Enlarge image

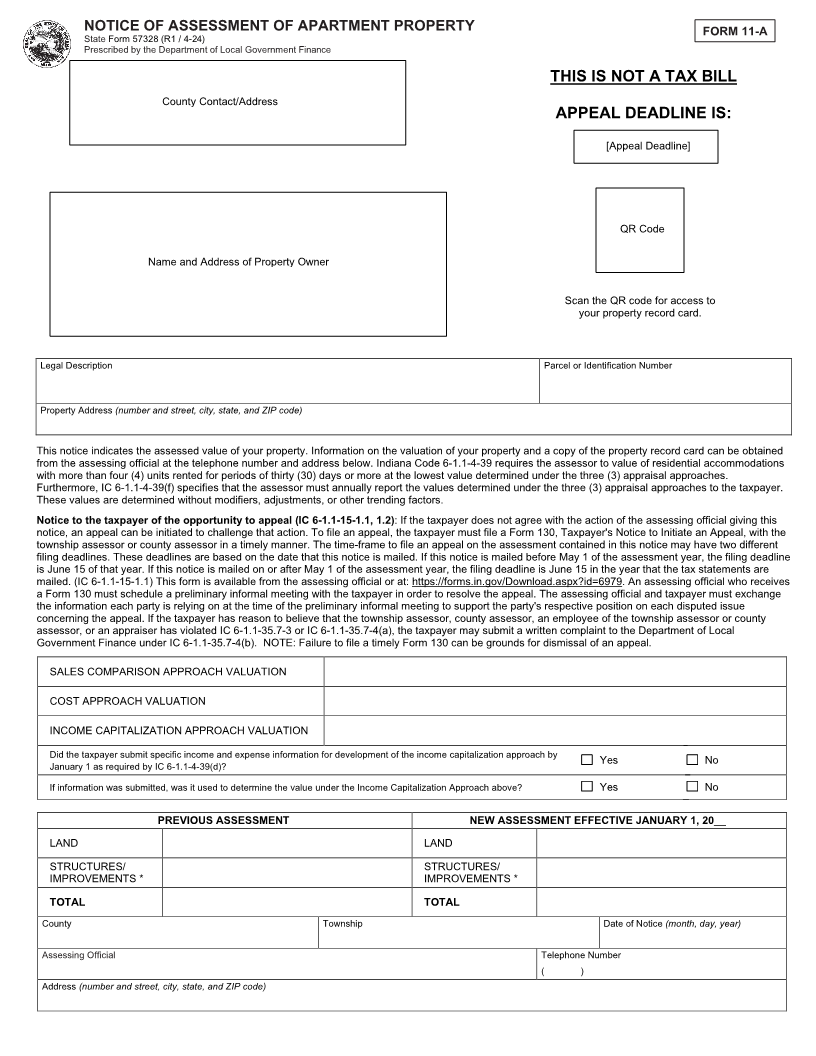

NOTICE OF ASSESSMENT OF APARTMENT PROPERTY FORM 11-A

State Form 57328 (R1 / 4-24)

Prescribed by the Department of Local Government Finance

THIS IS NOT A TAX BILL

County Contact/Address

APPEAL DEADLINE IS:

[Appeal Deadline]

QR Code

Name and Address of Property Owner

Scan the QR code for access to

your property record card.

Legal Description Parcel or Identification Number

Property Address (number and street, city, state, and ZIP code)

This notice indicates the assessed value of your property. Information on the valuation of your property and a copy of the property record card can be obtained

from the assessing official at the telephone number and address below. Indiana Code 6-1.1-4-39 requires the assessor to value of residential accommodations

with more than four (4) units rented for periods of thirty (30) days or more at the lowest value determined under the three (3) appraisal approaches.

Furthermore, IC 6-1.1-4-39(f) specifies that the assessor must annually report the values determined under the three (3) appraisal approaches to the taxpayer.

These values are determined without modifiers, adjustments, or other trending factors.

Notice to the taxpayer of the opportunity to appeal (IC 6-1.1-15-1.1, 1.2): If the taxpayer does not agree with the action of the assessing official giving this

notice, an appeal can be initiated to challenge that action. To file an appeal, the taxpayer must file a Form 130, Taxpayer's Notice to Initiate an Appeal, with the

township assessor or county assessor in a timely manner. The time-frame to file an appeal on the assessment contained in this notice may have two different

filing deadlines. These deadlines are based on the date that this notice is mailed. If this notice is mailed before May 1 of the assessment year, the filing deadline

is June 15 of that year. If this notice is mailed on or after May 1 of the assessment year, the filing deadline is June 15 in the year that the tax statements are

mailed. (IC 6-1.1-15-1.1) This form is available from the assessing official or at: https://forms.in.gov/Download.aspx?id=6979. An assessing official who receives

a Form 130 must schedule a preliminary informal meeting with the taxpayer in order to resolve the appeal. The assessing official and taxpayer must exchange

the information each party is relying on at the time of the preliminary informal meeting to support the party's respective position on each disputed issue

concerning the appeal. If the taxpayer has reason to believe that the township assessor, county assessor, an employee of the township assessor or county

assessor, or an appraiser has violated IC 6-1.1-35.7-3 or IC 6-1.1-35.7-4(a), the taxpayer may submit a written complaint to the Department of Local

Government Finance under IC 6-1.1-35.7-4(b). NOTE: Failure to file a timely Form 130 can be grounds for dismissal of an appeal.

SALES COMPARISON APPROACH VALUATION

COST APPROACH VALUATION

INCOME CAPITALIZATION APPROACH VALUATION

Did the taxpayer submit specific income and expense information for development of the income capitalization approach by ☐ Yes ☐ No

January 1 as required by IC 6-1.1-4-39(d)?

If information was submitted, was it used to determine the value under the Income Capitalization Approach above? ☐ Yes ☐ No

PREVIOUS ASSESSMENT NEW ASSESSMENT EFFECTIVE JANUARY 1, 20__

LAND LAND

STRUCTURES/ STRUCTURES/

IMPROVEMENTS * IMPROVEMENTS *

TOTAL TOTAL

County Township Date of Notice (month, day, year)

Assessing Official Telephone Number

( )

Address (number and street, city, state, and ZIP code)