Enlarge image

Reset Form

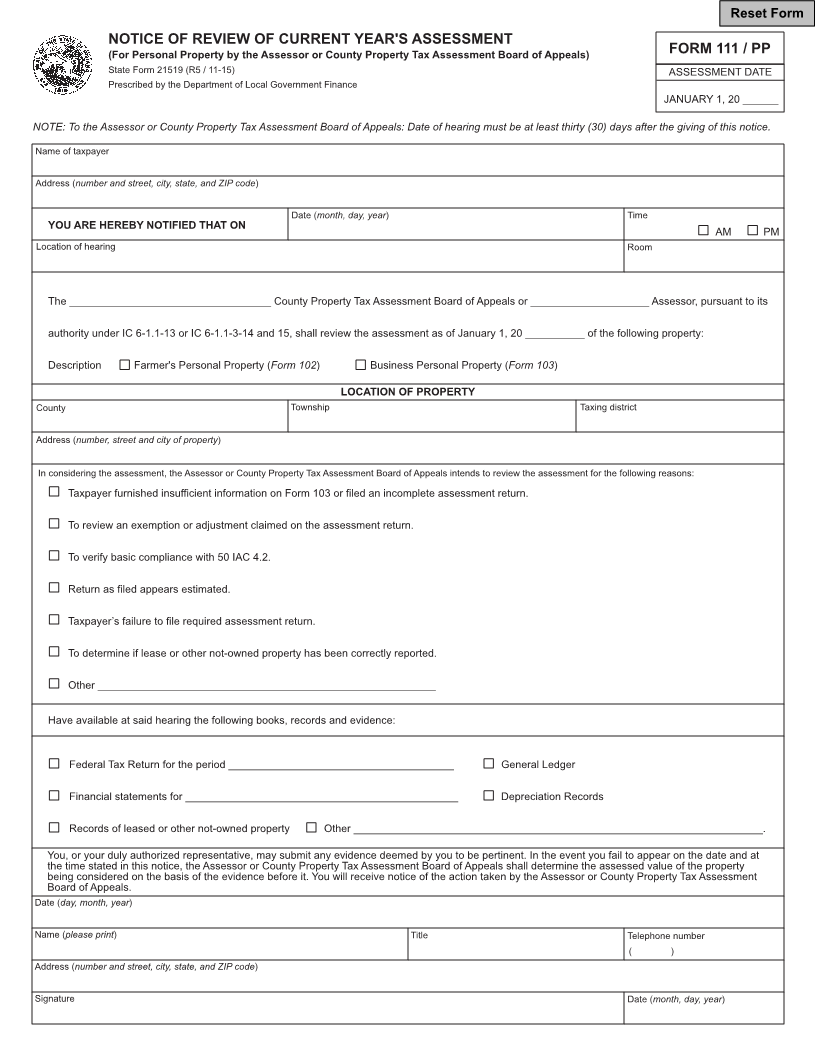

NOTICE OF REVIEW OF CURRENT YEAR'S ASSESSMENT

(For Personal Property by the Assessor or County Property Tax Assessment Board of Appeals) FORM 111 / PP

State Form 21519 (R5 / 11-15) ASSESSMENT DATE

Prescribed by the Department of Local Government Finance

JANUARY 1, 20 ______

NOTE: To the Assessor or County Property Tax Assessment Board of Appeals: Date of hearing must be at least thirty (30) days after the giving of this notice.

Name of taxpayer

Address (number and street, city, state, and ZIP code)

Date (month, day, year) Time

YOU ARE HEREBY NOTIFIED THAT ON

AM PM

Location of hearing Room

The __________________________________ County Property Tax Assessment Board of Appeals or ____________________ Assessor, pursuant to its

authority under IC 6-1.1-13 or IC 6-1.1-3-14 and 15, shall review the assessment as of January 1, 20 __________ of the following property:

Description Farmer's Personal Property (Form 102) Business Personal Property (Form 103)

LOCATION OF PROPERTY

County Township Taxing district

Address (number, street and city of property)

In considering the assessment, the Assessor or County Property Tax Assessment Board of Appeals intends to review the assessment for the following reasons:

Taxpayer furnished insufficient information on Form 103 or filed an incomplete assessment return.

To review an exemption or adjustment claimed on the assessment return.

To verify basic compliance with 50 IAC 4.2.

Return as filed appears estimated.

Taxpayer’s failure to file required assessment return.

To determine if lease or other not-owned property has been correctly reported.

Other _________________________________________________________

Have available at said hearing the following books, records and evidence:

Federal Tax Return for the period ______________________________________ General Ledger

Financial statements for ______________________________________________ Depreciation Records

Records of leased or other not-owned property Other _____________________________________________________________________.

You, or your duly authorized representative, may submit any evidence deemed by you to be pertinent. In the event you fail to appear on the date and at

the time stated in this notice, the Assessor or County Property Tax Assessment Board of Appeals shall determine the assessed value of the property

being considered on the basis of the evidence before it. You will receive notice of the action taken by the Assessor or County Property Tax Assessment

Board of Appeals.

Date (day, month, year)

Name (please print) Title Telephone number

( )

Address (number and street, city, state, and ZIP code)

Signature Date (month, day, year)