessing Official

and taxpayer must exchange the information each party is relying on at the time of the preliminary informal meeting to support the party's respective position on

each disputed issue concerning the appeal.

NOTE: Failure to file a timely Form 130 can be grounds for dismissal of this appeal.

Name of taxpayer

Address (number and street, city, state, and ZIP code)

You are hereby notified that the undersigned assessing official has taken the action described below with regard to the following property:

LOCATION OF PROPERTY

County Township Taxing district

Address where property is located (number and street, city, and ZIP code)

DESCRIPTION OF PROPERTY

Farmer's Personal Property (Form 102) Business Personal Property (Form 103)

Public Utility Company Distributable Property (Form UD45) (deductions only)

ACTION

Assessed value before deductions has been changed from $ ________________________ to $ ________________________ .

Assessed value of a deduction was changed from $ ________________________ to $ ________________________ .

Failure to file required assessment return. Assessment has been estimated to be $ ___________________________________ .

Other (explain) _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

REASON(S) FOR ACTION

Failure to file required assessment return. You have the right to file an assessment return within thirty (30) days of the first notice of assessment,

subject to the penalties imposed by IC 6-1.1-37-7. (50 IAC 4.2-3.1-2)

Mathematical error (describe below) Omitted property (describe below)

Mandatory or allowable adjustment not properly computed or disallowed (describe and state below)

Abnormal obsolescence adjustment disallowed (be sure to specify reason(s))

Exemption disallowed (describe and give reasons): In-whole In-part

Industrial waste control equipment not certified by Air pollution control equipment not qualified

Department of Environmental Management

Other __________________________________________________________________________________________________________________

Description or reasons (attach additional sheet if necessary)

Date of this notice (month, day, year) Name (please print)

Telephone number Title Signature

( )

Address (number and street, city, state, and ZIP code)